- A more relaxed Fed monetary policy favors EUR/USD.

- Investors are waiting to see if the EU can decide on Moscow.

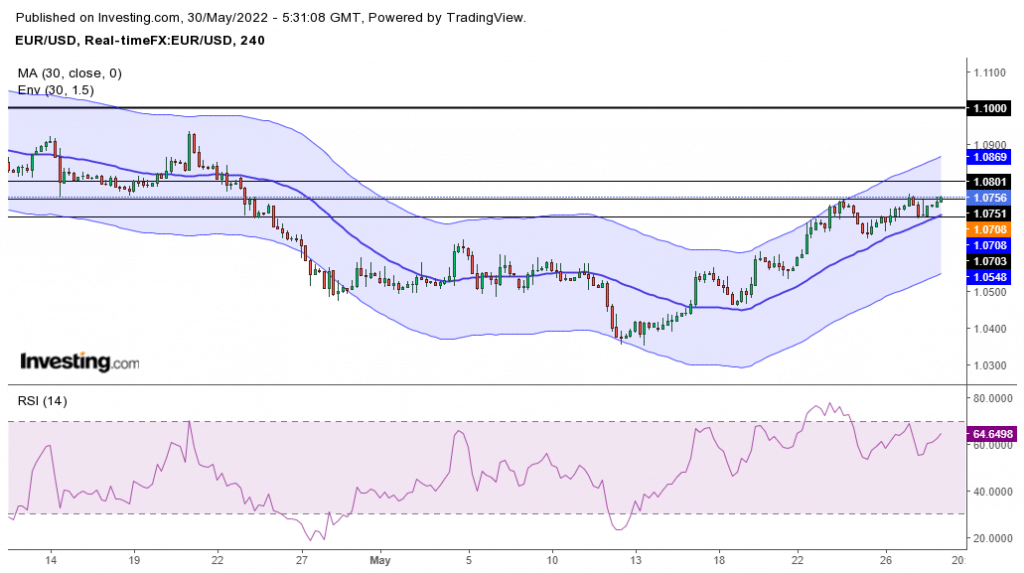

- The price is experiencing resistance at 1.0750 in the charts.

The EUR/USD forecast remains positive as the pair is trading above Friday’s close on Monday morning. The bulls continue pushing the pair higher. On the other hand, the dollar is stuck near five-week lows as investors wager on a possible relaxed monetary policy in the US after the big June and July rate hikes.

-Are you interested in learning about forex indicators? Click here for details-

Hope is the new word investors are clinging to regarding the Federal Reserve and rate hikes. Ray Atrill, head of FX strategy at National Australia Bank, said that investors’ hope, naive or otherwise, continues to spread over a pause in the Fed’s tight monetary policy.

“Money markets have reduced their pricing for additional Fed rate rises by end-2022 from 193bps to 180bps.” He said.

The calmer market mood has seen the safe-haven dollar weaken and the euro strengthens as the ECB points to a rate hike as early as July. Goldman Sachs analyst Zach Pandl noted that front-end rate differentials were moving in the euro’s favor and that ECB officials could be planning faster initial rate hikes as the US economy slows.

EUR/USD key events today

Investors today will be keen on the EU leaders’ summit. This summit will give a more precise direction on the Russian oil embargo. Talks have been going on for a month, and investors will be waiting to see if EU leaders can finally unite to respond to Moscow.

Hungary has been holding up the process as they fear an embargo could deteriorate the economy as they cannot get oil from anywhere else.

EUR/USD technical forecast: Bulls resting around 1.0750

Looking at the 4-hour chart, we see the price struggling to break above the 1.0750 level. RSI also shows us a weakness in the bulls at the same level. The price is trading above the 30-SMA; bulls could be resting and waiting for something to get them back and push the price above 1.0800.

-Are you interested in learning about the forex signals telegram group? Click here for details-

If this does not happen, we could see bears’ return after the price breaks below the 30-SMA and RSI goes back to trading below the 30 levels. The bias here remains bullish, and with bullish momentum, we could see 1.1000 being hit in the coming days.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money