The Canadian dollar could not hold on to its gains and retreated, hand in hand with the fall in oil prices. Retail sales and GDP figures are the highlights of this week. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

Last week, the consumer price index increased a modest 0.2% in August while expected to gain 0.4%, however Core CPI advanced by 0.3% in line with predictions following 0.1% decline in the previous month posing little inflationary threat for the BOC. Also other figures disappointed, and led USD/CAD above resistance. For example, Wholesale Sales declined unexpectedly by 0.6% in July after declining 0.1% in June.

Updates: BOC Governor Mark Carney spoke on a panel discussion in Ottawa. Core Retail Sales and Retail Sales will be released later on Tuesday. The markets are expecting both indicators to improve after last month’s declines. BOC Deputy Governor Timothy Lane is scheduled to speak at a meeting in Calgary. The loonie has edged upwards, as the pair dropped below 0.98. USD/CAD was trading at 0.9782. Core Retail Sales came in at 0.4%, just above the estimate of 0.3%. Retail Sales looked sharp, posting a 0.7% rise. This easily beat the market forecast of 0.2%. GDP, a key indicator, will be released Friday. The markets are predicting very modest growth of just 0.1%. The loonie is steady, as the pair was trading at 0.9837.

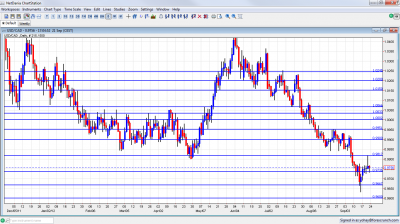

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Mark Carney speaks: Monday, 19:00. Mark Carney BOC Governor is scheduled to speak in Ottawa. His words can create volatility in the market as well as signal on relevant monetary policy changes.

- Retail sales: Tuesday, 12:30. Canadian headline and core retail sales dropped unexpectedly by 0.4% in June continuing the slowdown trend in the last few months. These declines followed a 0.2% rise in retail sales and a 0.4% gain in core sales in May. The BOC harsh monetary policy and its call to minimize household loans is a likely contributor to this slowdown. Headline retail sales are expected to gain 0.4% while Core sales are expected to climb 0.3%.

- Timothy Lane speaks: Tuesday, 18:15. BOC Deputy Governor Timothy Lane will speak in Calgary and can hint on monetary policy changes.

- GDP: Friday, 12:30. Gross domestic product increased by 0.2% in June following a 0.1% rise in May, beating predictions of a 0.1% growth. Bank of Canada governor Mark Carney stated that Canada’s output coincides with the economy’s production potential and is likely to increase in 2013. Gross domestic product is expected to grow by 0.2% this time.

* All times are GMT.

USD/CAD Technical Analysis

USD/C$ traded steaily on higher ground throughout most of the week, peaking out at 0.9817 before falling to support at 0.9725 (mentioned last week).

Technical lines, from top to bottom:

1.0066 was key support before parity. It’s strength during July 2012 was clearly seen and it gave a fight before surrendering. Now, it is somewhat weaker. 1.0030 is another line of defense before parity after capping the pair earlier in the year. The move below this line is not confirmed yet.

The very round number of USD/CAD parity is a clear line of course, and the battle was very clear to see at the beginning of August 2012. Under parity, 0.9950 is now the top border of the range, similar to a role it played in March 2012. It also worked well as resistance in August 2012, in more than one occasion.

0.99, the round number capped the pair in May 2012, was a pivotal line in the middle of the range during the summer of 2012. 0.9817 was a stubborn peak in September and is now significant resistance.

Lower, 0.9725 worked as strong support back at the fall of 2011. 0.9667, which was another strong cushion in June 2011 is the next line.

The round number of 0.96 provided some support back in 2011 and is minor now. Further below we find 0.9550, which worked as resistance when the pair traded in low ground.

0.9450 also provides some support on the way down. The ultimate line of support is 0.9406, which was the bottom in 2011 and the lowest since the financial crisis broke out.

I am neutral on USD/CAD.

With the price of oil on the retreat and a waning down of Middle East tensions (for now), the loonie has to lean on. On the other hand, Canada still enjoys QE3 and a relatively sound economy.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast