USD/JPY posted strong gains last week, as the pair climbed 230 points. USD/JPY closed at 106.49, close to 14-week highs. There are just two events this week, highlighted by Preliminary GDP. Here is an outlook for the highlights of this week and an updated technical analysis for USD/JPY.

Donald Trump’s stunning election win sent the yen on a roller-coaster ride, as the dollar dropped but rebounded with strong gains. In Japan, the current account surplus dropped sharply, missing expectations.

do action=”autoupdate” tag=”USDJPYUpdate”/]

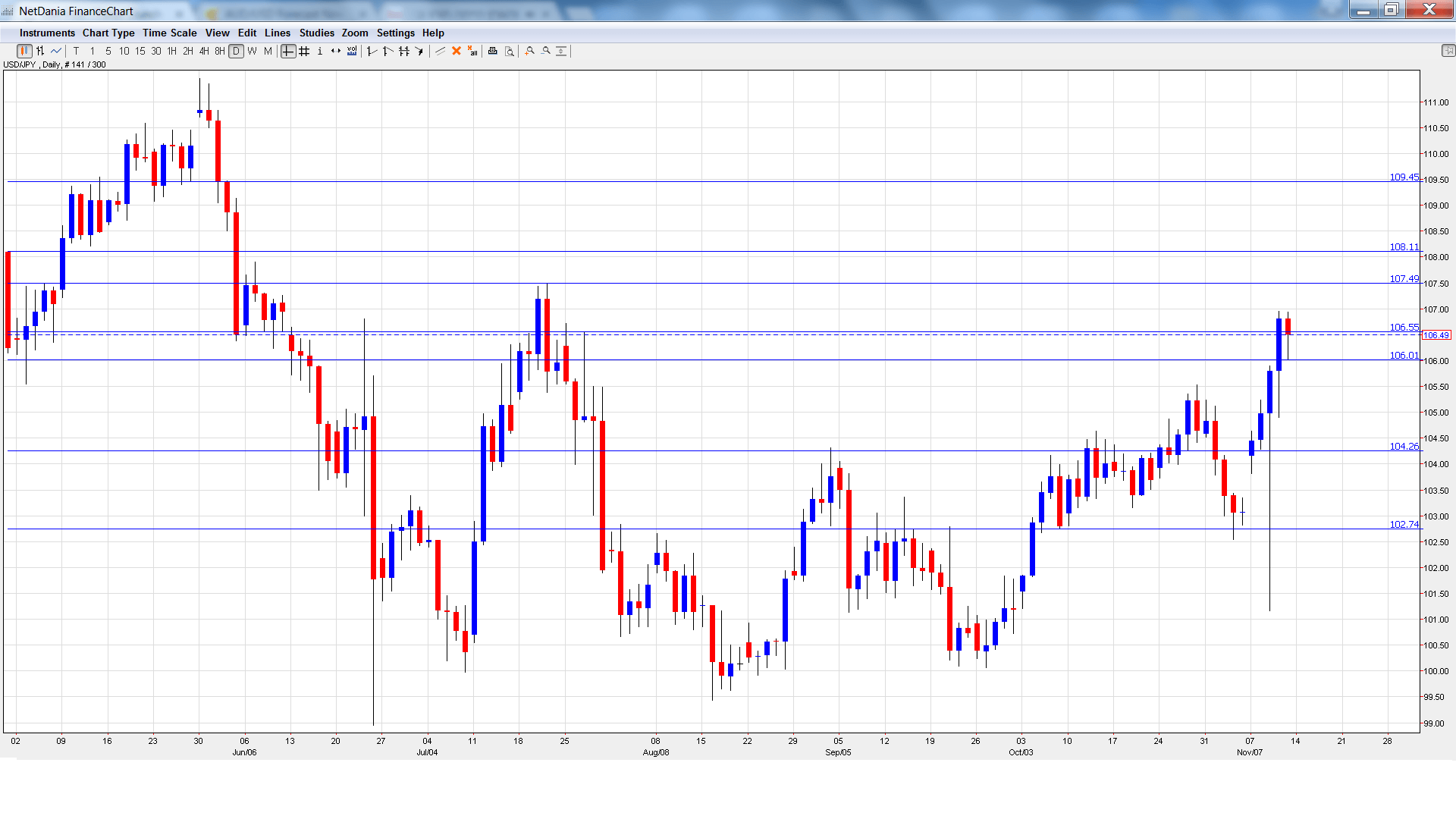

USD/JPY graph with support and resistance lines on it. Click to enlarge:

- Preliminary GDP: Sunday, 23:50. Preliminary GDP is one of the most important indicators and can have a sharp impact on the movement of USD/JPY. In Q2, the indicator slipped to 0.0%, shy of the forecast of 0.2%. The estimate for the third quarter remains unchanged at 0.2%.

- Revised Industrial Production: Monday, 4:30. The indicator jumped 1.3% in August, but this fell short of the estimate of 1.5%. The markets are expecting a sharp downturn in September, with an estimate of 0.0%.

* All times are GMT

USD/JPY Technical Analysis

It was a volatile week for USD/JPY. The pair opened the week at 104.15 and slid to a low of 101.16, as support held firm at 99.95 (discussed last week). USD/JPY then reversed directions and climbed to a high of 106.95. The pair closed the week at 106.49.

Live chart of USD/JPY:

Technical lines from top to bottom:

With USD/JPY posting strong gains, we start at higher levels:

109.45 has held in resistance since June.

108.11 is next.

107.49 was the high point in July.

106.55 was tested as USD/JPY posted sharp gains. It is a weak resistance line.

105.55 is providing support. It was a cushion in May and June.

104.25 is next.

102.74 is the final support line for now.

I am bullish on USD

The US dollar posted broad gains after the Trump shocker and could continue to rack up goals against the Aussie. As well, high expectations about a Fed rate hike in December is bullish for the greenback.

Our latest podcast is titled Trump-time – fiscal, monetary and market implications

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.