- German Retail Sales: Monday, 6:00. Retail Sales rebounded in February with a gain of 1.2%, after two straight declines. The March forecast stands at 2.9%.

- Manufacturing PMIs: Monday, 7:50 in France, 7:55 in Germany, and 8:00 for the whole eurozone. Eurozone manufacturing continues to show robust growth. The initial readings for April PMIs were 66.4 in Germany, 63.3 in the eurozone and 59.2 and France. The final readings are expected to confirm the initial readings. The neutral 50-level separates contraction and expansion.

- Services PMIs: Wednesday, 7:50 in France, 7:55 in Germany, 8:00 in the whole eurozone. The services sector was stagnant in April, with readings just above the 50-level. Germany came in at 50.1, the eurozone at 50.3 and France at 50.4. The upcoming readings are expected to confirm the initial releases.

- German Factory Orders: Thursday, 6:00. Factory Orders posted a gain of 1.2% in February, close to the estimate of 1.3%. The estimate for March stands at 1.5%.

- Eurozone Retail Sales: Thursday, 9:00. Retail Sales rebounded by 3.0% in February after two straight declines. The Mach estimate stands at 1.5%.

- German Industrial Production: Friday, 6:00. A global shortage in chips is taking a toll on automakers. Industrial Production has recorded two straight declines but is projected to post a gain of 2.1% in March.

EUR/USD sustained sharp losses on Friday and recorded its first losing week in a month. There are seven releases in the upcoming week. Here is an outlook at the highlights and an updated technical analysis for EUR/USD.

German ifo Business Climate improved slightly to 96.8, up from 96.6. However, this missed the estimate of 97.8. Consumer confidence remains weak as the GfK Consumer Confidence index weakened to -8.8, down from -6.2.

In April, German Inflation rose above the 2% level for the first time in two years. In the eurozone, CPI is expected to rise to 1.6% in April, up from 1.3%. German GDP fell by 1.7% in Q1 from the previous quarter, as Covid-19 caused a downturn in the economy.

In the US, consumer confidence soared, as the Consumer Board Consumer Confidence Index climbed to 121.7, up from 113.1 beforehand. The US dollar dipped after the FOMC meeting, as the Fed said it was premature to discuss tapering.

US GDP rose 6.4%, beating the forecast of 6.1%. The robust reading was another sign that the US economic recovery is in full swing.

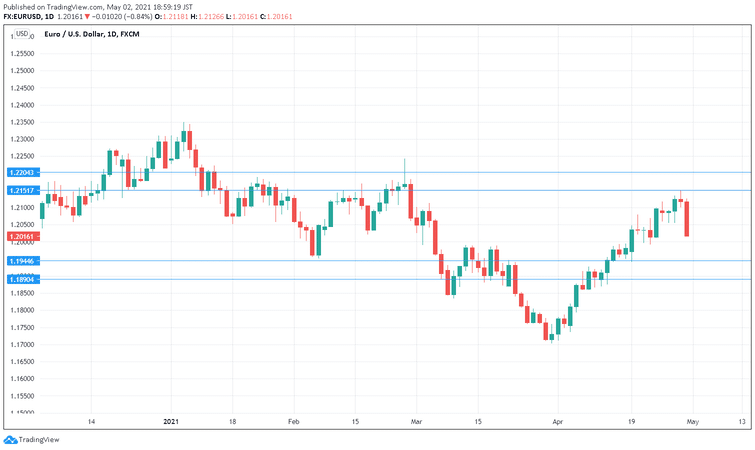

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

Technical lines from top to bottom:

1.2204 is an important monthly resistance line. It has held since late February.

1.2151 is next.

1.1994 is an immediate support line (mentioned last week).

1.1890 has held support since mid-April.

1.1779 is next.

1.1585 is the final support line for now.

.

I am bullish on EUR/USD

The euro slumped late in the week, as German GDP contracted and US consumer confidence outperformed. With the US economy continuing to surge, the dollar could get a boost next week.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!