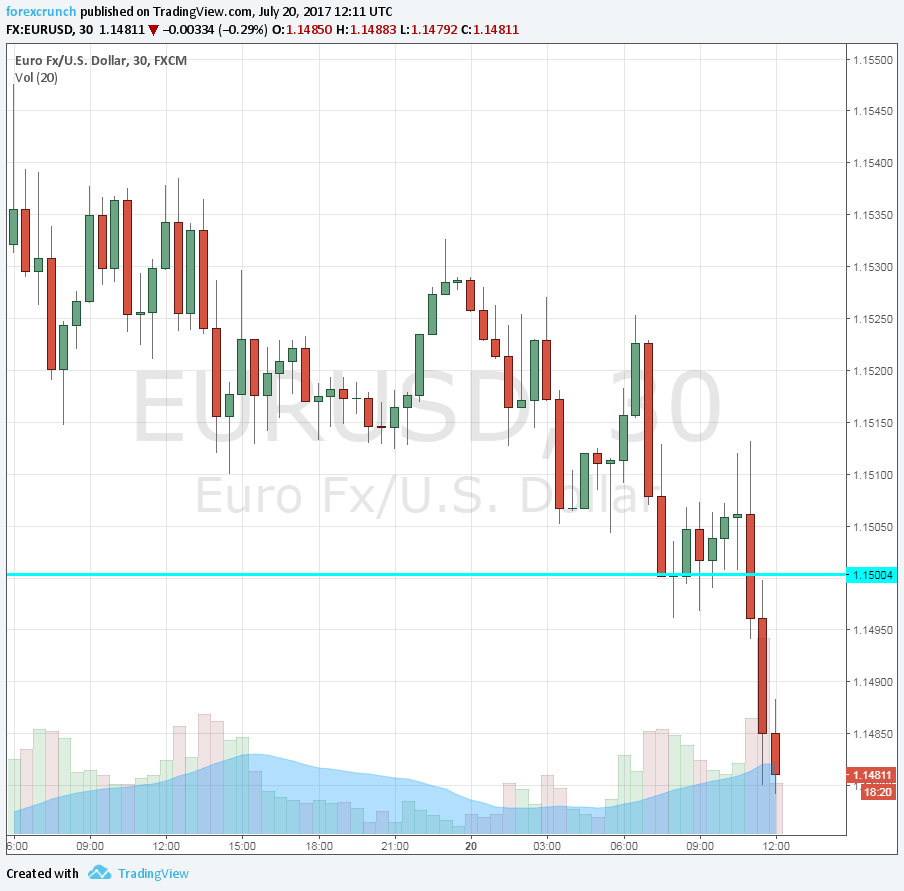

As expected. EUR/USD slips a bit lower, extending its drops and heading to 1.1485. Support awaits at 1.1145 and 1.13. Resistance is at 1.1580.

The main lending rate was left at 0% and the deposit rate at -0.40%. The QE program is at 60 billion euros a month and the big question remains about its future beyond the current end-date at the end of the year.

Update: Dovish Draghi? Doesn’t convince EUR/USD – jumps 80 pips

Any kind of tapering or reduction will help the euro. Interest rates will likely rise only in 2019 or 2020.

The press conference commences at 12:30 GMT. Stay tuned.

Is a dovish Draghi already priced in?

More:

Here is part of the statement:

If the outlook becomes less favourable, or if financial conditions become inconsistent with further progress towards a sustained adjustment in the path of inflation, the Governing Council stands ready to increase the programme in terms of size and/or duration.

Here is the chart showing the recent drag: