- USD weakened on Thursday, leading to a rise in GBP/USD.

- Fed hawkishness could limit USD losses and cap gains.

- Brexit worries may also keep traders from placing fresh bullish bets.

In the last hour, the GBP/USD price rose to fresh highs of 1.3325 due to some selling of the US dollar in the early European session.

–Are you interested to learn more about South African forex brokers? Check our detailed guide-

As of Thursday, the pair is trading at 1.3265, breaking a three-day losing streak. However, any significant recovery remains elusive as the rally was mainly driven by some weakness in the US dollar.

World Health Organization (WHO) spokesman indicates that most Omicron cases are mild, easing concerns about a new variant of the coronavirus. But, ultimately, this led to the dollar’s status as a safe haven being undermined.

A more aggressive tightening of the Fed’s monetary policy – to contain persistently high inflation – could positively affect the dollar. The money markets suggest that the Fed raise rates three times in 2022 and start a rally in June.

Jerome Powell, the Fed’s chief, recently said the central bank should be prepared for the possibility that inflation won’t fall in the second half of 2022. In addition to that, Powell said the Fed would consider cutting its bond purchases faster in the upcoming session.

In addition, the stalemate between Great Britain and the EU on the Northern Ireland Protocol and the escalating conflict between France and Great Britain over fishing rights after Brexit could deter more pound bulls. However, this requires some caution before taking any steps up.

The best way to determine whether the GBP/USD pair has bottomed out is to wait for sustained gains beyond the weekly swing high of 1.3370. As a result, we will likely see a rise in prices below 1.3200 or the previous year’s low this week.

The sterling pair is at the mercy of the dollar’s rate movements on Thursday since no major economic data is expected in the UK. However, traders will utilize the regular weekly initial US jobless claims later in the North American session.

In addition to speeches from influential FOMC members, these events will affect the US dollar and give the GBP/USD pair some momentum. Moreover, the Coronavirus saga and headlines related to Brexit could provide an opportunity to trade.

–Are you interested to learn more about spread betting brokers? Check our detailed guide-

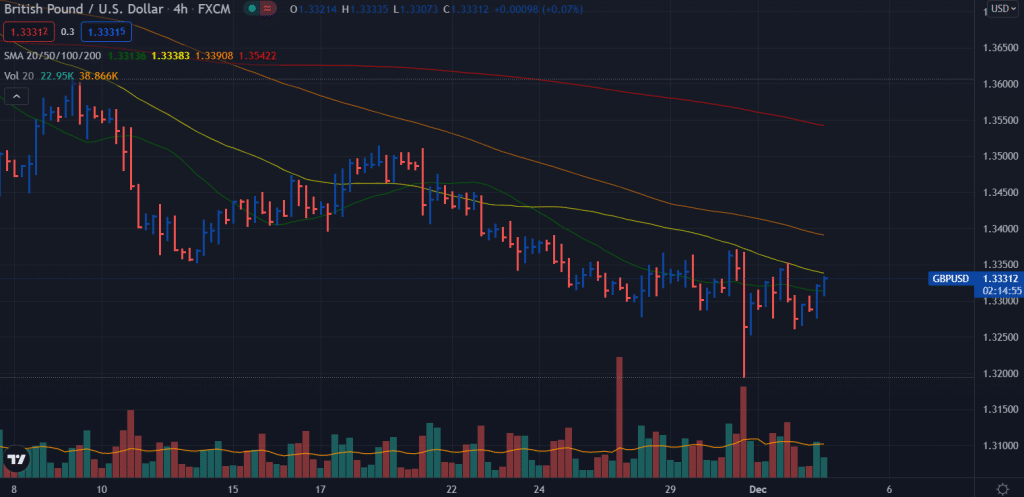

GBP/USD price technical outlook: Bulls attempting a breakout

The GBP/USD price manages to cross above the 20-period SMA on the 4-hour chart. However, the pair may remain capped by the 50-period SMA. The volume data is slightly favorable for the buyers. However, the pair may not go wild on the upside as there is no follow-through momentum at the moment.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.