- The Bank of Japan hiked interest rates on Tuesday for the first time in 17 years.

- Japan’s central bank intends to continue with easy monetary conditions.

- Traders are awaiting the FOMC policy meeting on Wednesday.

The USD/JPY outlook shines brightly with bullish sentiment, driven by the yen’s decline as investors take profits after the BoJ’s policy shift. Notably, the Bank of Japan hiked interest rates on Tuesday for the first time in 17 years. However, markets had already priced in such a move. Therefore, it was not a surprise.

-Are you interested in learning about the Bitcoin price prediction? Click here for details-

Moreover, Japan’s central bank intends to continue with easy monetary conditions, which might weigh on the yen. At the same time, the yen remains vulnerable to decisions by the Fed, which usually have a big impact on the currency.

Traders are now awaiting the FOMC policy meeting on Wednesday for more clues on the Fed’s rate cut outlook. Recently, the dollar strengthened after data revealed persistently high inflation in the US. Moreover, bets for a June rate cut fell as investors scaled back expectations.

Goldman Sachs recently revised its forecast for Fed rate cuts in 2024 from 4 to 3, meaning the Fed will likely hold high rates for longer.

Therefore, there is a chance the Fed will be hawkish at the meeting. Such an outcome would further strengthen the dollar and push USD/JPY back to the 152.00 key level. A hawkish Fed could also push expectations for the first rate cut to July.

USD/JPY key events today

After the BoJ policy meeting, there are no more significant events today. Therefore, investors will keep absorbing the policy shift.

USD/JPY technical outlook: Price soars beyond resistance zone

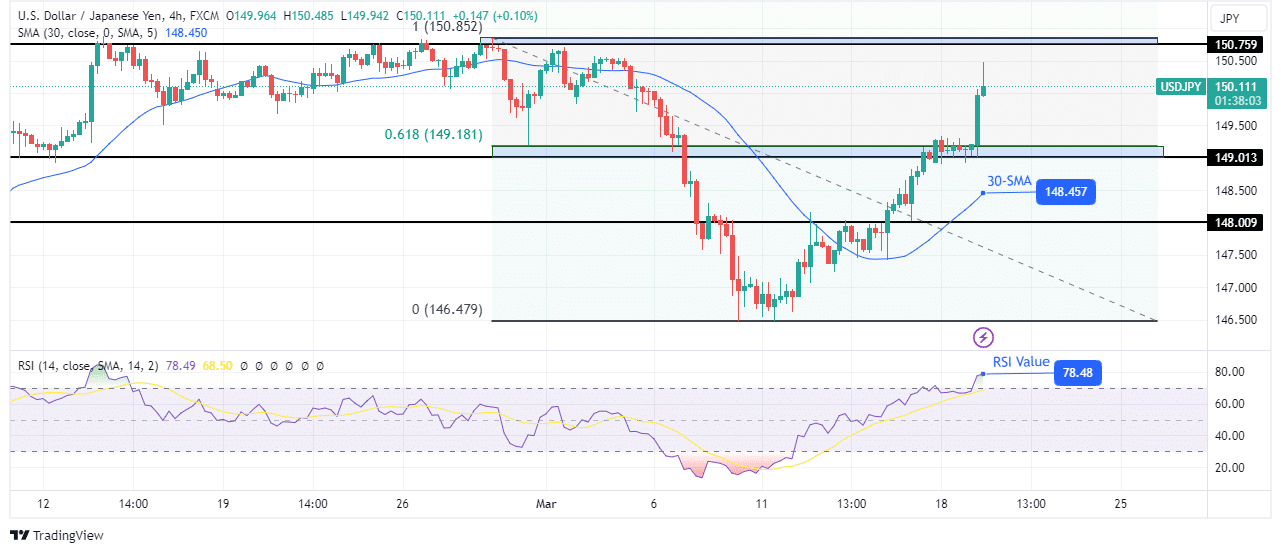

On the technical side, the USD/JPY price has broken above a resistance zone comprising the 0.618 Fib and the 149.01 key levels. The breakout shows massive momentum as the price made a solid bullish candle, pushing well above the 30-SMA. At the same time, the RSI entered the overbought region, indicating solid bullish momentum.

-Are you interested in learning about the forex signals telegram group? Click here for details-

Currently, the price is approaching the 150.75 key resistance level, where it might pause or pull back before continuing higher. A pullback could retest the recently broken resistance zone or the 30-SMA support, where bulls would resume the uptrend. Meanwhile, a break above the 150.75 resistance level would allow the price to retest higher resistance levels.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.