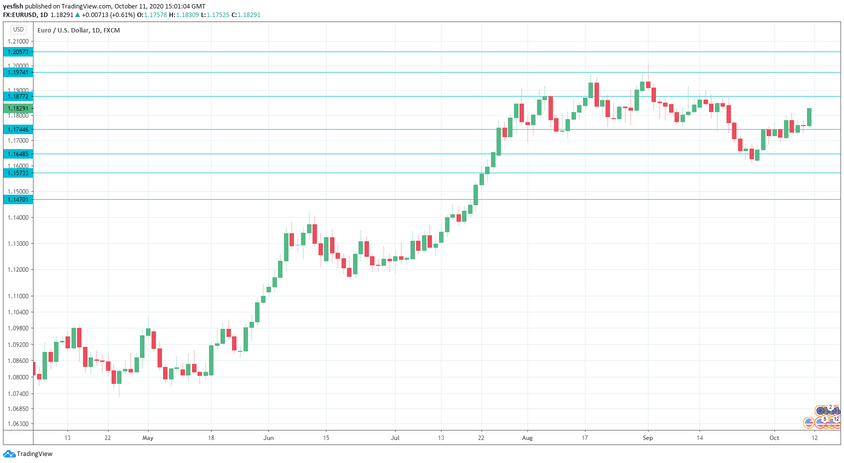

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Final CPI: Tuesday, 6:00. Inflation has been declining in the eurozone’s largest economy. The August reading came in at -0.1% and another decline is projected for September, with an estimate of -0.2%.

- German ZEW Economic Sentiment: Tuesday, 9:00. Confidence in the German economy improved to 77.4 in September, but is expected to drop to 74.1 in October.

- Industrial Production: Wednesday, 9:00. Industrial production slowed to 4.1 in September, down from 9.1% beforehand. The October reading is expected to come in at just 0.8%.

- Eurozone Inflation Report: Friday, 9:00. Deflation remains a major concern for ECB policymakers. Inflation declined by 0.2% in August and the markets are braced for a -0.3% reading in September.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2136, an important monthly line.

1.2057 has held in resistance since April 2018.

1.1974 is protecting the symbolic 1.20 level.

1.1877 is next.

1.1744 has switched to support after strong gains by EUR/USD last week.

1.1648 is next.

1.1573 (mentioned last week) has provided support since July.

1.1470 is the final support level for now.

.

I am neutral on EUR/USD

The euro has looked sharp, but it more a case of dollar weakness than euro strength, as the euro economy continues to struggle. If Germany and the eurozone register weak inflation numbers, the US could recover some ground.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!