- EUR/USD gains traction on Monday amid correction in the US dollar.

- Fed’s stance could undermine the tapering in Jackson Hole Symposium.

- Euro flash PMI data is the key on the day ahead of US PMIs.

The EUR/USD analysis suggests a neutral picture today as the price shed off some bearish pressure amid a correction in the US dollar.

The EUR/USD pair is now trading at 1.1720, up 0.19% on Monday.

As the US dollar remains under pressure in a risk-on environment at the start of a big week, the EUR / USD pairs try to continue to bounce back from a nine-month low to 1.1750.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

As a result of the Fed’s virtual symposium in Jackson Hole last week, risk sentiment shifted in favor of the optimists as expectations for tapering were lowered. Recent dollar gains undercut the positive sentiment of market participants.

A combination of the optimism about the Covid vaccine and Australia and New Zealand’s recent reviews of their Covid strategies have encouraged Asian retailers to support Delta’s Covid variant despite growing concern among consumers.

Meanwhile, attention is now turning to the preliminary PMI reports for the manufacturing and service sectors in the Eurozone to better understand the bloc’s economic recovery. Additionally, US PMIs will be in the spotlight later that day, ahead of durable goods orders and the Fed symposium this week.

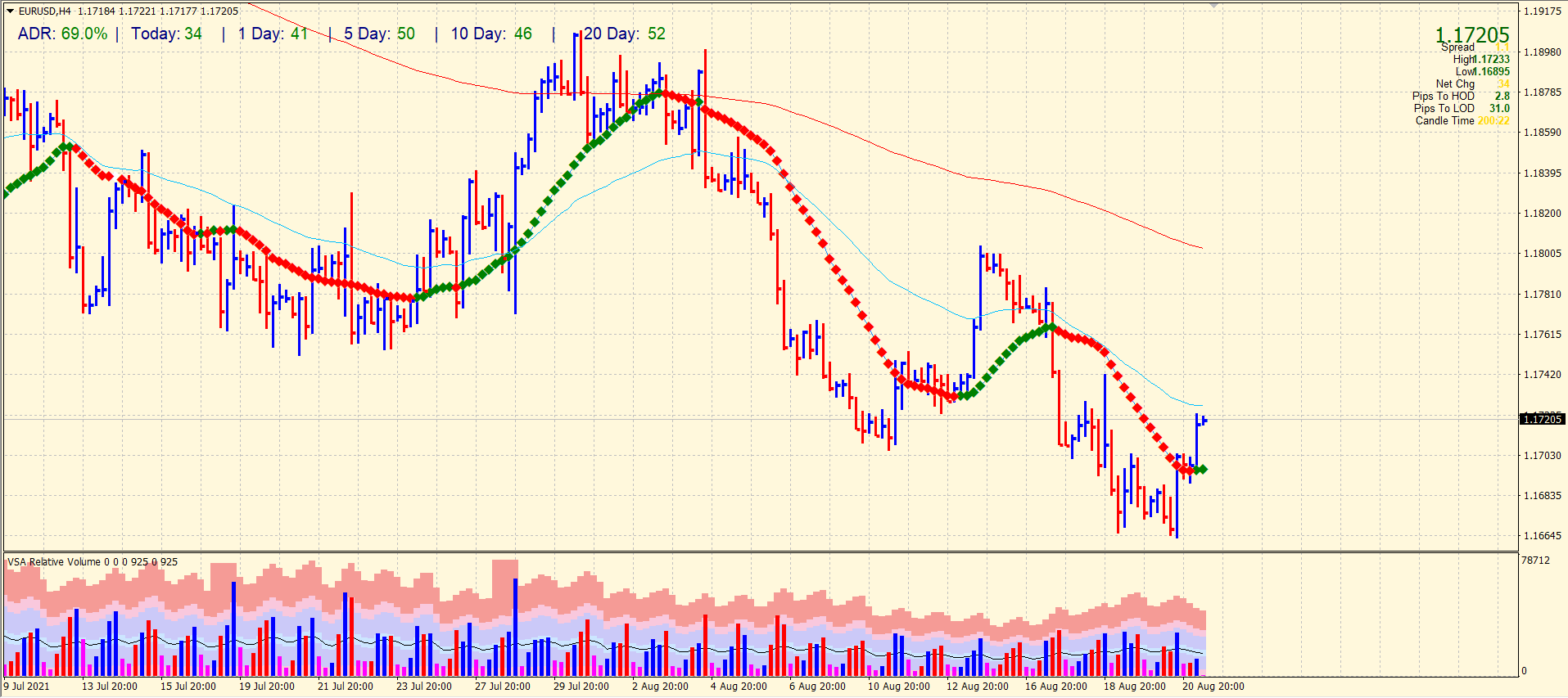

EUR/USD price technical analysis: Bulls finding the traction to target 1.1750

The EUR/USD pair managed to gain above the 1.1700 key level and is playing around the daily highs just under the 50-period SMA on the 4-hour chart. The price has moved beyond the 20-period SMA which indicates a further rally in the pair. The volume is bullish now, which is a sign of relief for the Euro buyers. However, the pair has already done 69% average daily in the Asian session. It means that the European session may not have a big role to play.

–Are you interested to learn more about forex signals? Check our detailed guide-

The immediate target of the relief rally is 1.1750, where some resistance can be seen. However, the next key level is the 1.1800 mark and the 200-period SMA. This is the key area that determines the trend bias of the pair. A sustained rally beyond the 1.1800 level can shift the bearish bias to the bullish trend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.