- A new lower low activates more declines.

- The median line (ml) is seen as a potential target.

- Tomorrow, the US data should bring high action.

The EUR/USD price is trading in the red at 1.0922 at the time of writing. The pair faces resistance as the price corrects lower amid profit-taking. The US dollar turned to the upside.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Yesterday, the fundamentals brought some volatility. The US CPI m/m rose 0.4% last month, matching expectations. The CPI y/y reported a 3.2% growth, beating the 3.1% growth estimated, while the Core CPI announced a 0.4% growth, exceeding the 0.3% growth expected.

Higher inflation could force the Federal Reserve to maintain monetary policy. Today, Eurozone Industrial Production reported a 3.2% drop versus a 1.8% drop expected after a 1.6% growth in the previous reporting period, while the Italian Quarterly Unemployment Rate came in at 7.4% in Q4, above 7.3% expected but below 7.6% in Q3.

The fundamentals should be decisive tomorrow as the US releases the PPI, Core PPI, Retail Sales, Core Retail Sales, and Unemployment Claims. Positive economic figures should boost the USD.

EUR/USD Price Technical Analysis: Correction

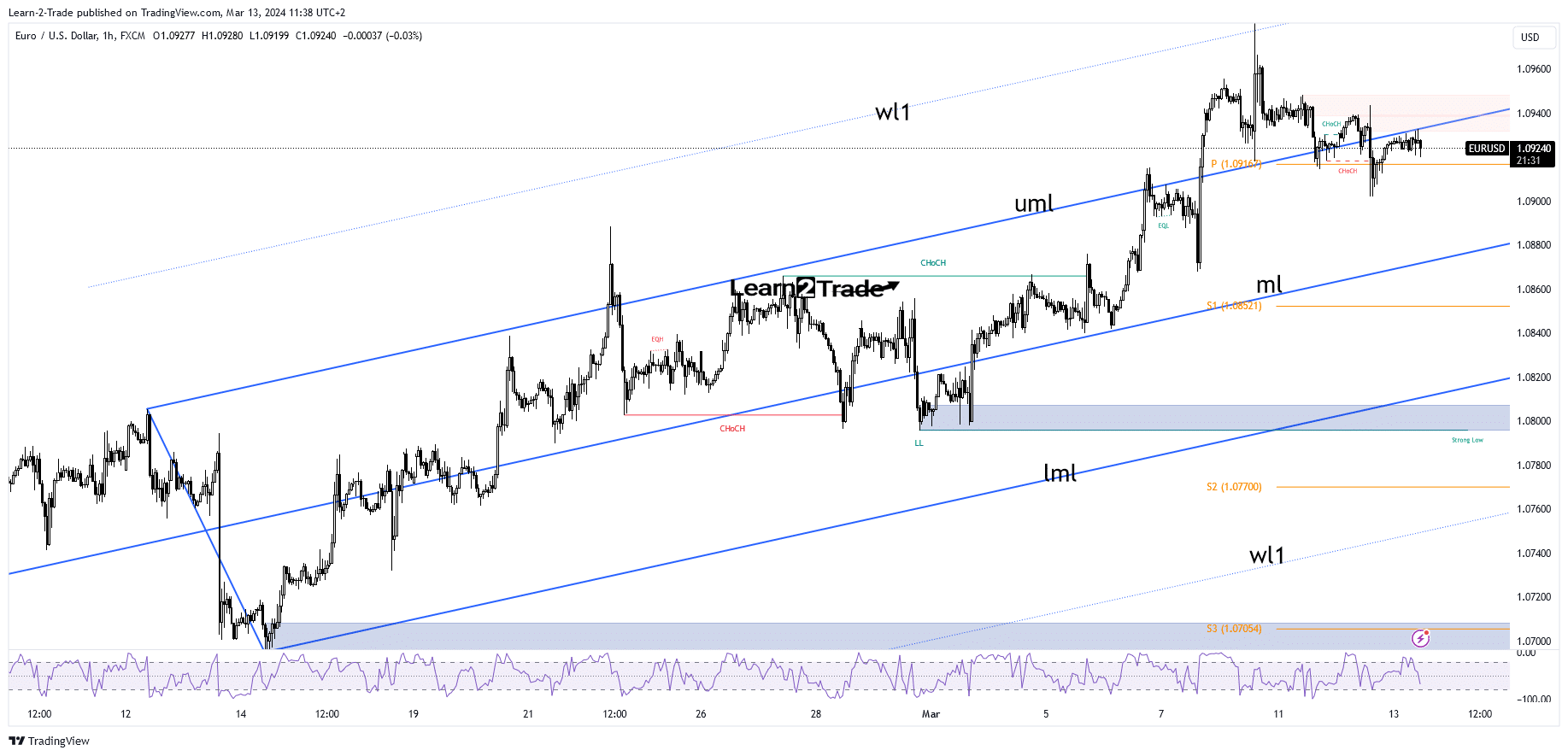

As you can see on the hourly chart, the EUR/USD pair registered only a false breakout through the warning line (wl1), confirming buyers’ exhaustion.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Now, it has turned to the downside and slipped below the upper median line (uml), representing dynamic support. The price retested this line, and now it looks under pressure again.

Still, only dropping and stabilizing below the pivot point of 1.0916 and making a new lower low activates more declines. If the pair drops deeper, the ascending pitchfork’s median line (ml) is seen as a potential target.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money