USD/JPY posted slight losses last week, closing at the 117 line. The upcoming week has just three events. Here is an outlook on the major events moving the yen and an updated technical analysis for USD/JPY.

In the US, retail sales and inflation numbers were weak, but consumer confidence levels beat expectations. In Japan, the current account surplus narrowed and missed expectations.

do action=”autoupdate” tag=”USDJPYUpdate”/]

USD/JPY graph with support and resistance lines on it:

- Revised Industrial Production: Monday, 4:30. This manufacturing indicator has improved of late, posting two consecutive gains. In October, the indicator came in at 1.4%, matching expectations. Another gain of 1.4% is expected in the November release.

- All Industries Activity: Thursday, 4:30. This event is a leading indicator of economic health. The indicator rebounded in October with a gain of 1.0%, which was within expectations. The markets are bracing for a downturn in the November release, with an estimate of -0.7%.

- Flash Manufacturing PMI: Friday, 1:35. This PMI continues to post readings over the 50-point level, which is indicative of ongoing expansion in the manufacturing sector. The December reading showed little change, coming in at 52.5 points, close to the estimate. Little change is expected in the January report.

* All times are GMT

Live chart of USD/JPY: [do action=”tradingviews” pair=”USDJPY” interval=”60″/]

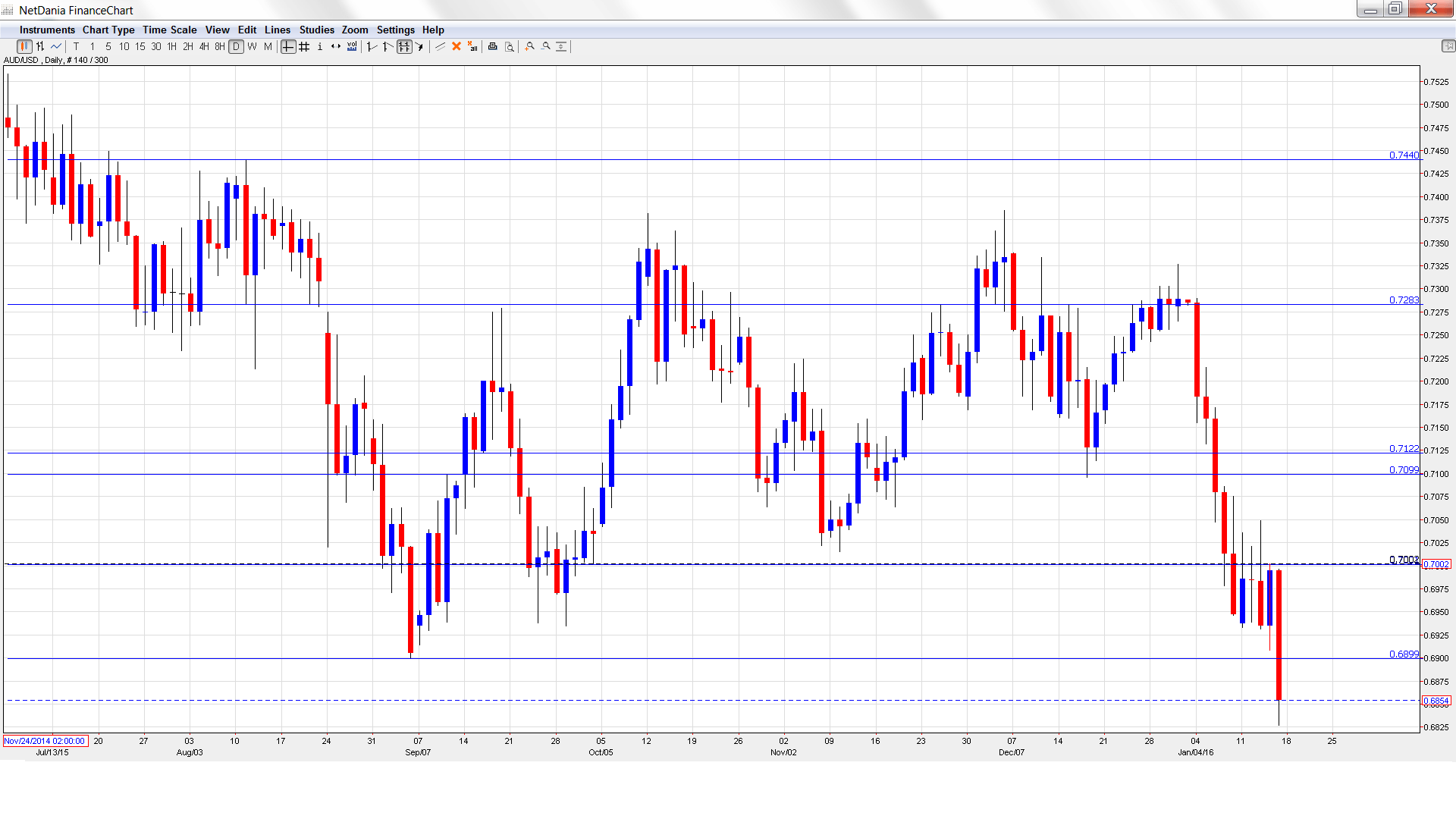

USD/JPY Technical Analysis

USD/JPY opened the week at 117.43 and quickly touched a high of 118.38, as resistance held at 118.50 (discussed last week). The pair then reversed directions and dropped all the way to 116.48. USD/JPY closed the week at 117.05.

Technical lines from top to bottom::

We start with resistance at 121.50.

120.47 marked the highpoint of a yen rally at the start of January, which saw the pair drop below the 117 line.

119.19 is the next resistance line.

118.50 held firm as the pair moved higher before retracting.

116.90 supported dollar/yen early in 2015. It is a weak support level and could see activity early the week.

115.90 has provided support since November 2007.

114.65 is next.

113.71 was an important resistance line in July 2005. It is the final support level for now.

I remain neutral on USD/JPY

The yen and the dollar, both safe haven currencies, have benefited from recent turmoil on the Chinese markets and geopolitical hotspots. Continuing weak inflation levels may delay another US rate hike, a move which would be bullish for the US dollar.

In our latest podcast we explain how to become a forex pro and avoid forex scams

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.