- Producer prices rose 0.6%, beating estimates of a 0.3% increase.

- US retail sales missed forecasts, showing a slowdown in consumer spending.

- The yen was steady as investors awaited the final results of the wage negotiations.

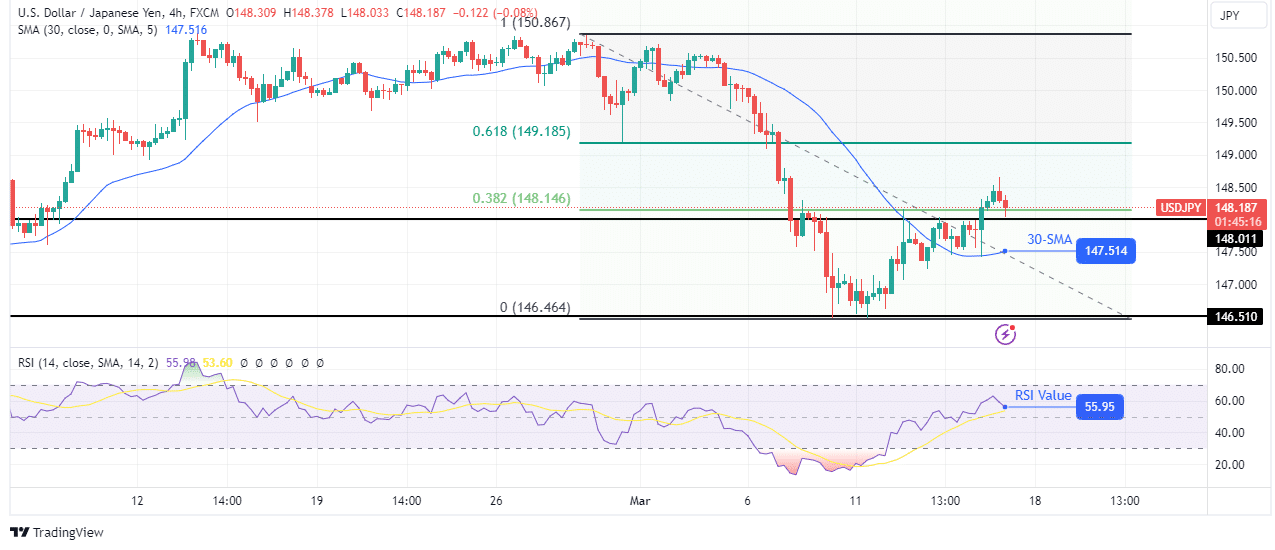

The USD/JPY outlook shows a bullish wave today ignited by the dollar’s surge following encouraging wholesale inflation figures. However, there was a slight pullback as investors took profits ahead of policy meetings in the US and Japan.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Notably, US wholesale inflation rose more than expected in February, leading to a drop in rate cut expectations. Producer prices rose 0.6%, beating estimates of a 0.3% increase. This was the second inflation report in the week that showed inflation in the US remains high.

Other data from the US included weekly jobless claims, which fell, indicating tight labor market conditions. Additionally, US retail sales missed forecasts, showing a slowdown in consumer spending. Despite the mixed data, there was a decline in rate cut expectations as investors focused on inflation.

Next week, the Fed will meet to decide on interest rates. Markets expect the Fed to hold current rates. Moreover, traders will focus on what policymakers will say regarding the outlook for rate cuts, especially after the recent inflation reports.

Meanwhile, the yen was steady on Friday as investors awaited the final results of the wage negotiations. So far, most major companies in Japan have agreed to pay increases. Therefore, there is a high chance that the Bank of Japan will be ready to shift policy next week. Such a move would greatly boost the yen.

USD/JPY key events today

- US Empire State Manufacturing Index

- US preliminary UoM consumer sentiment

USD/JPY technical outlook: Bulls above strong resistance

On the technical side, the USD/JPY pair has broken above the 148.01 key resistance level and the 0.382 Fib level. Moreover, the bias is bullish as the price trades above the 30-SMA while the RSI is above 50.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The recent shift in sentiment came when the price found support at the 146.51 key level. Bulls took over control when the price broke above the 30-SMA resistance. At the moment, the price is retracing the previous bearish move and might soon reach the 0.618 Fib level. However, the price might consolidate as the SMA catches up before continuing higher.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.