- The ECB and the Fed are on the same page regarding rate hikes.

- ECB’s looming Quantitative Tightening goes a step further than the Fed.

- ECB’s Villeroy sees energy subsidies only postponing eurozone inflation.

Today’s EUR/USD forecast is slightly bullish. Recent statements from the heads of the two key central banks, the European Central Bank (ECB) and the US Federal Reserve (Fed), indicate hawkish play at both institutions. However, the ECB’s Quantitative Tightening (QT) is a step ahead of the Fed.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

In recent meetings, ECB Chief Economist Philip Lane stated that rate increases are necessary. However, Klaas Knot, the head of the Dutch Central Bank and an ECB policymaker, stated that once interest rates increase to a level that neither encourages nor slows economic development, the ECB “should consider starting to decrease its enormous stock of assets.” The policymaker also stated that he does not anticipate a sudden halt to policy rate increases, adding that smaller steps are likely to become the norm.

On the other hand, James Bullard, president of the St. Louis Federal Reserve Bank, said, “The US has a serious inflation problem,” the policymaker also added, “Front loading fed policy is the right strategy.”

Elsewhere, Francois Villeroy de Galhau, a European Central Bank (ECB) policymaker, said Europe’s energy subsidies may lower the current inflation rate but only at the expense of future higher readings, thus complicating the mission of monetary policy. Villeroy emphasized that governments should also do their share by reestablishing fiscal discipline because the fiscal and monetary policies are out of sync.

EUR/USD key events today

The pair will likely consolidate as there are no significant news releases that might cause volatile moves.

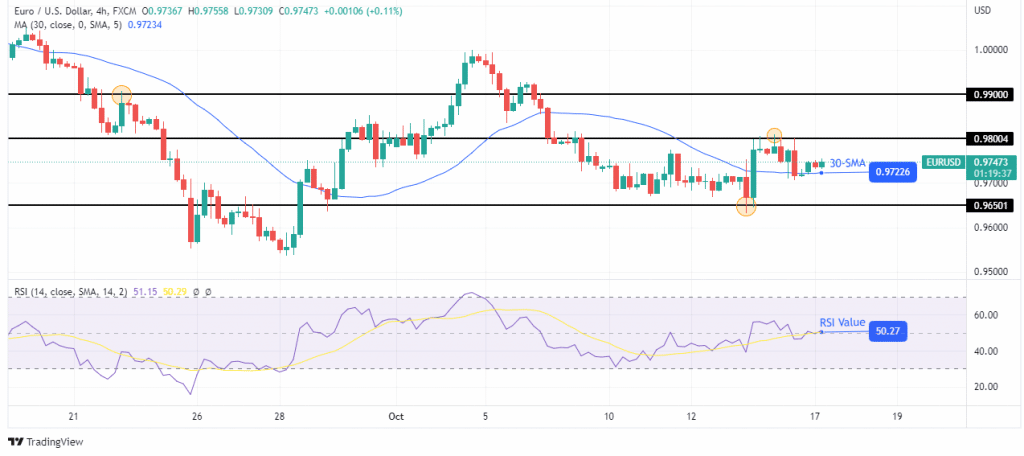

EUR/USD technical forecast: Bulls above 30-SMA

Looking at the 4-hour chart, we see the price trading slightly above the 30-SMA and RSI above 50. Bulls have a tenuous hold on control and could lose it anytime. At this point, bears are almost as strong as bulls.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

Therefore, bulls need to gather more momentum to push off the 30-SMA support and retest the 0.9800 resistance level. If they fail, bears might be the ones with enough momentum to push the price back below the SMA. This would mean retesting the 0.9650 support level and possibly breaking below.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.