Euro/dollar recovered after the falls, but didn’t really go very far. It seems that some progress has been made both in Spain and in Greece, but uncertainty remains high. Meetings of the Eurogroup and a speech by Mario Draghi are the main events in a busy week. Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

Mario Draghi didn’t provide any big news in the rate decision, apart from clarifying that the bond buying program is fully ready, awaiting a Spanish aid request, that hasn’t happened so far. Will Spain wait another week, after regional elections? In Greece, there seems to be an agreement about privatization but many other issues remain open. The government estimates that its coffers will run dry by the end of November. In the US, the positive NFP and unemployment rate improved the global mood and hurt the dollar, but this could eventually backfire.

Updates: Chancellor Angela Merkel is in Athens on Tuesday, as the Greek capital braces for wide demonstrations. The Euro-zone financial ministers are meeting in Luxembourg, with the Greek and Spanish bailouts at the top of the agenda. In Brussels, ECB head Mario Draghi testified before the Committee on Economic and Monetary Affairs of the EU. France’s government budget deficit increased to 97.7 billion euros. This was up from a deficit of 85.5B in the previous release. The French trade deficit worsened in September, climbing to 5.3 billion euros. This exceeded the estimate of a deficit of 4.9B. Italian GDP declined 0.7% in Q2, slightly better than the estimate of a 0.8% drop. The markets got some much-needed good news on Wednesday from European releases. German WPI climbed 1.3%, beating the estimate of 0.4%. French Industrial Production jumped 1.5%, a four-month high. The market estimate stood at -0.2%. Italian Industrial Production shot up 1.7%, its largest gain since last October. The markets had expected a decline of 0.5%. IMF released a Global Finance Stability Report which rattled market sentiment. The IMF issued its Global Finance Stability Report. The report reduced a previous IMF forecast for global growth from 3.5% to 3.3%, and expressed pessimism about the situation in Europe. Without drastic action to combat the debt crisis, the report stated, the capital flight out of Europe will worsen, and deteriorating economic conditions could lead to the breakup of the Euro-zone. The euro initially dropped following the report, but has since rebounded, as the pair tests 1,29. EUR/USD was trading at 1.2890. The euro is trading higher following an S&P downgrade to Spain, as the markets are optimistic that the credit rate cut will force Spain to seek a bailout. EUR/USD pushed above 1.29, as the pair was trading at 1.2922. German Final CPI came in at a flat 0.0%, as expected. French CPI disappointed, dropping by 0.3%. The estimate stood at 0.1%. The ECB Monthly Bulletin was released earlier on Thursday. The report stated that economic indicators confirm a weak Q3 for the Euro-zone. The report also noted that the OMT has helped reduce tensions over the debt crisis, but governments must take further actions.

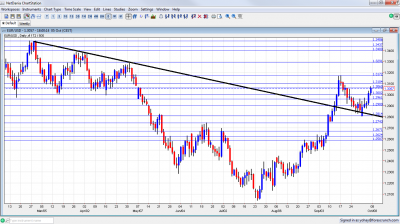

EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Eurogroup Meetings: Monday. Finance ministers of the 17 euro-zone member states meet in Brussels. This meeting was some kind of a deadline for the talks about Greece. However, there are too many disagreements between the troika and the Greek governments. There is a lot of doubt if the last minute weekend minutes will be able to produce some significant paper for the meetings on Monday. Nevertheless, statements about the future of Greece, potential concessions by Germany and other musing coming out of Brussels will certainly rock the euro.

- German Trade Balance: Monday, 6:00. Germany’s high trade surplus is among the things supporting the euro. The surplus more than passes the deficit of all other members. After peaking at 16.3 billion, the figure fell to 16.1 and is now expected to slide to 15.8 billion euros – still very high.

- German WPI: Monday, 8:30. With the Bundesbank digging its heels about the ECB’s role, only a fall in German inflation can open the door for rate cuts. So, the Wholesale Price Index is of importance. It leaped by 1.1% last month and is expected to rise by 0.4% this time.

- Sentix Investor Confidence: Monday, 10:00. This wide survey of 2800 analysts and investors saw some improvement last month, with the score rising to -23.2 points. Another rise to -20.6 points is expected. Note that the negative number implies pessimism.

