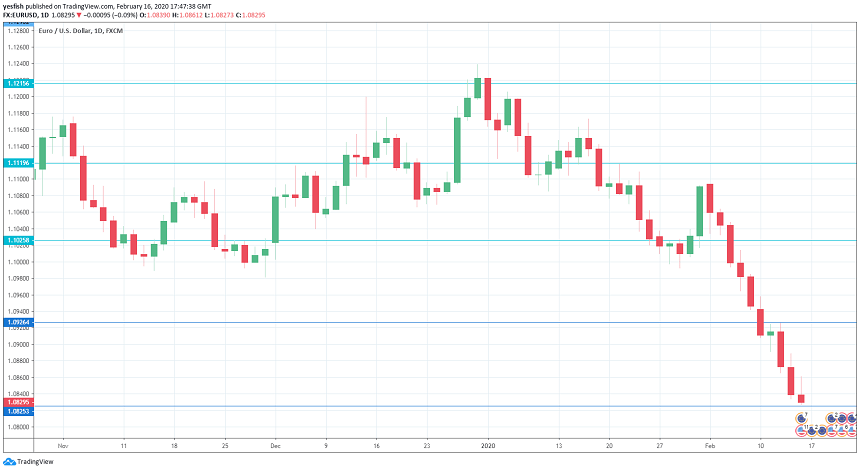

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German ZEW Economic Sentiment: Tuesday: 10:00. The indicator climbed to 26.7 in January, up from 10.7 in the previous release. Another strong reading is expected in February, with an estimate of 20.0 points. The all-eurozone indicator jumped to 25.6 in January, with the February release expected at 21.3 points.

- Eurozone Current Account: Wednesday, 9:00. The current account surplus has widened in each of the past five releases, with a surplus of EUR 33.9 billion in November. This was shy of the estimate of EUR 34.3 billion. The upswing is expected to continue in December, with a forecast of EUR 34.5 billion.

- German GfK Consumer Climate: Thursday, 7:00. Consumer confidence improved to 9.9 in January, up from 9.6 points. No change is expected in the February release.

- French Final CPI: Thursday, 7:45. Consumer inflation in the eurozone’s second-largest economy improved to 0.4% in December, marking a four-month high. Analysts are braced for a sharp downturn in January, with a forecast of -0.4%.

- ECB Monetary Policy Meeting Accounts: Thursday, 12:30. The minutes will provide details of the most recent policy meeting. At the meeting, ECB President Christine Lagarde said that she would prefer higher interest rates, but that stronger growth and inflation were needed first. Investors will be combing through the minutes, looking for hints regarding future monetary policy.

- Eurozone Consumer Confidence: Thursday, 15:00. The eurozone consumer remains pessimistic, as the indicator has been mired in negative territory. The indicator is expected to remain at -8 points for a third straight month.

- Flash PMIs: Friday, 8:15 in France, 8:30 in Germany, and 9:00 for the whole eurozone. The January PMIs showed growth in the services sector, but pointed to continuing contraction for German and eurozone manufacturing PMIs. Both of these manufacturing PMIs are expected to weaken in the initial estimates for February, with estimates of 47.4 and 44.8, respectively.

- Eurozone Inflation: Friday: 10:00. Consumer inflation in the eurozone remains well below the ECB inflation target of around 2 percent. The final estimates for February are expected to confirm the initial estimates of 1.1% for CPI and 1.4% for core CPI.

EUR/USD Technical analysis

EUR/USD posted considerable gains at the end of the week, coming close to the 1.11 level.

Technical lines from top to bottom:

We start with resistance at 1.1215.

1.1119 has some breathing room in resistance.

1.1025 (mentioned last week) has switched to resistance after sharp losses by EUR/USD last week.

1.0925 is an immediate support level.

1.0825 is under strong pressure in support. 1.0690 is next.

The round number of 1.0600 follows.

1.0520 is the final support level for now.

.

I remain bearish on EUR/USD

The euro has had a dreadful start to 2020, falling 3.5% since the New Year. With few bright spots in the euronzone economy, there is more room for the currency to fall.

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!