- Officials in Japan got concerned when the USD/JPY crossed above the $150 level.

- Data from Japan on Thursday revealed a recession in the last part of 2024.

- Economists expect BoJ rate hikes to start in April.

On Thursday, the USD/JPY outlook took a bearish turn after Japanese officials sounded the alarm over the yen’s recent downturn. Officials in Japan got concerned on Wednesday when the pair crossed above the $150 level after the US inflation report. Meanwhile, data from Japan on Thursday revealed a recession in the last part of 2024. As a result, some experts believe the BoJ might hesitate to hike rates.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The recent surge in USD/JPY beyond the $150 level came after the US released a high inflation report. Consequently, the dollar surged as investors pushed back rate hike bets to June. Japan’s top officials got worried when the yen broke above $150.

Notably, Finance Minister Suzuki warned that he was closely monitoring currency moves. However, he did not comment on whether they would intervene to stem the yen’s decline. Meanwhile, currency diplomat Masato Kanda said that the country would do what was necessary if needed.

On Thursday, Germany officially became the world’s third-largest economy, taking over from Japan. Notably, data revealed that Japan’s economy experienced a second quarter of contraction in economic growth. As a result, the BoJ might take longer before shifting from negative interest rates.

However, some experts believe the stage is set for a policy shift as corporate spending is robust and the labor market is tight. Moreover, a Reuters poll found that economists expect rate hikes to start in April.

USD/JPY key events today

- US retail sales report

- The US Empire State Manufacturing Index

- US initial jobless claims

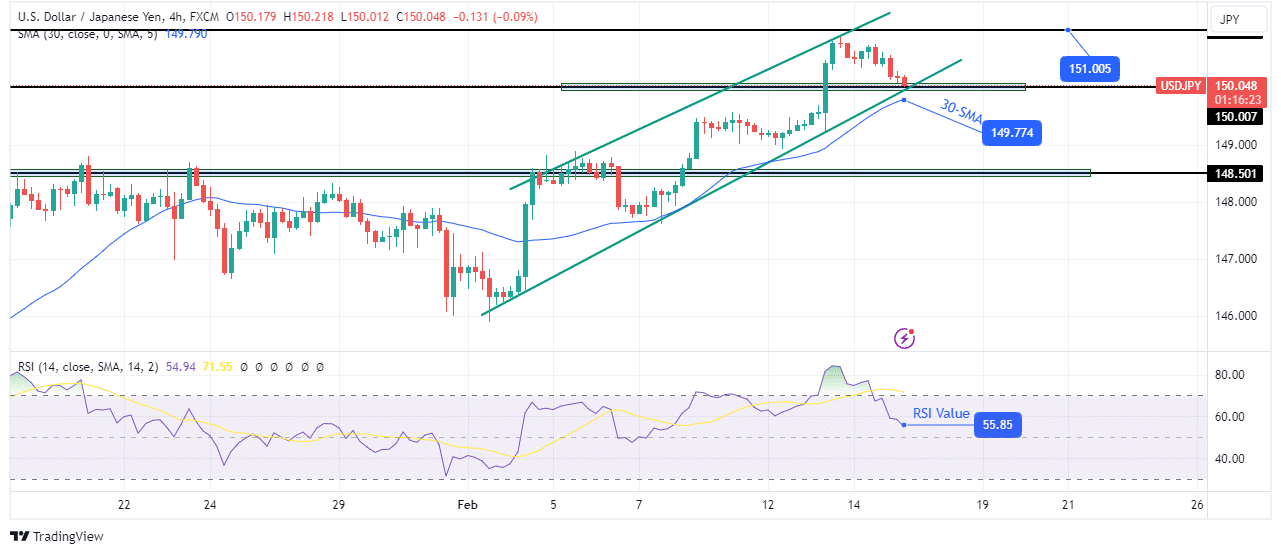

USD/JPY technical outlook: Price revisits bullish channel support.

On the charts, the price has pulled back to its channel support after making new highs. USD/JPY is trading in a bullish channel, above the 30-SMA, showing a strong bullish bias. Moreover, the RSI recently got to the oversold region and is still in bullish territory.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

The price broke above the 150.00 key resistance level and has now pulled back to retest this level and the channel support. Additionally, there is support at the 30-SMA line. If bulls are still strong, the price will bounce off this support zone and likely reach the 151.00 resistance level. However, a break below the zone would indicate a bearish sentiment shift.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.