- The Japanese government plans to nominate Kazuo Ueda as the next BoJ governor.

- The government will propose Ryozo Himino and Shinichi Uchida for nomination as deputy governors.

- Wholesale prices in Japan went up by 9.5% in January.

Today’s USD/JPY price analysis is bearish. The announcement by the Japanese government to nominate Kazuo Ueda as the new governor of the Bank of Japan on Friday led to a significant increase in the yen’s value. Kazuo Ueda is an academic and a former member of the central bank’s policy board.

-If you are interested in forex demo accounts, check our detailed guide-

Additionally, the government will propose Ryozo Himino, a former leader of Japan’s banking watchdog, and BOJ executive Shinichi Uchida for nomination as deputy governors.

Investors have regularly attempted to increase the yields on Japanese government bonds in recent months on the assumption that the BOJ will begin to phase down its expansive stimulus program after Haruhiko Kuroda’s second term finishes in April.

However, most analysts claimed that Ueda’s nomination came as a surprise, and it was difficult to predict immediately whether or not this would influence the bank’s near-term monetary policy orientation.

According to data on Friday, wholesale prices in Japan went up by 9.5% in January compared to the same month last year. This adds to other signals of price inflation that may keep the central bank under pressure to gradually end its extensive stimulus program.

Thomas Barkin, president of the Richmond Fed, stated on Thursday that tight monetary policy was unmistakably slowing the American economy, allowing the Fed to proceed “more cautiously” with any additional interest rate rises.

Investors will closely watch US CPI figures next week to determine whether disinflation is occurring.

USD/JPY key events today

There won’t be any key economic releases from the US or Japan today, so the pair will likely keep reacting to the BoJ news.

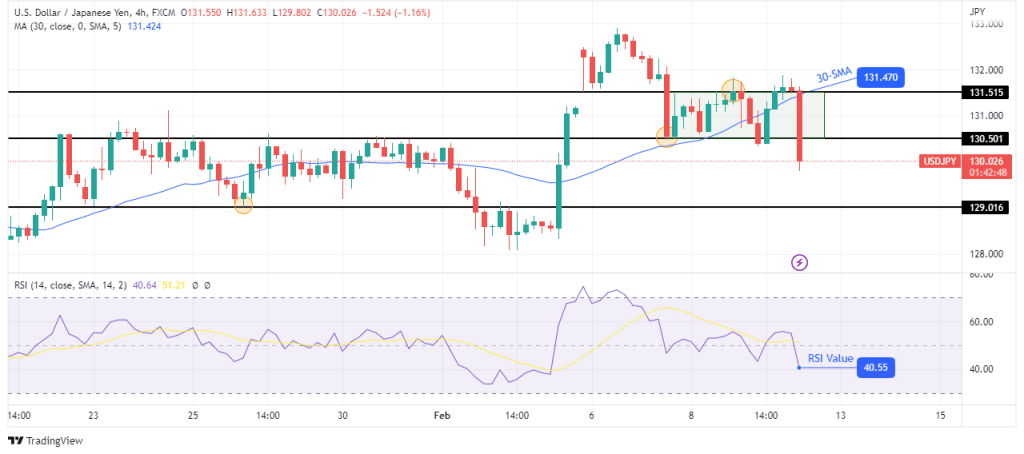

USD/JPY technical price analysis: Bears break out of the consolidation area

The 4-hour chart shows USD/JPY trading far below the 30-SMA, with the RSI also far below the 50-mark. This point to strong bearish momentum. When bears initially took over, they were stopped by the 30-SMA support.

-If you are interested in Islamic forex brokers, check our detailed guide-

The price then got into a consolidation area with the 131.51 level as resistance and the 130.50 level as support. However, bears have finally managed to break out of this range and will likely head for the next support level at 129.01.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.