EUR/USD staged a nice recovery, with the weakness of the dollar serving as the main driver. Does this provide an opportunity to sell the pair in the wide range?

The team at Morgan Stanley weighs in:

Here is their view, courtesy of eFXnews:

Morgan Stanley picks EUR/USD as its technical FX chart of the week where MS remains medium-term bearish and looks for selling opportunities on rebounds. MS provides some important levels for this potential trade where traders should consider entering this trade and placing their stops and targets accordingly. The details of MS’ latest limit order to short EUR/USD is also provided.

On the long term EUR/USD chart:

“Having accelerated to a low of 1.0463, going out of the lower end of the multi-year trend channel, EURUSD didn’t remain there for very long and has since rebounded to a high of 1.1036. However the longer term bearish picture remains and so, should the downside momentum return, we watch for breaks of the following key levels: 1.0463, 0.9613 then 0.8565,” MS notes.

On the 2-year EUR/USD Chart

“EURUSD is still within a 5 th wave structure of the larger Cwave. The 5 th wave has formed a substructure, which we would expect to complete around parity. However we expect some volatility before getting there. A move above the 1.1052 level would mean that there is a larger 4th wave forming, suggesting a move towards 1.15 before the longer term downtrend continues,” MS projects.

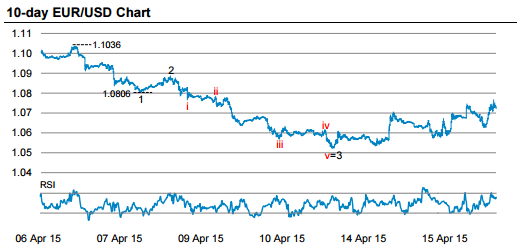

On the 10-day EUR/USD Chart

“EURUSD has begun to form an impulsive structure from the 4-th wave correction, we look for the rebound to sell. We put a stop just above the 1.10 high since a move above here would be out of the top end of the recent range and we would have to reassess our trading strategy at this point,” MS advises.

The trade: limit order to sell EUR/USD

In line with this view, MS runs a limit order to sell EUR/USD at 1.09 in its strategic portfolio. The trade has a stop at 1.1050 and a target at 1.00.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.