EUR/USD continued struggling, tumbling out of range as the US Dollar stormed the board. What’s next? A mix of different figures awaits the common currency now. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Euro-zone data was mixed with an increase in inflation to 2.1% but GDP disappointed with only 0.3%. The US Dollar enjoyed several positive factors. The Federal Reserve left rates unchanged but upgraded the language on growth and inflation. In addition, the mounting trade tensions with China have also pushed the greenback higher, and so have higher yields. The Non-Farm Payrolls report missed on the headline with 157K but was as expected on wages with 2.7% y/y and 0.3% m/m. It does not alter the course of the Fed to raise rates.

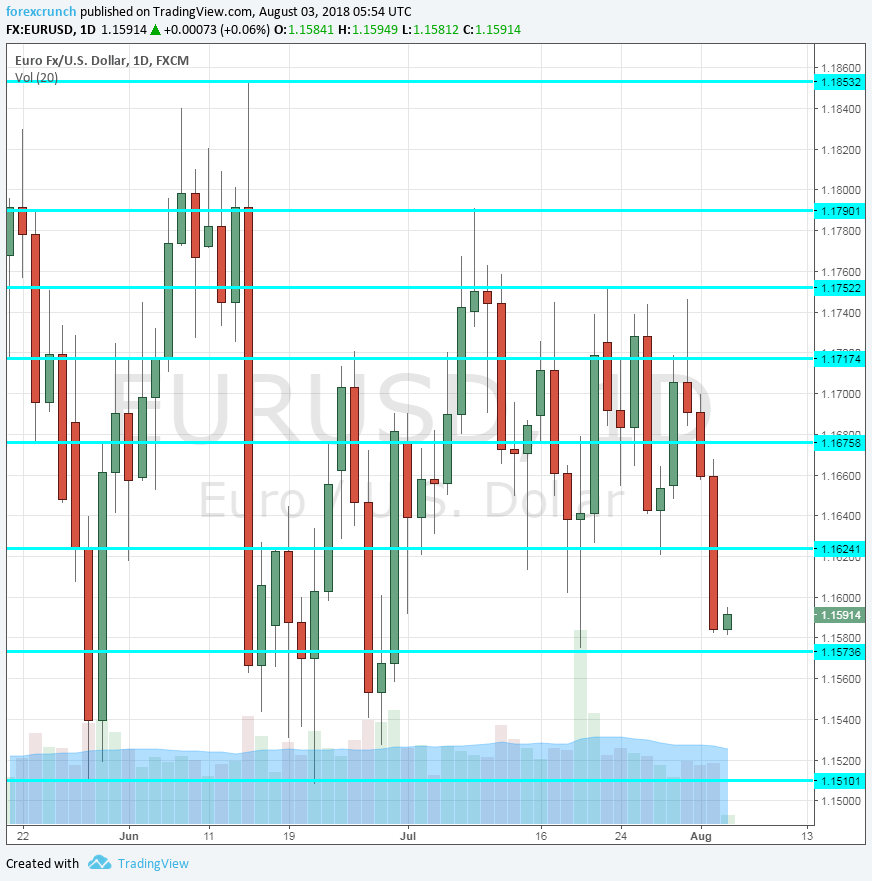

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Factory Orders: Monday, 6:00. Factory orders in the euro zone’s locomotive jumped by 2.6% in May, beating expectations. The figure for June may be more moderate. A drop of 0.3% is expected. The German economy relies on manufacturing and exports.

- Sentix Investor Confidence: Monday, 8:30. The survey of around 2,800 analysts and investor surprised in July with a rise to 12.1 points after quite a few months of declines. Will optimism prevail? A score of 12.8 is projected.

- German Industrial Production: Tuesday, 6:00. Output out of the continent’s largest economy increased by 2.6%, an identical scale to factory orders. And also here, we could see a drop now: -0.5% is on the cards.

- German Trade Balance: Tuesday, 6:00. Germany has a broad trade balance surplus which stood at 20.3 billion euros in May. A similar figure is likely for June: 21.4 billion.

- French Trade Balance: Tuesday, 6:45. The second-largest economy in the euro-zone suffered a wider trade deficit in May, 6 billion. The chronic deficit is unlikely to be erased anytime soon. A small squeeze to a deficit of 5.6 billion is expected.

- Retail PMI: Tuesday, 8:10. Markit’s forward-looking gauge for the retail sector ticked up to 51.8 in June, the second consecutive month of enjoying a score above 50, the level that separates expansion and contraction. A similar figure is likely now.

- ECB Economic Bulletin: Thursday, 8:00. A fortnight after the European Central Bank’s rate decision, it publishes the data it assessed before making its decisions. Comments on inflation and on trade will be of interest to markets.

- French Industrial Production: Friday, 6:45. Contrary to Germany, France saw a drop of 0.2% in its industrial output back in May. A bounce could be seen now: +0.5% is estimated.

- French Private Payrolls: Friday, 6:45. The final figure for France’s employment change in Q1 stood at a growth rate of 0.2%. We will now receive the preliminary measure for Q2. A faster growth rate could be seen: +0.3% is predicted.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar made another attempt to break above 1.1750 (mentioned last week). The failure to do so sent it down.

Technical lines from top to bottom:

1.2060 was the low point in late April and it is the last barrier before the round number of 1.20.

The round number of 1.19 is also notable as a pivotal line in the range and it also temporarily held the pair back in late 2017. 1.1845 was the high point in early June.

Further down, the 1.1820 level was a stubborn support line in late 2017. 1.1790 capped the pair in mid-July 1.1750 is a low point recorded in mid-May.

1.1720 is a veteran line that worked in both directions, last seen in November. 1.1676 was a temporary low point in late May.

1.1625 provided support to the pair several times in June and July. It is followed by the mid-July trough of 1.1575.

Below, 1.1510 is the 2018 low and also a ten-month trough. Further down, 1.1480 served as support back in July 2017.

I remain bearish on EUR/USD

Monetary policy divergence weighs on the pair and so do Trump’s clashes with China. Nothing material is likely to change now, allowing the pair to extend its falls.

Our latest podcast is titled Festive Fed, Dovish Draghi, and a global trade war

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!