- German Industrial Production: Monday, 10:00. After a weak factory orders number, expectations are low for industrial output – a drop of 0.7% is expected after a rise of 1.3% last month.

- Merkel and Samaras meet: Tuesday. The German Chancellor Angela Merkel is taking a courageous step and flying to Athens, trying to show support and ease tensions. Austerity measures are associated strongly Merkel, and two unions plan to greet her with a strike. The statements released by Merkel and Greek PM Samaras will be watched alongside the pictures from the streets of Athens. No big breakthrough is expected though.

- French Trade Balance: Tuesday, 6:45. Europe’s second largest economy saw its trade deficit squeeze to 4.3 billion in July. It is now expected to widen once again to -4.9 billion.

- Mario Draghi talks: Tuesday, 7:30. After saying that the OMT is fully ready, Draghi will now meet European lawmakers in an official testimony. Draghi often releases interesting statements. Anything related to Spain will be of interest.

- French Industrial Production: Wednesday, 6:45. France enjoyed a rise in industrial output during July: +0.2%. A rise of 0.1% is now expected for August. Manufacturing PMIs for September already point to negative numbers.

- German Final CPI: Thursday, 6:00. Prices remained flat during September according to the initial release, and this will likely be confirmed now. The impact of a stronger euro will likely be felt only in October.

- ECB Monthly Bulletin: Thursday, 8:00. The ECB’s report provide an insight about what the central bank saw before making its recent rate decision. Future prospects about inflation and growth will likely look gloomy.

- Industrial Production: Friday, 9:00. Industrial output will probably be negative: 0.5%, the same scale of the rise in the previous month. Despite earlier releases by France and Germany, the all-European release still has a significant impact.

* All times are GMT

EUR/USD Technical Analysis

€/$ started the new quarter with a leap, but couldn’t break above the 1.2960 (mentioned last week) at first. Towards the end of the week, the pair finally broke higher and also crossed the important 1.30 line.

Technical lines from top to bottom:

1.3615 provided support to the pair when it was trading at elevated levels back in the fall of 2011. 1.3550 served as a cap at that same period of time.

1.3480 is very important resistance: it was the peak seen in February. At the time, it was very stubborn. 1.3437 is of historic significant and is a minor line now.

The round level of 1.34 is a strong cap after serving as such during March. 1.3290 worked as resistance for the pair during April and is also of importance.

1.3170 worked very well as a double top during September 2012 and is now the top frontier. 1.3105 provided some support in April and is a weak line at the moment.

1.3060, was a clear separator in May and also had an important role beforehand. It slowed the rally in September 2012 and is still very relevant.

The very round 1.30 line was a tough line of resistance for the September rally. In addition to being a round number, it also served as strong support. It is now becoming more pivotal and a battleground. It is closely followed by 1.2960 which provided some support at the beginning of the year and also in September.

1.29 is a round number that also provided support when the euro was tumbling down back in May. 1.2814 was the peak of a recovery attempt in May and also capped the pair in September 2012.

1.2750 capped the pair after the Greek elections and also had a similar role in the past. It is weaker now. 1.2670 was a double bottom during January and was the high line of the recovery before the Greek elections in June. It also capped the pair at the beginning of July 2012.

1.2624 is the previous 2012 low and remains important as also seen at the end of August, when it served as resistance. Below, 1.2587 is a clear bottom on the weekly charts but after holding the pair down for a while, but it is weak now.

Long Term Downtrend Working Again

The line starting from February at the 1.3486 peak was formed in March and April. The rally sent the pair surging through this level, as the graph shows. The pair flirted with this line again and again. the recent move towards this line proved to work again as sending the pair away from the line and higher.

I am bearish on EUR/USD

Uncertainty remains high in Europe, and it seems that no breaking news will be announced until we get closer to the October 18-19 summit. This is especially relevant regarding Greece, where negotiations are endless. Even if Spain finally makes the bailout request (although it isn’t likely before October 21st), this move is mostly priced in, and we could get a “sell the fact” reaction.

In the US, the jobs reports was relatively positive, especially when looking at the big revisions. This will not impact the Fed decision, which is too close to the elections, but will certainly impact the political debate.

For an alternative technical view on the euro after the NFP, see EUR/USD Headed for Even Higher Resistance? by Matthew Lifson.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more. Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast