GBP/USD posted slight gains last week, with the pair closing at 1.2337. This week’s key events are the three PMI releases. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

In the US, consumer confidence jumped, as consumers continue to feel optimistic about the economy as we enter 2017. On the labor front, unemployment claims dropped, beating expectations. There were no major British releases last week. Soft Brexit or hard reality remains a key theme.

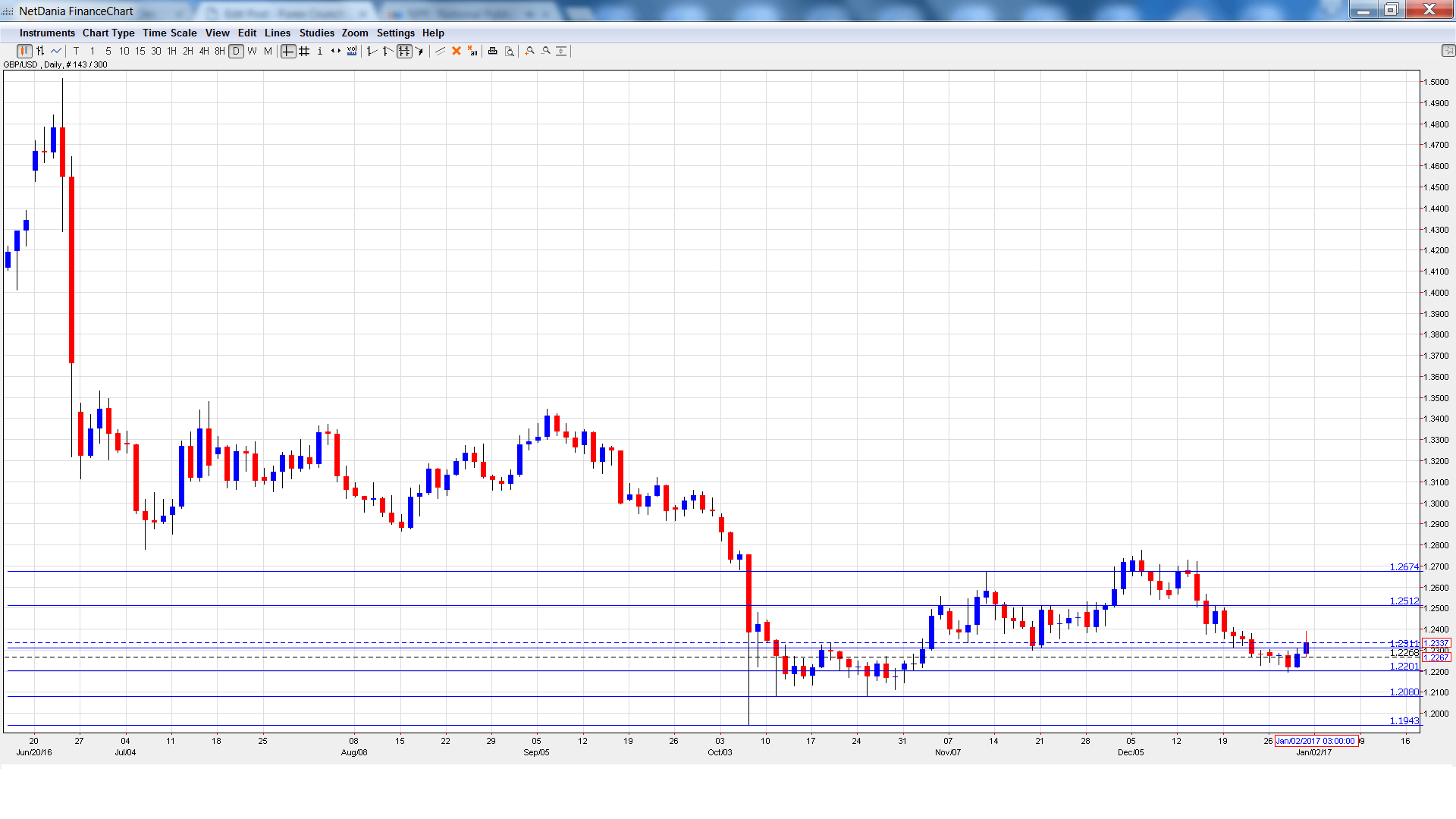

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Manufacturing PMI: Tuesday, 9:30. The PMI dipped to 53.4 points in November, shy of the estimate of 54.4 points. Little change is expected in the December report.

- Construction PMI: Wednesday, 9:30. Construction PMI was almost unchanged in November, posting a reading of 52.8. This figure beat the forecast of 52.3. The estimate for December stands at 52.6.

- Net Lending to Individuals: Wednesday, 9:30. This indicator is closely related to consumer spending, a key driver of economic growth. In October, the indicator climbed to GBP 4.9 billion, above the estimate of GBP 4.8 billion. No change is expected in the November report.

- Services PMI: Thursday, 9:30. The index rose to 55.2 points in November, pointing to expansion in the services sector. This was above the forecast of 54.2 points. The estimate for the December report stands at 54.8 points.

- BOE Chief Economist Andy Haldane Speech: Thursday, 13:00. Haldane will speak at an event in London. Analysts will be looking for clues as to the BoE’s future monetary policy.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2287 and dropped to a low of 1.2195, testing resistance at 1.2201 (discussed last week). The pair then reversed directions and climbed to a high of 1.2388. GBP/USD closed the week at 1.2337.

Live chart of GBP/USD:

Technical lines from top to bottom

1.2674 was a cap in November.

1.2512 is next.

1.2311 remains busy and has switched to a support role. It is a weak line.

1.2201 is the next support line.

1.2080 is protecting the symbolic 1.20 level.

1.1943 is the final support line for now.

I am bearish on GBP/USD.

With the Trump presidency just a few weeks away, the markets are expecting US growth to continue, which could mean more rate hikes from the Federal Reserve. So, the US dollar could start 2017 with broad gains.

Our latest podcast is titled What will move markets in 2017

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.