GBP/USD had a good week, as the pair gained close to one cent, closing at 1.6091. The highlights of the week are the Manufacturing and Construction PMIs. Here is an outlook of the upcoming events, and an updated technical analysis for GBP/USD.

Preliminary GDP was a stellar performer, as it jumped 1.0%, its highest increase since July 2010. On the flip side, CBI Industrial Order Expectations plunged to -23 points, its worst performance in 2012.

Updates: Net Lending to Individuals jumped to an eight-month high, posting a reading of 1.7 billion pounds. This easily beat the forecast of 0.6B. M4 Money Supply remained at 0.2%, falling below the estimate of 0.4%. Mortgage Approvals came in at 50 thousand, just above the estimate of 49K. CBI Realized Sales will be released later on Tuesday. The markets are expecting a slight improvement, with an estimate of 7 points. The pound is improving, as GBP/USD was trading at 1.6065. GfK Consumer Confidence continues to look awful, as the consumer index dropped to its lowest level since April, falling to -30 points. The estimate stood at -28 points. BOE Deputy Governor Charles Bean delivered a lecture in Hull. Nationwide HPI rebounded nicely, rising 0.6%. The estimate stood at 0.2%. Manufacturing PMI hit a three-month low, dropping to 47.5 points. The estimate stood at 48.1. The index has been below the important 50 line since May, indicating ongoing contraction in the UK manufacturing sector. The pound is steady, as GBP/USD was trading at 1.6162.

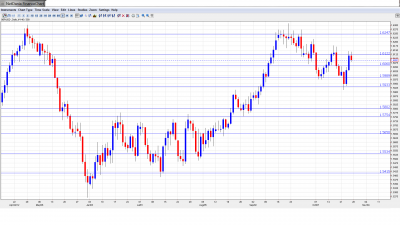

GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Net Lending to Individuals: Monday, 9:30. Net Lending was a major disappointment in September, as the consumer indicator failed to post a gain for the first time since February 2011. The markets are expecting a turnaround this month, with an estimate of 0.6 billion pounds.

- CBI Realized Sales: Tuesday, 11:00. This diffusion index is based on a survey of UK retailers and wholesalers. The index rose to 6 points last month, and the markets are expecting a slight improvement in the upcoming reading, with an estimate of 8 points.

- GfK Consumer Confidence: Wednesday, 00:01. The indicator is mired in a deep slump, indicating prolonged pessimism about the UK economy. The previous reading came in at -28 points, and no change is expected.

- Nationwide HPI: Thursday, 7:00. This important housing inflation index fell 0.4% last month, well below the forecast. The markets are expecting a rebound in the November release, with an estimate of a modest 0.2% gain.

- Manufacturing PMI: Thursday, 9:30. Manufacturing PMI has not cracked the important 50 line since May, as the manufacturing sector continues to look sluggish. The markets are expecting more of the same in the November reading.

- Construction PMI: Friday, 9:30. This PMI continues to flirt with the 50 level, and the estimate for this month’s release stands at 49.1 points. Will the index surprise the markets and break the 50 level?

*All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.5997, and touched a low of 1.5913, as it broke through support at 1.5930 (discussed last week). The pair then make a strong push upwards, climbing up to 1.6141. The pair then gave up some gains, and closed the week just below 1.61, at 1.6091.

Technical lines from top to bottom:

We start with resistance at 1.6747, which has held firm since April 2011. Next is the round number of 1.66, which was last tested in August 2011. Below, there is resistance at 1.6475. This is followed by the 1.6343 line, which was last breached when the pound dropped sharply in September 2011. We next encounter resistance at 1.6247. Below, is the line of 1.6122, which was breached temporarily for the second straight week, as the pound showed some strength before retracting.

GBP/USD is receiving weak support at 1.6060, which was in a resistance role just last week. Next is 1.5992, which has strengthened as the pair trades at higher levels. This line was briefly breached last week as the pair sagged. Below is the line at 1.5930, which also was breached as the pair dropped close to 1.59 before rebounding sharply. This is followed by support at 1.5805. This line has remained in place since early September. We next find support at 1.5750.

This is followed by support at 1.5648, which saw a lot of action in August. Below, there is support at the round figure of 1.5600, which has held firm since early August. Next is the support line of 1.5530. This line has held firm since August, when the pound started its impressive summer rally. The final support line for now is 1.5414, which was last breached in July.

I am neutral on GBP/USD.

UK releases were mixed last week, and the markets are not expecting any dramatic improvements from the UK economy. The pound has been choppy in October, and has not moved much from its levels at the beginning of the month. If numbers out of the US continue to improve, the pound could benefit and make some inroads against the greenback.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.