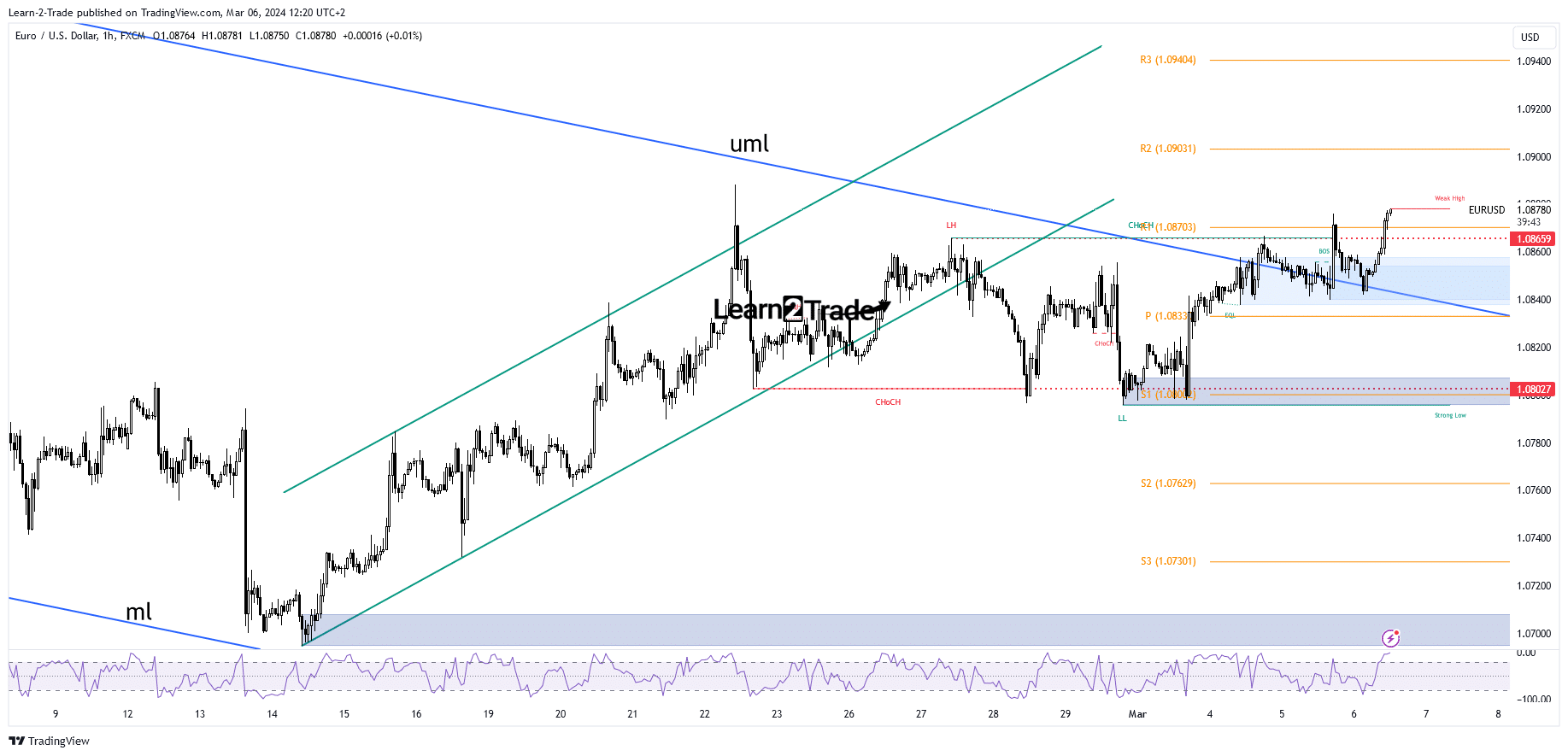

- Staying near the upper median line signaled an imminent breakout.

- The R2 represents a potential target.

- The BOC and the US data should have a major impact today.

The EUR/USD price is trading in the green at 1.0877 at the time of writing. The pair seems determined to extend its growth amid broader dollar weakness.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

Fundamentally, the US ISM Services PMI dropped from 53.4 points to 52.6 points, below the 53.0 points expected. Meanwhile, Factory Orders reported a 3.6% drop, more versus the 3.1% drop estimated.

On the other hand, the German Final Services PMI and the Eurozone Final Services PMI came in better than expected, while the Eurozone PPI registered a 0.9% drop again.

Today, the German Trade Balance came in better than expected, at 27.5B above 21.0B expected, while the Retail Sales rose by 0.1% as expected. Later, the US economic figures and the BOC should bring sharp movements.

The ADP Non-Farm Employment Change could jump from 107K to 149K, while JOLTS Job Openings may drop from 9.03M to 8.80M. Also, the Fed Chair Powell Testifies represents a high-impact event, so anything could happen.

Furthermore, the BOC is expected to keep the Overnight Rate at 5.00%, but the BOC Press Conference should have a major impact.

EUR/USD Price Technical Analysis: Bullish Momentum

From a technical point of view, the EUR/USD price stayed near the upper median line (uml) indicating an imminent breakout and continuation. As you can see on the hourly chart, the price jumped and stabilized above this broken dynamic resistance, signaling further growth.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The breakout was confirmed, and now it has passed above the former high of 1.0865 and through the weekly R1 of 1.0870. These represented upside obstacles, so more gains are in the cards. The 1.09 psychological level and the weekly R2 of 1.0903 are seen as the next targets.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.