EUR/USD made a small recovery after two weeks of falls. Is it headed higher once again? Or is it just a correction before the next leg down? German ZEW and IFO business indicator and PMIs are among the main events this week. Here is an outlook for these events among others, and an updated technical analysis for EUR/USD.

Last week, Eurozone GDP disappointed, with a small climb of 0.1% in Q3, suggesting recovery remains fragile. French and Italian preliminary GDP declined by 0.1%, below market consensus. German preliminary GDP was in line with forecasts, but was lower than the 0.7% expansion registered in September. Greece remains weak despite the troika’s 240 billion euros aid injected since 2010. The Greek government is expected to reduce a2 billion euros from its 2014 budget which seems unlikely at this point. Will the Eurozone be able to boost growth in the coming weeks? Let’s start:

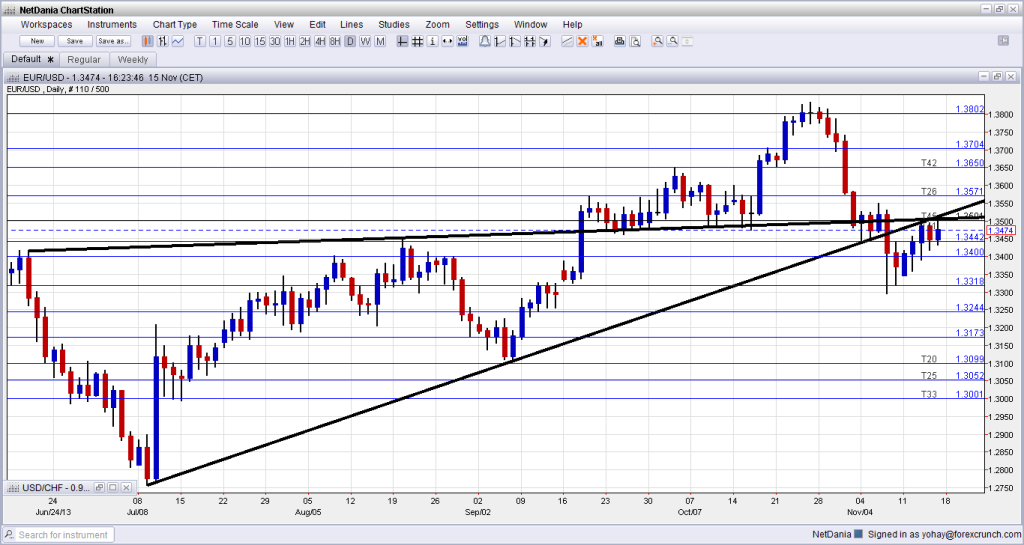

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Current Account: Monday, 9:00. Current account surplus in the Eurozone widened to 17.4 billion euros ($23.6 billion) in August from 15.5 billion euros in July. On a yearly base, surplus expanded to 192.8 billion euros, compared to 88.2 billion euros for the same period a year earlier. This important indicator reinforces the claim that the Eurozone is on a recovery path. Another rise to 18.3 is expected this time.

- German ZEW Economic Sentiment: Tuesday, 10:00. German analyst and investor sentiment increased unexpectedly in October, reaching 52.8 from 49.6 in September amid signs of a continuous recovery in the euro area. German investors are more confident in the Eurozone than in Germany, indicating the gap between Germany and other EU countries is expected to close in the coming months. Economic sentiment is expected to climb further to 54.6. Economic sentiment in the Eurozone according to the German ZEW institute improved to 52.8, the highest level in more than three years, from 58.6 in September, but current conditions declined to 29.7 from 30.6 in the prior month. However, German think tank ZEW president Clemens Fuest is still believes sentiment will continue to rise in the coming months. Economic climate for the Eurozone is expected to edge up to 63.1.

- German PPI : Wednesday, 7:00. Germany`s Producer Price Index gained 0.3% in September following a drop of 0.1% in August, missing analysts` estimate of a 0.1% increase. Headline PPI remained unchanged at minus 0.5 %year-on-year, beating forecasts for 0.7% decline. A rise of 0.1% is forecasted.

