- Investors ignored Canada’s upbeat retail sales data as USD/CAD soared.

- Experts expect a drop in retail sales in July due to lower consumer demand.

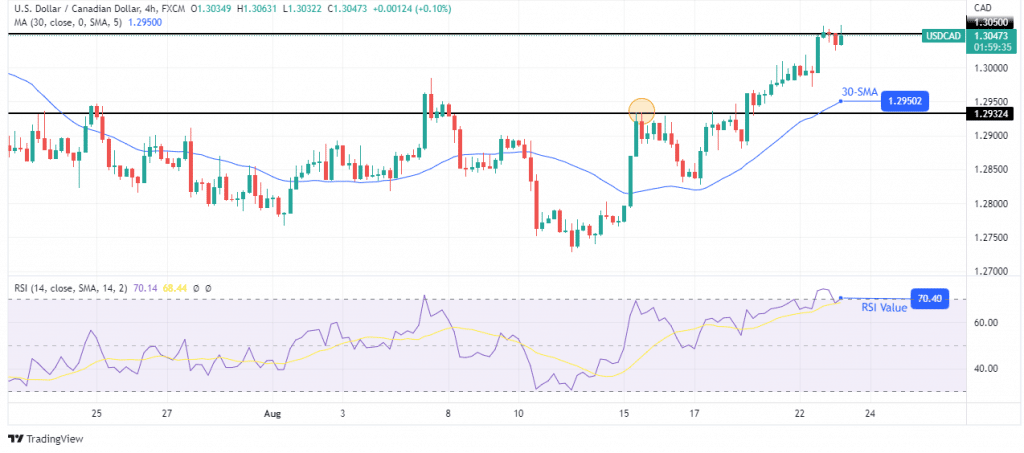

- In the charts, 1.30500 is offering resistance.

Today’s USD/CAD forecast is bullish after experts forecasted poor retail sales for Canada in July. As a result of more expensive gas and stronger sales at car dealerships, Canadian retail sales increased 1.1% in June, comfortably surpassing expectations, according to data Canada statistics released on Friday. However, sales were predicted to decline in July.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Retail sales were forecasted by analysts surveyed by Reuters to increase by 0.3%. Retail sales are expected to decline 0.2% in July, according to a preliminary estimate from Statscan.

According to experts, a significant portion of the July reduction results from reduced fuel costs. Still, it also indicates growing consumer fatigue and demand cooling in the wake of several interest rate hikes by the Bank of Canada.

“Canadians have been feeling the pinch from both high inflation and rising interest rates,” Royce Mendes, head of macro strategy at Desjardins Group, said in a note.

“So it should come as little surprise that retailers are beginning to see the slow sales pace.”

The most recent TD Consumer Spending Tracker, also made public on Friday, revealed that spending is plateauing.

“June’s spending held relatively flat, and there are signs of a developing downward trend in July. That could be an early sign of easing consumer demand as inflation chips away at purchasing power,” TD economist Ksenia Bushmeneva said in the note.

USD/CAD key events today

USD/CAD investors will pay attention to new home sales data from the US. The new home sales data measures the annualized number of newly constructed single-family homes sold over the preceding month.

USD/CAD technical forecast: Bulls may pause at 1.305

The 4-hour chart shows the price in an uptrend, as seen in how it trades above the 30-SMA. The RSI favors bullish momentum as it trades above 50. When the price got to 1.30500, some resistance allowed bears to come in and try to retrace the move.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

If bears successfully retraced the recent move, the price might push lower to the 30-SMA, where it would find support before continuing higher. The trend will remain bullish if the price stays above the 30-SMA and the RSI trades above 50.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.