EUR/USD managed to recover and rise on the “risk off” atmosphere as well as on Draghi’s speech. But is it off for the races?

Not so fast. The team at Barclays has other ideas for the pair:

Here is their view, courtesy of eFXnews:

“We have revised higher our EURUSD forecasts to reflect considerable changes to the global outlook and the common currency’s recent resiliency versus the USD, but maintain our expectation of significant further downside in EURUSD.

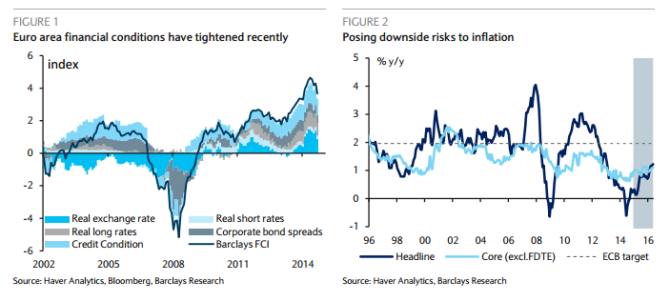

Adjustment of China’s FX regime and increased concerns about Chinese growth, have materially increased downside risks for euro area growth and inflation, but they also appear to have pushed back expectations for Fed tightening. These developments, in conjunction with the EUR’s resiliency, have led to a tightening in euro area financial conditions that we expect will push the ECB to respond with further easing.

The ECB’s actions likely will reinstitute trend EUR weakness, as it serves to remind markets of the euro area’s more fragile recovery relative to other G10 economies, but the descent may be slower than we previously expected.

We forecast EURUSD to depreciate to 1.03 by yearend and below parity by Q2 2016.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.