- Flash Manufacturing and Services PMIs: Thursday. French manufacturing activity slowed in October to 49.4 points, from 49.8 in September, falling to the lowest level in three months. Likewise the services index ticked down to 50.2, from 51 posted in September, indicating the French private sector started the fourth quarter poorly. Meanwhile, Germany expanded at a slower pace; the services sector dropped to 52.3 from 53.7 in September, missing predictions for a rise to 53.9 amid jobs cut and slow growth in new business, however stronger growth was posted in the manufacturing sector with a rise to 51.5 from 51.1 in the prior month. Finally, the Euro area continued its modest upturn with a rise to 51.3 in the manufacturing sector from 51.1 in September, however the services sector grew at a slower pace, reaching 50.9 following 52.2 in the previous month. French Manufacturing is expected to reach 49.6, French Services – 51.3, German Manufacturing – 52.3, German Services 53.1, Eurozone Manufacturing- 51.6, Eurozone Services 51.9.

- Consumer Confidence: Thursday, 15:00. Consumer sentiment in the euro zone improved at a lower rate than expected in October, reaching -14.5, from -14.9 in September. Nevertheless the general direction is positive, suggesting a sustained recovery in the Euro area. The reading was the best since July 2011, when it stood at -11.2. The recovery, however, remains fragile, since countries like Greece, Portugal and Spain continue to battle with the impact of the downturn and the fallout from the bloc’s debt crisis. Another improvement to -14 is forecasted.

- German Final GDP: Friday, 7:00. According to the first release, the German economy grew by 0.3% in Q3, as expected. This will likely be confirmed now. This growth countered contraction of 0.1% seen in both France and Italy.

- German Ifo Business Climate: Friday, 9:00. German business morale fell for the first time in six months in October, reaching 107.4 from 107.7 in September, a sign that German economic recovery is still fragile. Nevertheless, recovery is expected to continue amid growth in exports and business sentiment. A rise to 107.9 is expected.

- Belgian NBB Business Climate: Friday, 14:00. Belgian NBB Business Climate worsened in October, dropping to -7.7 from -6.7 in September. The reading was weaker than the -4.1 figure predicted by analysts. The fall in manufacturing was mainly due to high levels of inventories. In construction, the decline was chiefly due to weaker demand prospects. A rise to -6.9 is expected now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started the week by moving gradually higher, but the 1.35 (mentioned last week) worked as resistance. It then continued trading in high range, and closed just below this line.

Technical lines from top to bottom:

1.3870 capped the pair during the fall of 2011 and served as the “shoulders” in a H&S pattern. 1.38 is a round number and also worked as a temporary cap during that period of time and also in October 2013.

1.3710 was the previous 2013 peak, and served as a clear separator. The pair needed a big trigger to break above this line, and when it lost it again, the fall was painful.

1.3650 temporarily capped the pair during that period of time and is stronger after capping the pair in October 2013. It returns to serve as resistance. 1.3570 is the swing high of September 2013 and also proved itself as resistance afterwards. It temporarily stopped the avalanche.

1.35 is a nice round number and was a pivotal line or “magnet” within the previous range. 1.3440 worked as a clear separator in early November 2013 and is a key line to the upside.

The round number of 1.34 worked as resistance several times in 2013, but is only minor resistance. 1.3320 worked as a double top in early September and it was crossed only with a Sunday gap. It remains a clear separator of ranges.

It is followed by 1.3240, which capped the pair in April and also had a role in August. It worked as support in September. 1.3175 capped the pair during July 2013.

1.3100 is worked as temporary resistance in December 2012 and is becoming more important once again, after capping a recovery attempt in June and then in July and providing support in September. It is followed by 1.3050, which proved be strong support in May 2013, defending the round number in more than one occasion, but it is less significant now.

The very round 1.30 line was a tough line of resistance. In addition to being a round number, it also served as strong support and recently worked as a pivot line. 1.2940 is the next line of support. It worked as such during April and May 2013.

Lower, 1.2890 worked in both directions during 2012 and was the beginning of the uptrend support line. It is becoming more important, as a clear separator of ranges. 1.2840 worked as a cushion for the pair during May 2013.

EUR/USD broke below two uptrend support lines

The steeper uptrend support line accompanied the pair since early July and was clearly broken now. Also the more moderate line that worked in both directions since June, was now clearly taken.

I remain bearish on EUR/USD

The euro-zone is still muddling though, as GDP figures have shown. PMIs will probably show that the recovery doesn’t have momentum. Most importantly, ECB members have begun calling for outright QE, like other central banks. More comments like these could continue weighing on the single currency.

In the US, the recent rate decision wasn’t too dovish, and the meeting minutes could reinforce this sense. All in all, it seems that the pair needed to correct some of its falls, and that it might be ready to resume the downfall.

More:

- Currency wars redux – is USD next?

- Forex Analysis: EUR/USD Consolidating after Sharp Decline and Rebound

If you are interested a different way of trading currencies, check out the weekly binary options setups, including EUR/USD and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.