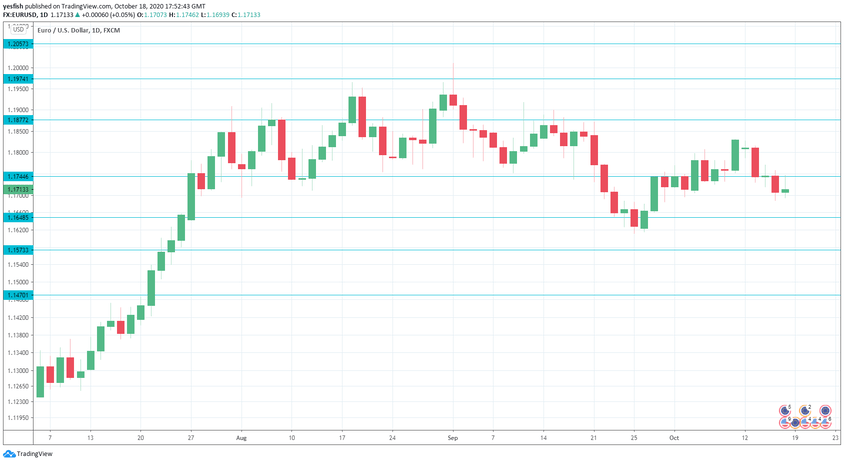

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German PPI: Tuesday, 6:00. The Producer Price Index slowed to 0.0% in August, as German inflation levels remain low. A small increase of 0.1% is forecast for September.

- Current Account: Tuesday, 8:00. The current account surplus fell to EUR 16.6 billion in July, down from EUR 20.7 billion. The forecast for August stands at EUR17.2 billion.

- German GfK Consumer Climate: Thursday, 6:00. German consumer confidence came in at -1.6 in September and analysts are expecting the indicator to dip lower to -2.9 points. Since March, the indicator has been in negative territory, which indicates pessimism over economic conditions.

- Consumer Confidence: Thursday, 14:00. The official Eurostat consumer sentiment gauge continues to indicate pessimism among eurozone consumers. The broad survey of 2,300 consumers came in at -14 in September and is expected in at -15 in the October release.

- PMIs: Friday, 7:15 in France, 7:30 in Germany, and 8:00 for the whole eurozone. German and eurozone manufacturing PMIs continue to point to expansion, with readings of 56.4 and 53.7, respectively. The October readings are expected to be slightly lower, with forecasts of 55.0 in Germany and 53.0 in the eurozone. The French index came in at 51.2, and is projected to edge up to 51.3. The services sector has been in contraction, with German Services PMI coming in at 49.6 and the eurozone PMI at 47.1 points. The French PMI came in at 47.5. The October forecasts are 49.6 for Germany, 47.1 for the eurozone and 47.0 for France.

EUR/USD Technical analysis

Technical lines from top to bottom:

1.2057 has held in resistance since April 2018.

1.1974 is protecting the symbolic 1.20 level.

1.1877 is next.

1.1744 has switched to resistance after strong losses by EUR/USD last week.

1.1648 is next.

1.1573 (mentioned last week) has provided support since July.

1.1470 is the final support level for now.

.

I am bearish on EUR/USD

The euro took a tumble last week, and there is further room on the downside. The eurozone economy could face another downturn as Covid-19 worsens on the continent. As well, the Brexit deadlock could hurt the euro.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!