The kiwi eventually had an excellent week, bouncing only at high resistance, as European optimism gave it a big boost. It escaped the long running range. Employment data is the major event this week . Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

Last week New Zealand’s business confidence edged higher than predicted in July rising to 15.1 from 12.6 in the previous month, in light of stronger employment figures and improved view over the European’s debt crisis. A net 10.7% of businesses expected hiring to increase and investment intentions also climbed. The National Bank of New Zealand forecasts a 2.2% economic growth by the end of next year. Are things getting better for NZ economy?

Updates: The Labor Cost Index, released quarterly, will be published later on Monday. The markets are not expecting much change from the previous reading. NZD/USD is steady, trading at 0.8178. The Labor Cost Index gained 0.5%, just under the estimate of 0.6%. The kiwi pushed across the 0.82 line, and NZD/USD was trading at 0.8203. The quarterly Employment Change and Unemployment Rate will be released later on Wednesday. The markets are expecting both releases to show improvement compared to Q2. The kiwi lost ground, dropping below the 0.82 line. NZD/USD was trading at 0.8148. Employment data looked very weak. Employment Change was a big disappointment, dropping by 0.1%. The market estimate stood at 0.3%. It was the first drop by the indicator in two years. The Unemployment Rate jumped to 6.8%, its highest level since February 2011. The markets had forecast a rate of 6.5%. REINZ HPI dropped sharply, posting a 0.7% decline. The kiwi was down following the weak releases as NZD/USD was trading at 0.8118.

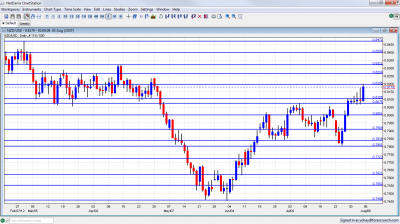

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Labor Cost Index: Monday, 22:45.New Zealand wage cost slowed in the first quarter rising 0.5% compared to 0.7% increase in the fourth quarter of 2011. The moderate rise in wages ensures rate stability.0.6%

- Employment data: Wednesday, 22:45. The labor market added 18,000 jobs in the first quarter rising 0.4% from 0.2% growth in the fourth quarter of 2011. On an annual basis, NZ job market gained gain of 0.9%, in line with predictions. These encouraging figures suggest improvement in the job market with more workers in the labor force with a participation rate of 64.2% following 63.9% in the previous quarter. Meantime, unemployment rate increased more than predicted reaching 6.7% after 6.4% in the previous quarter, Analysts expected a drop to 6.3%. A job increase of 0.4% is expected with a lower unemployment rate of 6.5%.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/$ began the week trading in a tight range, between 0.8075 to 0.8105 (mentioned last week) before it began moving higher. It was eventually capped by 0.8195 before closing at 0.8179.

Technical lines, from top to bottom:

We move even higher this week. 0.8573 capped the pair in September 2011 and is distant resistance. 0.8505 served as support at the same time.

0.8470 was the swing high seen in February. 0.84 was resistance back in February 2012. 0.8320 was a wing high in April, just before the big dive.

0.8260 capped the pair during March, and is stubborn resistance. 0.8195 was resistance in the past and now has a new role after capping the pair in August 2012.

0.8105 is the new peak reached in July 2012 and should be closely watched on any upside movement. 0.8075 was the peak in July 2012 and replaces other lines in this region. This is the highest in 3 months.

The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance. It was hit by the recent moves and somewhat weaker now.

Another round number, 0.79, is key resistance, after being a very distinct line separating ranges. It proved its strength also in June 2012. 0.7840 provided support for the pair several times during June 2012 and also worked as resistance back at the end of 2011.

The round number of 0.78 is significant support after working as such in July 2012. 0.7723 supported the pair back at the beginning of 2012 and also worked in the other direction in June 2012.

0.7620 provided support in May 2012 and is resistance once again, although weaker than in previous weeks. 0.7550 is resistance once again, even after the breakdown. It was a very distinct line separating ranges and had a similar role back in January.

I am bullish on NZD/USD

The improvement in Europe is certainly good news for the risk loving kiwi bulls, and after the breakout, there’s room for more rises. The employment report is critical.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the Swiss Franc, see the USD/CHF forecast.