EUR/USD reached the highest in six months, mostly enjoying the weakness of the dollar. PMIs, a key German survey and the ECB meeting minutes stand out in the last full week of May. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The US dollar was falling as President Trump was engulfed by more scandals. The suspicion of obstructing justice in the Comey memo was the highlight of a terrible week for the White House. The greenback fell on the fear that growth-friendy policies would be delayed. Euro-zone GDP was confirmed at 0.5% q/q and 1.7% y/y. Germany’s ZEW economic sentiment advances, but slightly below expectations. In the US, housing starts and building approvals came out below expectations.

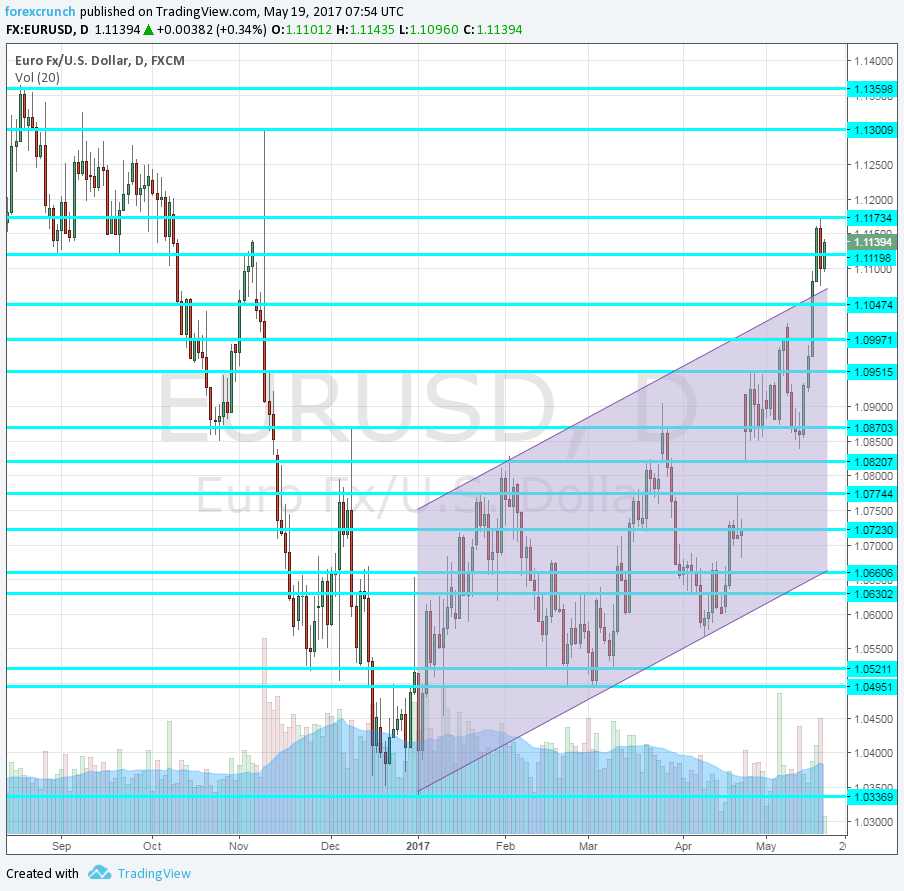

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German GDP (final): Tuesday, 6:00. The German locomotive is firmly on the tracks. Europe’s largest economy grew by 0.6% q/q according to the first release. The numbers will likely be confirmed now.

- German Ifo Business Climate: Tuesday, 8:00. Germany’s No. 1 Think-tank has shown an uptick in business confidence. The score reached 112.9 points in April. We now get a fresh figure for May. A rise to 113.1 is expected now.

- ECB Financial Stability Review: Tuesday, 8:00. Twice a year, the ECB publishes a report about financial stability. Worries about the banks have faded away after the height of the crisis, yet issues with some Italian banks still lurk.

- Flash PMIs: Tuesday morning. Data for France is published at 7:00, for Germany at 7:30 and 8:00 for the euro-zone. The final data for April for France showed ongoing growth. The manufacturing sector had a score of 55.1 points, above the 50 point threshold separating expansion and contraction. We now get the preliminary figures for the month of May The French services sector PMI had a score of 56.7 points in April. Germany had a strong score of 58.2 points in manufacturing and a slide to 58 is on the cards. The services sector lagged behind with 55.4 points and a tick up to 55.5 is projected. The eurozone’s PMIs stood at 56.7 and 56.4 for manufacturing and services respectively and they now carry expectations for 56.7 and 56.5.

- German GfK Consumer Climate: Wednesday, 6:00. The 2000-strong consumer survey beat expectations in April and reached 10.2 points, around the peak of recent figures. A repeat of the same number is predicted now.

- ECB Meeting Minutes: Thursday, 11:30. In the last ECB meeting, Draghi showed optimism on growth but was doubtful about inflation, postponing any announcement about tapering of the QE program. Yet since then, the core inflation reached the highest level since 2013, 1.2% and comments from ECB officials show pressure to scale back the program. We will get more information via the meeting minutes.

- Belgian NBB Business Climate: Thursday, 13:00. Despite coming from a small country, the wide, 6000-strong survey has some influence. Last time, the score came out at -0.8 points, in negative territory, but almost balanced. Another small rise is likely.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar advanced nicely within the uptrend channel (mentioned last week). The pair hit the high ground well above 1.10.

Technical lines from top to bottom:

1.1420 was a high back in the summer of 2016. 1.1360 capped the pair in September.

1.13 is the top line seen in November before the collapse. 1.1170 was the high line in May 2017, after the Comey memo.

1.1120 was a support line beforehand. The round number of 1.10 is a key psychological level.

1.0950 is close by, and the most recent 2017 high. The swing high of 1.0870 is the swing high in December and remains fierce resistance.

1.0820 was the post-French elections low. 1.0775 capped the pair in January and remains of importance.

1.0720 was also high in January. The pair was unable to crack 1.0660 in February and it remains the high end of the range.

Pair breaks above channel

EUR/USD has had three significant and rising lows in 2017: 1.0340 in the wake of the year, 1.0490 in March and 1.0565 in April. Also on the topside, we can see higher highs. In the past week, the pair made a move above the channel limits, as seen on the charts.

I remain bullish on EUR/USD

The breakout finally happened and it has room to run. Growth is stronger in the eurozone than in the US, politics look more stable in the euro-zone in comparison to Trump’s scandals and monetary policy is set to tighten in Europe. Even if nothing new happens, the pair is set to rise.

Our latest podcast is titled Fading political risk, constructive on crude

Follow us on Sticher or iTunes

Safe trading!