GBP/USD dropped almost 2 cents during the week, before rebounding and closing the week down 70 points. The pair closed the week down 70 points, closing at the 1.27 line. There are 7 events this week. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

The BoE was in the headlines last week, as Governor Mark Carney’s warning against rate increases sent the pound sharply lower. Carney was contradicted by MPC member Ande Haldane, who said he was in favor of raising rates. The Fed continues to sound hawkish, as policymakers reiterated the upbeat message from the June rate statement.

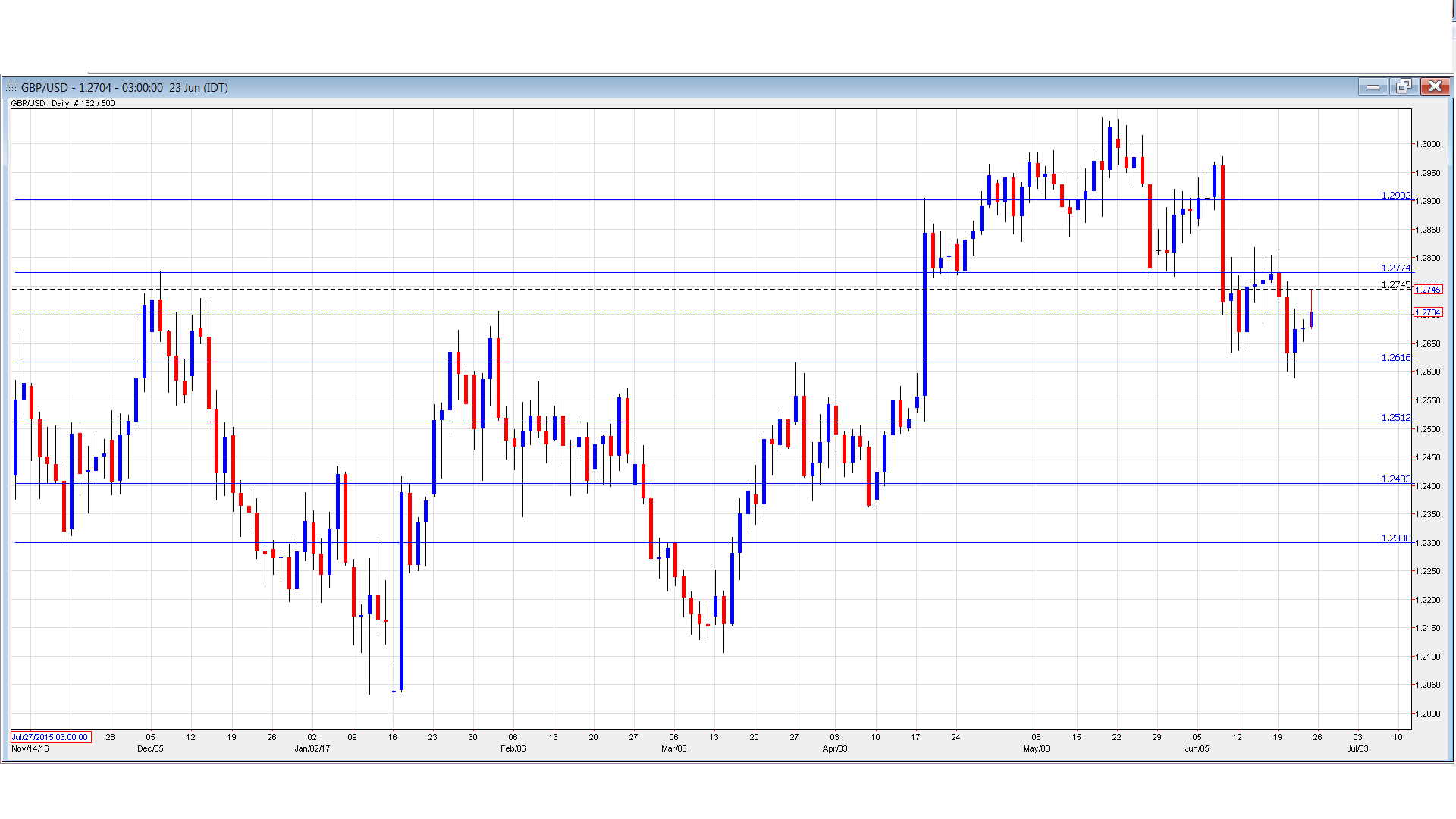

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- BBA Mortgage Approvals: Monday, 8:30. Mortgage Approvals have softened for three straight months, dropping to 40.8 thousand in April. This matched the forecast. The downward trend is expected to continue, with an estimate of 40.3 thousand.

- BoE Financial Stability Report: Tuesday, 9:30. This report examines the stability of the banking system and highlights potential risks to financial stability. Any unexpected risks could send the pound lower. BoE Governor Mark Carney will hold a press conference following the release.

- CBI Realized Sales: Tuesday, 10:00. The indicator dropped sharply in May to 2 points, shy of the estimate of 12 points. The estimate for June stands at 2 points.

- Nationwide HPI: Wednesday, 28th-30th. The index provides a snapshot of the strength of the housing sector. The indicator has posted three straight declines, each of which missed expectations. Will we see a reading in positive territory in the June report?

- BoE Governor Mark Carney Speaks: Wednesday, 13:30. Carney will speak at an ECB event in Portugal. A speech that is more hawkish than expected is bullish for the pound.

- Net Lending to Individuals: Thursday, 8:30. This indicator is closely linked to consumer spending, a key driver of economic growth. In April, the indicator dropped to GBP 4.3 billion, short of the forecast of 4.5 billion. The downward trend is expected to continue, with an estimate of GBP of 4.0 billion.

- GfK Consumer Confidence: Thursday, 23:01. Consumer confidence in the UK continues to point to pessimism. The indicator improved to -5 points in May, but is expected to weaken to -7 points in June.

- Current Account: Friday, 8:30. The UK’s current account deficit narrowed to GBP 12.1 billion in Q4, better than the estimate of GBP 16.3 billion. The deficit is expected to rise to GBP 16.5 billion in Q1.

- Final GDP: Friday, 8:30. This indicator follows Second Estimate GDP, for Q1 which posted a weak gain of 0.2%. The forecast for Final GDP stands at 0.2%.

*All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2773 and quickly climbed to a high of 1.2814. The pair then reversed directions and dropped to a low of 1.2588, testing support at 1.2616 (discussed last week). GBP/USD recovered and closed the week at 1.2704.

Technical lines from top to bottom

1.3112 has held in resistance since September 2016.

1.3020 is protecting the symbolic 1.30 level.

1.2902 is next.

1.2775 has switched to a resistance role following losses by GBP/USD.

1.2616 is next.

1.2512 has provided support since April.

1.2404 is the next support level.

1.2300 is the final support level for now.

I am bearish on GBP/USD.

British consumer spending has softened and there are growing worries that Brexit will take a hefty toll on the UK economy. The political situation remains fluid, and this could scare off investors and hurt the pound.

Our latest podcast is titled Fed faking it until they make it? + a Brexit brawl

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.