AUD/USD dropped 140 pips this week, closing at 1.0460. The upcoming week is very quiet, with just three releases. Here is an outlook for the Australian events, and an updated technical analysis for AUD/USD.

Updates: AUD/USD dropped below the 1.05 line, trading at 1.0412. Markets are waiting the release of HIA New Home Sales. AUD/USD continues to sag, trading at 1.0346

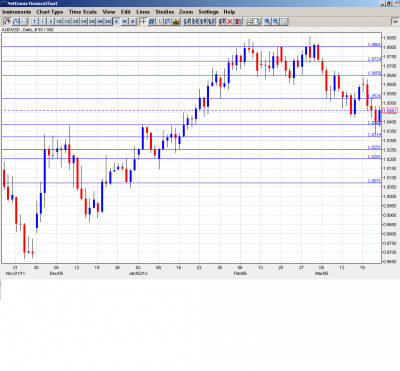

AUD/USD graph with support and resistance lines on it. Click to enlarge:

-

RBA Financial Stability Review: Wednesday, 00:30. This report by the central bank discusses financial and economic conditions, and analysts look for any hints as to bank’s future monetary policy. A report that is more hawkish than expected is bullish for the aussie.

-

HIA New Home Sales: Friday, publication time unknown. This indicator tends to be quite volatile, and last month plunged by 7.2%, its worst reading in over four years. If the indicator remains below zero in March, it will be the third straight reading in negative territory, and this could hurt the Australian dollar.

-

Private Sector Credit: Friday, 00:30. This indicator measures the change in credit issued to individuals and businessses. The indicator has showed little movement over the past several months, and little change is forecast for March, with an expected rise of 0.3%.

AUD/USD Technical Analysis

AUD/USD opened at 1.0601. The pair reached a high of 1.0636. It then dropped all the way to 1.0336, close to the resistance line of 1.0320 (discussed last week). AUD/USD recovered somewhat, closing the week at 1.0461.

Technical levels from top to bottom:

We begin with the resistance line of 1.1009, just above the psychologically important level of 1.10. This is followed by strong resistance at 1.0884. Below, the round number of 1.08 is providing resistance to the pair. The next line of resistance is at 1.0724. This is followed by the resistance line of 1.0650, which continued to hold firm this week. The line of 1.0525, which recently was providing resistance to the pair, is now serving in a support role.

AUD/USD broke through the 1.0383 line as the US dollar showed some strength. The next line of support is at 1.0320, which held firm this week. It could be tested if the aussie continues to sag. Below, is the support line of 1.0250. This is followed by 1.02, a strong support line. Next, is the support level of 1.0080, which is protecting the all-important parity level.

I am bearish on AUD/USD.

AUD/USD managed to partially rebound from the US dollar’s surge this week, but the trend over the past few weeks has been downwards. Weaker economic activity in China, Australia’s number one trading partner, is weighing on the aussie.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.