NZD/USD retreated for a second week in row, despite receiving some positive figures. The greenback’s strength was just too much. Has the pair peaked? Inflation Expectations is the major event this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

Last week, New Zealand’s retail sales increased better than predicted posting a 1.3% gain in the second quarter following 1.5% decline in the first quarter. This reading was way higher than the 0.7% increase anticipated by analysts. Meantime Core sales increased by 0.9% broadly within expectations indicating NZ market is expanding.

Updates: Visitor Arrivals will be released later on Monday. NZD/USD was steady, as the pair was trading at 0.8089. Visitor’s Arrivals was a disappointment, declining by 3.4%. This was a five-month low for the indicator.. Inflation Expectations was dropped slightly, to 2.3%. It marked the fifth consecutive drop in the indicator. Credit Card Spending dropped sharply, posting a weak 0.1% gain. It was the consumer indicator’s worst reading in almost three years. The kiwi is moving upwards, as NZD/USD was trading at 0.8139. Trade Balance will be released on Thursday. The markets are expecting a slight deficit, following a string of surpluses. The kiwi dropped below the 0.81 line, as NZD/USD was trading at 0.8091. The kiwi has strengthened, pushing into the mid-81 range. NZD/USD was trading at 0.8166.

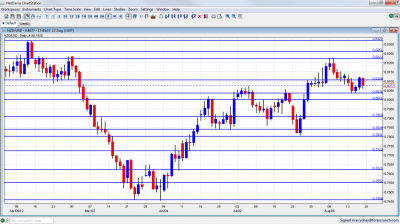

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Visitor Arrivals: Monday, 22:45. The number of short-term arrivals edged up unexpectedly by 2.8% in June after 0.8% decline in May, in light of a surge in Australians and Chinese tourists.

- Inflation Expectations: Tuesday, 3:00. New Zealand companies expected inflation will be further subdued in the next two years, enabling the Reserve Bank to keep interest rates on hold for longer. Consumer price index was expected to reach 2% a year, down from 2.24% in the last survey, while two-year ahead expectations fell to 2.41% from 2.5%.

- Credit Card Spending: Tuesday, 3:00. Credit card spending increased to 4.6% in June from a year earlier, following 3.9% in May. The rise indicated a pickup in NZ market activity but did not generate market volatility.

- Trade Balance: Thursday, 22:45.New Zealand improved its trade balance surplus to a seasonally adjusted NZ$331 million in June, following the downwardly revised NZ$232 million surplus in May. The reading blew away predictions for NZ$77 million amid sharp increase of 7.9% in exports and a 1.9% decrease in imports.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/$ made an initial attempt to cross the 0.8105 line (mentioned last week) before falling to support at 0.8035. A second move also failed and the pair eventually closed at 0.8066.

Technical lines, from top to bottom:

0.8573 capped the pair in September 2011 and is distant resistance. 0.8505 served as support at the same time.

0.8470 was the swing high seen in February. 0.84 was resistance back in February 2012. 0.8320 was a wing high in April, just before the big dive.

0.8260 capped the pair during March, and is stubborn resistance. 0.8220 worked as stubborn resistance in August 2012 and joins the chart.

0.8105 is the new peak reached in July 2012 and should be closely watched on any upside movement. 0.8035 was a clear line of support in August 2012 and is now quite strong.

The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance. It was hit by the recent moves and somewhat weaker now. Another round number, 0.79, is key resistance, after being a very distinct line separating ranges. It proved its strength also in June 2012.

0.7840 provided support for the pair several times during June 2012 and also worked as resistance back at the end of 2011. The round number of 0.78 is significant support after working as such in July 2012.

0.7723 supported the pair back at the beginning of 2012 and also worked in the other direction in June 2012. 0.7620 provided support in May 2012 and is resistance once again, although weaker than in previous weeks.

0.7550 is resistance once again, even after the breakdown. It was a very distinct line separating ranges and had a similar role back in January.

I remain bearish on NZD/USD

Chinese growth is still a worry and so are New Zealand’s fundamentals, especially the weak labor figures. In addition, the greenback now enjoys strength even European worries, and this should be another warning sign for the kiwi.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the Swiss Franc, see the USD/CHF forecast.