- The latest economic projections hint at the former inflation and growth rate moving towards the Fed policy normalization from the US central bank.

- The Sino-American tussle also weighs on the market mood and tries to defend the US Dollar bulls, but cannot be ahead of the Fed.

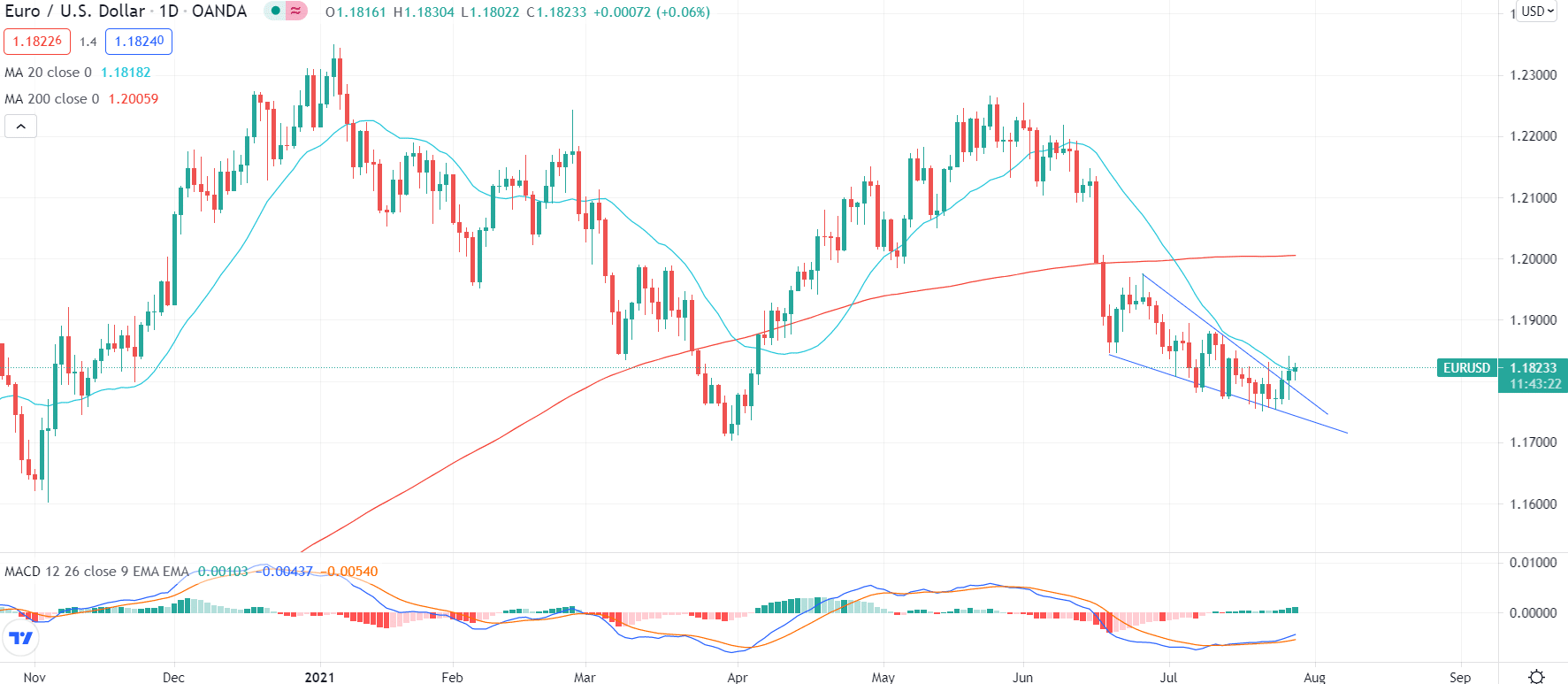

- EUR/USD increases for the 3rd consecutive day on Wednesday after confirming the falling wedge bullish formation on the daily chart trend.

The EUR/USD forecast remains mildly up for the third consecutive day around the 1.1825 heading into the European session on Wednesday. The currency pair confirmed the bullish chart pattern earlier in the week, and upside momentum expands as markets prepare for the US Federal Open Market Committee (FOMC).

–Are you interested to learn more about automated trading? Check our detailed guide-

US center for Disease Control and Prevention edits the mask directive and Australia critical Covid-19 infected state. New South Wales reported 16 months of high daily cases to probe the EUR/USD bulls.

Moreover, the UK reports the highest death rate since 17-March and also offers other reasons to be worried. Additionally, China cracks down on ed-tech stocks. The Sino-American tussle also weighs on the market mood and tries to defend the US Dollar bulls, but cannot offer more support ahead of the Fed. Against this background, Wall Street benchmarks five days uptrend, and US 10-year Treasury yields slipped from 3.7 basis points to 1.23 at the time of writing.

Looking forward, German consumer confidence for the August expected +1 versus -0.3 prior and risk catalyst, entertain the EUR/USD traders. Yet, somehow, most attention will be given to FED.

The latest economic projections hint at the former inflation and growth rate moving towards the Fed policy normalization. Though Chairman Jerome Powell stayed defensive, the latest Delta variant is another primary reason for policymakers to be cautious before tampering.

Mr. Powell is unlikely to reveal the expound on Fed consideration or the plans on Wednesday afternoon. But, of course, that will not stop the market from running with assumptions.

–Are you interested to learn more about forex signals? Check our detailed guide-

EUR/USD technical forecast: Bulls to hold the bias

The EUR/USD pair rises for the 3rd consecutive day on Wednesday after confirming the falling wedge bullish formation on the daily chart trend. Since late April, MACD histogram prints the strongest bullish signals, backing the breakout. Somehow, 20-DMA probes the pair quickly upside around the 1.1820, a break which will aim for a monthly high near 1.1900. For the moment, pullback moves are less worrisome until staying above the last resistance line near 1.1780, a break of which should refresh the monthly lows under around 1.1751.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.