EUR/USD made a big breakout and topped 1.20 but fell quite quickly as well. Where will it head next? The ECB meeting is undoubtedly the key event of the week, and there are other events as well. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The Jackson Hole Symposium pushed EUR/USD higher, but the pair needed some time before making a decisive breakout above 1.20. That did not hold: reports that the ECB does not like the current strength of the currency outweighed higher inflation in the euro-zone. Reports about a “no decision” from the ECB weighed on the pair late in the week. The downfall was also driven by a stronger US dollar. Apart from a necessary correction, the greenback enjoyed upbeat economic data: GDP growth came out at the robust level of 3% and other data was also supportive.

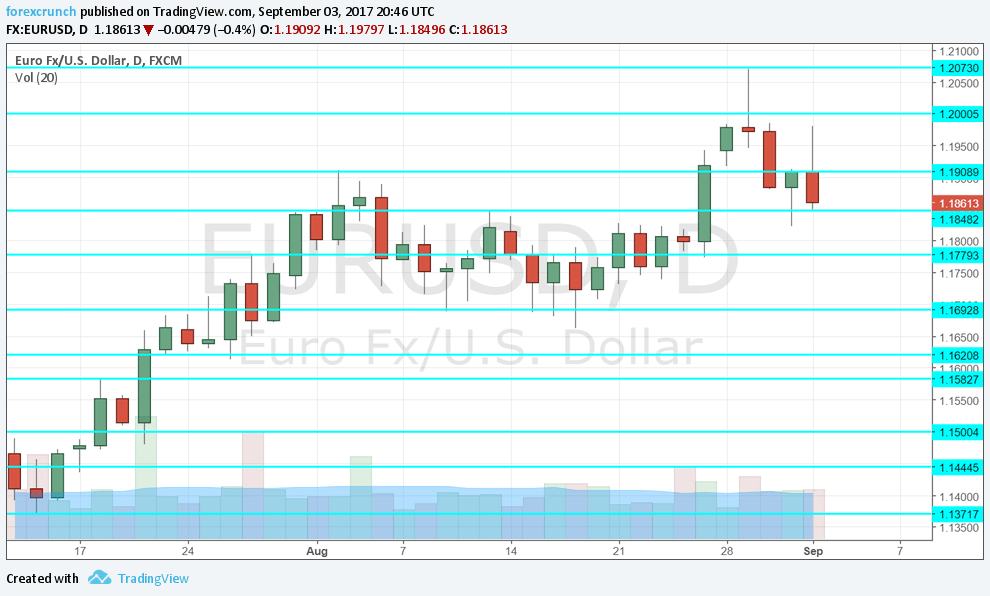

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Spanish Unemployment Change: Monday, 7:00. Spain still suffers from a high unemployment rate despite the improvements in recent years. This snapshot of the jobs markets serves as a gauge for the wider economy. The number of those that are out of a job fell by 26.9K in July, but it came out below expectations. Another drop is likely now: 16.3K is expected.

- PPI: Monday, 9:00. Producer prices serve as a forward-looking gauge of future consumer prices. In June, prices dropped by 0.1% m/m, as expected. A rise of 0.1% is projected.

- Services PMIs: Tuesday: 7:15 for Spain, 7:45 for Italy, final French data at 7:50, final German figures at 7:55 and the final euro-zone number at 8:00. Back in July, Spain enjoyed a robust growth rate in the services sector according to Markit, with a score of 57.6 points/ A slide to 571 is forecast for August. Italy, the third-largest economy, had 56.3 points. A score of 55.3 is estimated now. According to the preliminary read for August, France had a score of 55.5, Germany had 53.4 and the euro-zone had 54.9, all above the 50 point level that separates expansion from contraction.

- Retail Sales: Tuesday, 9:00. The retail sales numbers for the euro-zone are released after German and French have already released their own numbers. Nevertheless, the data has a tendency to provide surprises. A rise of 0.5% was seen in June. A drop of 0.2% is expected now.

- GDP (revised): Tuesday, 9:00. The previous reads of euro-zone GDP both showed a growth rate of 0.6%, for the second time in a row. The updated version for Q2 GDP will likely confirm it.

- German Factory Orders: Wednesday, 6:00. Changes in orders at factories are volatile but are still telling. In June, Germany enjoyed a rise of 1% in orders. Will we see a drop now? A rise of 0.4% is predicted.

- Retail PMI: Wednesday, 8:10. This measure of the retail sector has been above 50 points in the past 4 months, hitting 51 points in July. We now get the data for August.

- German industrial output: Thursday, 6:00. Contrary to factory orders, this measure of industrial production disappointed with a drop of 1.1% in June. A bounce up of 0.6% is expected.

- French Trade Balance: Thursday, 6:45. France suffers from a chronic trade deficit. In June, this deficit widened to 4.7 billion. A similar figure is likely now: -4.5 billion.

- ECB decision: Thursday, 11:45, press conference at 12:30. Will the ECB announce QE tapering? And what will the scale be? These are open questions that keep EUR/USD on the edge. We know that the central bank will make a decision in the fall, according to what ECB President Mario Draghi said in the previous decision. The bond-buying scheme currently consists of 60 billion euros per month until the end of 2017 and the big question is for the future of the program in early 2018. Will they make another reduction of 20 billion but continue the program for longer? Or will they reduce the scale on a monthly basis and end it soon? The ECB could also delay the decision to the October meeting, but making a decision now makes more sense. The ECB releases new forecasts for inflation and growth right now and they usually make decisions around the decisions that include new forecasts. EUR/USD is holding its breath.

- German Trade Balance: Friday, 6:00. Contrary to France, Germany enjoys a wide trade surplus and this is one of the things keeping the euro bid. The surplus reached 21.2 billion and is now predicted to rise to 21.5 billion.

- French industrial output: Friday, 6:45. The drop in French industrial output mirrored Germany’s. Production slipped by 1.1% in June. A rise of 0.5% is expected.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar was hovering above 1.19 and edged closer to the 1.20 level (mentioned last week).

Technical lines from top to bottom:

1.2565 capped the pair back in late 2014. It is followed by 1.2240, another line from that time and 1.2170, quite close by.

1.2070 was the swing high in August 2017 and remains the high watermark. 1.2040 was the low point in 2012 and close to the round number of 1.20. It is followed by 1.1876, the trough in 2010, also seen in early August 2017.

1.17 is a round number that served as a cushion for the pair during the month of August. It replaces the 2015 high of 1.1712. 1.1620 was a swing high in May 2016.

1.1580 was a stepping stone for the pair on the way up in July 2017. It is followed by the round number of 1.15.

1.1445 is the June 2017 peak and immediate resistance. 1.1390 is the post-breakout low and works as support.

1.13 is the top line seen in November before the collapse. 1.1230 capped the pair in June.

I remain bullish on EUR/USD

The uptrend is totally justified. The euro enjoys stable politics, a central bank that is moving towards the exits (even if gradually) and robust growth. The US suffers from bad politics, slowing growth and a central bank that is hesitating. It will be hard for Draghi to convince us that he is dovish when everything seems to be on the right track.

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!