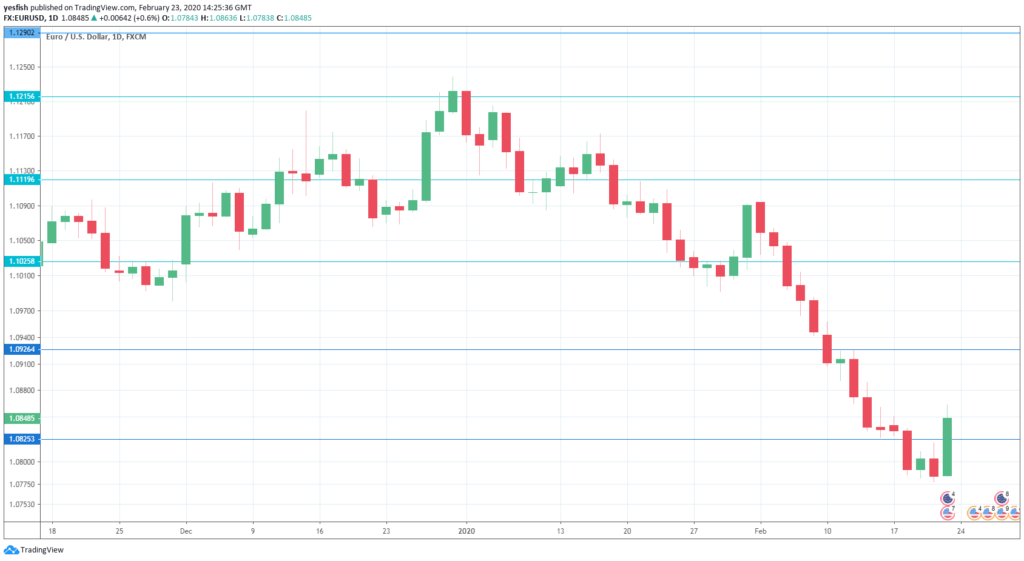

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Ifo Business Climate: Monday, 9:00. The survey of 7,000 businesses showed a drop in sentiment among businesses in January: 95.9 points against 96.3 beforehand. The indicator is forecast to fall to 95.0 in February.

- German Final GDP: Tuesday, 7:00. The final release is projected to confirm that the German economy was stagnant in Q4, as the initial GDP reading came in at 0.0%. The final figures do not usually deviate from the initial readings.

- Eurozone Monetary Data: Thursday, 9:00. M3 Money Supply slowed down to an annual growth rate of 5.0% in December, short of the forecast of 5.5%. This was down sharply from the November reading of 5.0%. Private Loans grew by 3.7% y/y, up from 3.5% in November. We will now receive data for January. Money supply is projected to rebound to 5.3%, while private loans is expected to remain at 3.7%.

- German Preliminary CPI: Friday, All Day. Inflation levels remain low in the eurozone’s largest economy. The final release for January came in at -0.6%, matching the forecast. The initial reading for February is expected to rebound to 0.3%.

- French Preliminary GDP: Friday, 7:45. The second-largest economy in the eurozone contracted by 0.1% in Q4, according to the initial GDP reading. The second estimate is expected to confirm this figure.

- German Unemployment Change: Friday, 8:55. Unemployment rolls declined by 2 thousand in December, better than the estimate of a gain of 5 thousand. The estimate for January stands at 5 thousand.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.1215, which has held since mid-January. 1.1119 is next.

1.1025 (mentioned last week) switched to a resistance role last week.

1.0925 is the next line of resistance.

1.0825 was tested in support last week. 1.0690 is next.

The round number of 1.0600 follows.

1.0520 is the final support level for now.

I remain bearish on EUR/USD

The euro remains under pressure, and with confirmed cases of coronavirus in Italy and Germany, investor sentiment could head towards safe-haven assets. As well, the U.S. economy continues to outperform the eurozone.

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!