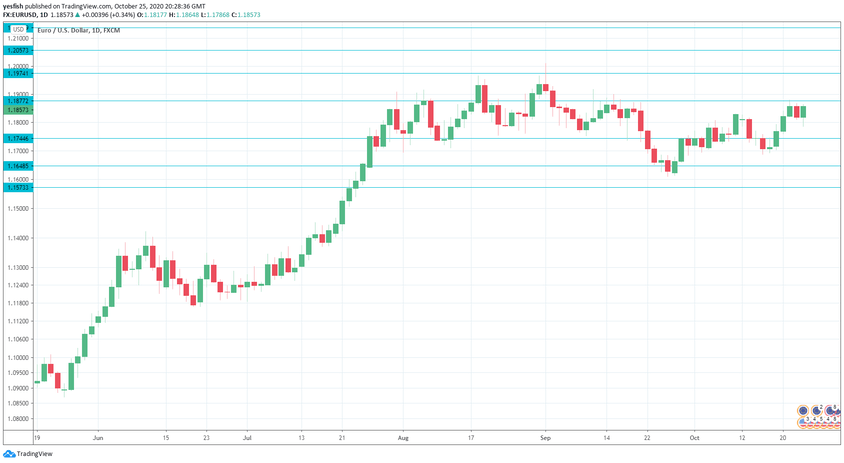

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Ifo Business Climate: Monday, 9:00. Business confidence in the eurozone’s largest economy has accelerated for five straight months, reaching 93.4 in September. The forecast for October stands at 93.1 points.

- Monetary Data: Tuesday, 9:00. M3 Money Supply fell to an annual growth rate of 9.5% in August, down from 10.2% beforehand. Private Loans remained pegged at 3.0% in August y/y. Money Supply is projected to rise to 9.6% and Private Loans are expected to edge up to 3.1%.

- German Prelim CPI: Thursday, All Day. Inflation in Germany has fallen off sharply. CPI has posted three straight declines, with a reading of -0.2%. We now await the September data.

- ECB Rate Decision: Thursday, 12:45. The ECB is likely to maintain rates at 0.00%, so the focus will be on the rate statement and press conference with ECB President Christine Lagarde. Any discussion about deflation or the high value of the euro could affect the movement of the currency.

- French Consumer Spending: Friday, 6:30. Consumer spending in the eurozone’s No. 2 economy rose 2.3% in August, but analysts are braced for a reading of -2.0% in the upcoming release.

- German GDP: Friday, 7:00. Germany’s economy plunged 10.1% in Q2, but a strong rebound is projected for Q3, with an estimate of 6.9%.

- Eurozone Inflation Report: Friday, 10:00. Deflation remains a major headache for eurozone policymakers. CPI has posted two straight declines and another decline of 0.3% is expected in October. The core reading is projected to remain at 0.2%.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2136.

1.2057 has held in resistance since April 2018.

1.1974 is protecting the symbolic 1.20 level.

1.1877 is an immediate resistance line.

1.1744 is providing support.

1.1648 is next.

1.1573 (mentioned last week) has provided support since July. It is the final support level for now.

.

I am neutral on EUR/USD

The euro continues to show volatility and this trend could continue. The ECB rate announcement and German GDP and CPI reports could have a significant impact on the fortunes of the currency this week.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!