Euro/dollar finally broke out and made a very impressive rally, rising more than 300 pips. The second Greek bailout was agreed upon, and the euro shrugged off the long list of doubts. Has the euro turned a page, or is this a rise before the fall? The highlight of the upcoming week is the second LTRO by the ECB, in which banks will get more money. Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

Greece still needs to pass 38 demands by the troika until the end of February. That’s Wednesday. The Greek parliament was quicker with igniting the bond swap. Regarding this, the haircut for private bondholders requires 66% of volunteers. Will they be found when they’ll get only 26%-27% of their money, and some have insurance against a default? These are the two major hurdles. Let’s see the events. The past week’s German indicators were good.

Updates: EUR/USD is still above 1.34, but the pair is slipping from the highs reached last week. The G-20 meeting in Mexico has not provided any concrete resolutions, and IMF funding for the Greek bailout is still up in the air. S&P downgraded Greece to Selective Default, but this was shrugged off by the markets. German finance minister showed Greece the door, and another hit came from the Irish announcement of a referendum for the recent treaty changes. EUR/USD is slipping under 1.34 once again, after regaining it earlier. See how to trade the US GDP with EUR/USD. EUR/USD has moved upwards, trading at 1.3440. The pair could react to the second LTRO of the ECB and Fed Chairman Bernanke’s testimony. The euro dropped sharply to 1.3320 after Fed Chairman Bernanke’s testimony.

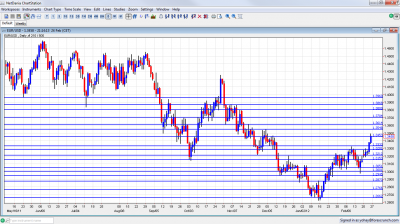

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- M3 Money Supply: Monday, 9:00. Growth of money in circulation has slowed down more than expected in recent months and reached 1.6%. It is now expected to rise to 1.8%. This is a sign of recession.

- German CPI:Tuesday. Consumer prices in Europe’s No. 1 economy dropped by 0.4% after a jump of 0.7% beforehand. This see-saw will likely continue, with prices rising by 0.5% this time. The various German states release this figure during the day. The figures are for February.

- German GfK Consumer Climate: Tuesday, 7:00. This survey of around 2000 consumers has been on the rise, reflecting German economic strength. After reaching 5.9 points last month, a rise to 6.1 is predicted now.

- German Import Prices: Wednesday, 7:00. The prices of imported goods are expected to rise for a third month in a row. After rising by 0.3% last time, an acceleration of 0.5% is predicted now.

- ECB LTRO II: Wednesday. The European Central Bank allots money to European banks in three year loans. The interest rate is low and the ECB accepts low grade bonds as collateral. This has two goals: encouraging banks to buy sovereign debt, pledge it as collateral, enjoy the arbitrage and lower yields for troubled countries such as Spain and Italy. The second goal is getting money for these troubled banks, especially in case they lose money on sovereign bonds of countries such as Greece. The first operation resulted in 489 billion euros of loans and is considered to have saved the banking system from a credit crunch. Estimations for the second operation vary from 200 billion to 1 trillion euros. A large sum means that banks are reliant on the ECB and that they are ready for a default of Greece. This event will be closely watched.

- French Consumer Spending: Wednesday, 7:45. Europe’s second largest economy suffered from a drop of 0.7% in spending after two months of modest rises of 0.1%. A return to growth is expected now, with a rise of 0.3%.

- German Unemployment Change: Wednesday, 8:55. The German job market is unstoppable. The number of unemployed drops constantly, with very brief stops. A big fall of 34K was seen last time. A mild drop of 5K is now foreseen. Optimists are looking at Germany to pull everybody out. Pessimists are awaiting for Germany to be pulled down.

- Final Manufacturing PMI: Thursday, 9:00. The initial read of the purchasing managers’ index for February showed that this sector is contracting, albeit at a slower pace, with the score rising from 48.8 to 49 points. This figure will likely be confirmed. A score above 50 represents growth.

- CPI: Wednesday, 10:00. These are final figures for January, published later than usual this time. The initial figures showed that headline CPI remained at 2.7% for another month. This will likely be confirmed now. Core CPI, is expected to rise from 1.6% to 1.8%. With a mild recession already acknowledged and a deep recession feared, inflation isn’t that worrying.

- Unemployment Rate: Thursday, 10:00. Contrary to Germany, the average in the euro-area is much higher: 10.4%. This figure will likely remain unchanged. Spain’s rate is around 23%. The new Rajoy administration is tackling labor laws in a controversial manner.

- CPI Flash Estimate: Thursday, 10:00. This is an initial estimate for February, published on time. Headline CPI is expected to tick down from 2.7% to 2.6%. Rising oil prices are expected to have a minor impact this time.

- German Retail Sales: Friday, 7:00. The German consumer may be confident, but he isn’t on a shopping spree. The volume of sales rose last month by only 0.1% after two months of drops. A more significant rise of 0.5% is likely now.

- PPI: Friday, 10:00. Producer prices haven’t changed too much recently: they dropped by 0.2% after rising by the same scale. A stronger rise of 0.6% is likely now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week with more range trading between the 1.3212 and 1.3280 lines mentioned last week. It then broke higher, and after a temporary stop under 1.3333, it surged forward and ends the week around the 1.3450 line. The pair certainly deserves its high location in the list of most predictable currencies.

Technical lines from top to bottom:

In case the rally continues in a stronger manner, we’ll start from a very high point: 1.3960. This was resistance in October 2011, as well as support more than once beforehand. 1.3868 served as resistance at during October and November, and is the next line of resistance.

1.38, that stopped the pair in September and also later on is weak and now not so distant resistance. 1.37 had a similar role at the same time and also worked as support afterwards. It is stronger resistance.

1.3615 switched from support in October to support in November and is now resistance. 1.3550 capped the pair in November and December and marked the beginning of the plunge.

1.3450 was support in November. It is now a minor line of struggle, as seen recently. 1.3333 provided some support for the pair during December 2011 and is a stronger line now after being very distinct.

Quite close by, 1.3280 had a similar role at the same time, but is weakening once again after working only in a temporary manner. 1.3212 held the pair from falling and switched to resistance later on. It is now support, after working as resistance more than once in February 2012.

1.3150 is the updated version of the 1.3145 line, after the recent choppiness. The lowest point recorded in October 2011, is now a pivotal line in the middle of the range. 1.3050 is the updated version of 1.3060, which was the top border of a very narrow range that characterized the pair towards the end of 2011. It is now serious support on the downside after serving as the bottom border of the range and despite a temporary move under this line.

The round number of 1.30 is psychologically important but is much weaker now. It was a pivotal line before Bernanke’s rally. The 1.2945 line is stronger once again and still provides support.

1.2873 is the previous 2011 low set in January, and it returns to support once again. This is a very strong line separating ranges. 1.2760 is a pivotal line in the middle of a recent range. It provided support early in the year.

1.2660 was a double bottom during January and the move below this line is not confirmed yet. 1.2623 is the current 2012 low, but only has a minor role now.

Despite the huge rally, I remain bearish on EUR/USD

There are too many reasons to doubt the chances that the Greek bailout will see light: the timetable for passing 38 reforms, the unknown contribution of the IMF, the German refusal to add more funds, the uncertainty of the bond swap and lots more. It also seems that the creditors, and especially Germany, just want the deal to fail. After the banks get the necessary cash in the LTRO, all hell could go loose. Full details are available in the special report. Join the newsletter to download it.

On the other side of the Atlantic, things are OK. Ben Bernanke might be soft, but the chances of QE3 in March remain low.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast.