GBP/USD posted sharp losses last week, dropping over 200 points. The pair closed at 1.3246. This week’s highlights are PMI reports and Manufacturing Production. Here is an outlook on the major market-movers and an updated technical analysis for GBP/USD.

After a historic plunge following the Brexit vote, the pound took another hit last week, following Mark Carney’s blunt message that the BoE was planning a rate cut in the summer. In the US, GDP posted came in at 1.1%, beating the estimate of 1.0%. The week wrapped up on a positive week, as ISM Manufacturing PMI beat expectations.

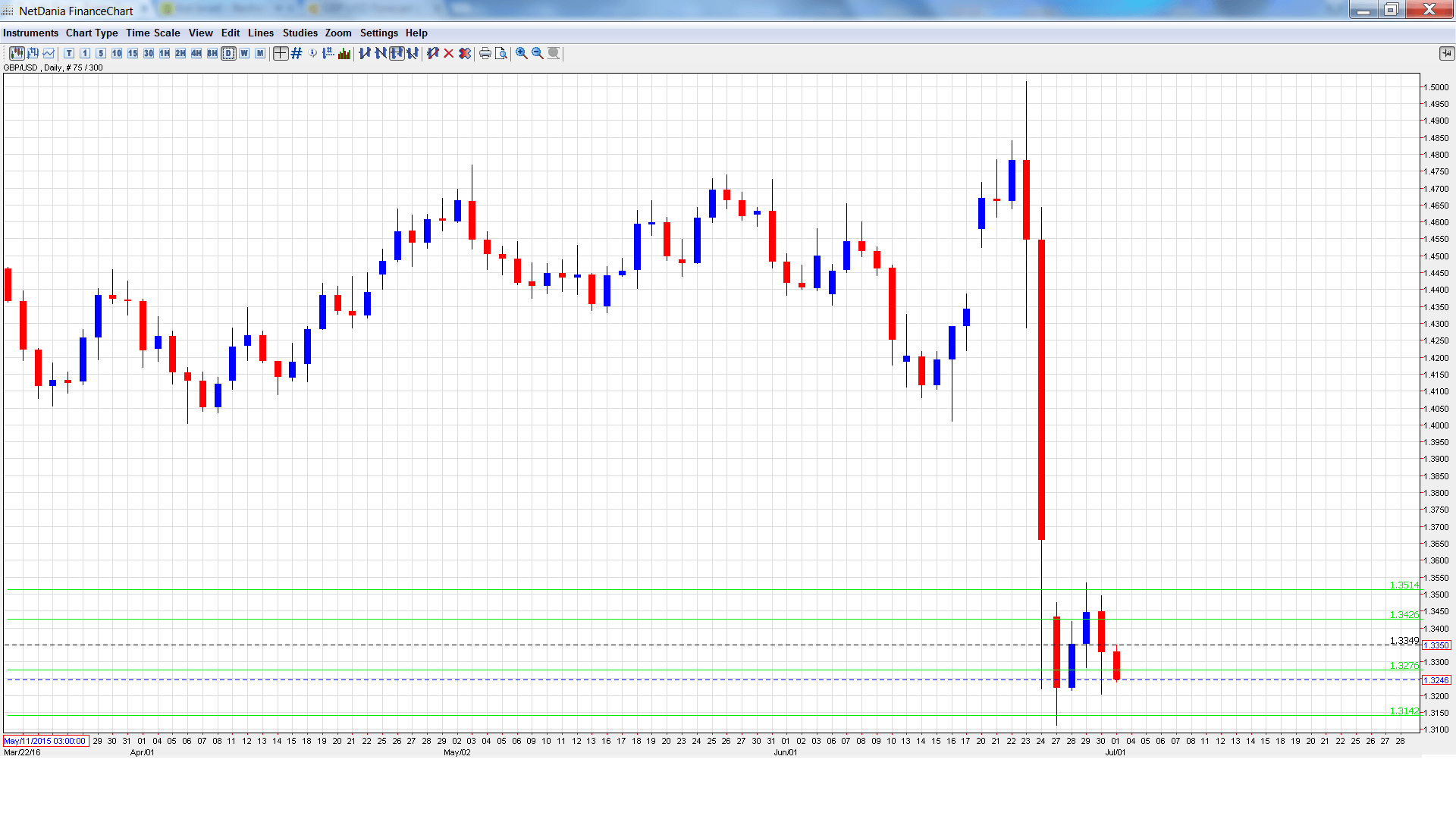

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Construction PMI: Monday, 8:30. The indicator continues to show stagnation in the construction sector, posting a reading of 51.2 in May. This was short of the estimate of 51.9 points. Another weak reading is expected in the June report, with a forecast of 50.6 points.

- Services PMI: Tuesday, 8:30. The indicator improved to 53.5 points in May, above the forecast of 52.5 points, The June reading stands at 53.1 points.

- BOE Financial Stability Report: Tuesday, 9:30. This report is published twice each year and examines the risks to the British financial system. Governor Mark Carney will hold a press conference after the report is published.

- BRC Shop Price Index: Tuesday, 23:01. This indicator measures consumer inflation in BRC shops. It continues to post declines, and the May report came in at -1.8%.

- Housing Equality Withdrawal: Wednesday. 8:30. This indicator is released every quarter. In Q4 of 2015, the indicator widened to GBP 9.5 billion, compared to an estimate of GBP 9.2 billion. The forecast for Q1 stands at GBP 10.1 billion.

- Halifax HPI: Thursday, 7:30. This indicator provides a snapshot of the level of activity in the housing sector. The indicator posted a gain of 0.6% in May, above the forecast of 0.3%. The estimate for the June release stands at 0.4%.

- Manufacturing Production: Thursday, 8:30. Manufacturing Production posted a strong gain of 2.3% in April, crushing the estimate of 0.0%. The markets are bracing for a sharp downturn in May, with the forecast standing at -1.4%.

- 10-year Bond Auction: Friday, Tentative. The yield on 10-year bonds climbed to 1.66% in May, compared to 1.55% a month earlier. Will the upward trend continue in the upcoming release?

- NIESR GDP Estimate: Friday, 14:00. This monthly indicator helps analysts track GDP, which is released every quarter. The indicator climbed to 0.5% in May, its highest level in 2016.

- Goods Trade Balance: Friday, 8:30. Britain’s deficit narrowed to GBP 10.5 billion in April, compared to an estimate of GBP 11.1 billion. This positive trend is expected to continue, with the May estimate standing at GBP 10.2 billion.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.3432 and dropped to a low of 1.3112. The pair then reversed directions and climbed to 1.3533, testing resistance at 1.3514 (discussed last week). GBP/USD then retracted and closed at 1.3246.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

Technical lines from top to bottom

With the pound posting sharp losses, GDP/USD is trading at levels not seen in 30 years. We begin at lower levels:

1.3600 switched to resistance after the pound’s huge losses after the Brexit vote. This line had provided support since 2009.

1.3514 was the low point of the pound’s slide back in January 2009.

1.3426 is the next line of resistance.

1.3276 is an immediate resistance line. It could see further action early in the week.

1.3142 is next.

1.3064 is the final support level for now.

I am bearish on GBP/USD.

In the US, monetary policy is not expected to be hawkish and a rate hike appears doubtful. With the British political scene in disarray and the financial markets struggling to come to grips with Brexit, stormy waters could continue to engulf the pound.

Our latest podcast is titled Brexit Boiling Point

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.