EUR/USD managed to recover after Draghi didn’t offer anything really new. The ECB is ready to do more, but there seems to be a lack of urgency.

But this may be only a pause on the way down according to Credit Suisse:

Here is their view, courtesy of eFXnews:

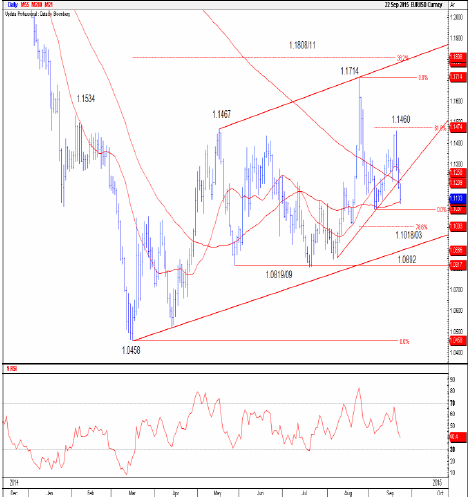

EUR/USD has been trapped in a broad sideways range since March this year, notes Credit Suisse.

“However, with a multi-year top in place following the collapse below the 1.2043 low of 2012, we correspondingly view this as a pause before the core bear trend resumes,” CS argues.

CS thus continues to look for an eventual breakdown in EUR/USD below the May/July lows at 1.0819/09 to trigger a test of the March 2015 1.0458 trough low.

“We would again allow for an initial hold here. However, beneath it can see the medium-term trend turn lower again for our long standing core bear objective at 1.01/.99,” CS projects.

“Resistance shows first at 1.1460, above which would warn of strength back to 1.1714, and more likely the 38.2% retracement of the 2014/2015 collapse at 1.1808/11,” CS adds.

Short-term, CS looks for a retest of the 55-day average at 1.1122 and a clear eventual extension beneath to test the September low at 1.1087 next.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.