- Underpinned US yields push the EUR/USD down after the strongest gains on Friday.

- Omicron led fears to undermine the risk sentiment.

- Market participants eye German inflation data, Biden, and ECB’s Lagarde.

The EUR/USD forecast remains mixed to bearish as the price has dropped below the key 1.1300 mark after the risk-off sentiment was triggered. The EUR/USD price fell to 1.1272, down 0.44% in one day to reverse the virus-triggered rebound on Friday morning.

–Are you interested to learn more about South African forex brokers? Check our detailed guide-

According to the United States, the upbeat comments about the prevailing fears in Europe may have influenced the decision. However, despite that, traders remain cautious ahead of a preliminary reading of the German Harmonized Consumer Price Index (HICP) for November, which predicts 5.4% y/y versus 4.6% previously. In addition, short-term equalization will be influenced by the speeches of European Central Bank (ECB) President Christine Lagarde, Federal Reserve Chairman Jerome Powell, and US President Joe Biden.

NIH officials renewed hopes that viral vaccines and booster doses could help address the latest challenge facing the global economy after there were no new cases of COVID-19 detected in the United States. Israeli professor Dror Mevorah went in the same direction when he described Omicron as less serious than the Delta version of the Coronavirus.

According to ECDC’s statement over the weekend: “the Omicron variant is the most deviant option in significant numbers.” “We are concerned that Omicron could significantly reduce the effectiveness of vaccines and raise the risk of re-infection,” it added.

A controversy over viral issues echoes recent policy comments and supports the Fed-ECB battle, which benefits EUR/USD bears. As Reuters reports, Lagarde of the ECB stated: “There is obvious concern about the [eurozone] economic recovery in 2022, but I think we have learned a lot.” On the other hand, Atlanta Federal Reserve President Raphael reported that “Covid is the source of inflation.”

As of press time, the 10-year US Treasury yield had jumped 4.5 basis points (bp) to 1.53%, while S&P 500 futures rose 0.80%. On Friday, US yields and stocks fell to their lowest levels since the early days of the pandemic, after the World Health Organization (WHO) declared it a “worrying possibility.”

Shortly, the November inflation rate in Germany could lead to a decline in EUR/USD values, but the likelihood of the Fed raising rates against the ECB could make the major currency pair climb.

–Are you interested to learn more about spread betting brokers? Check our detailed guide-

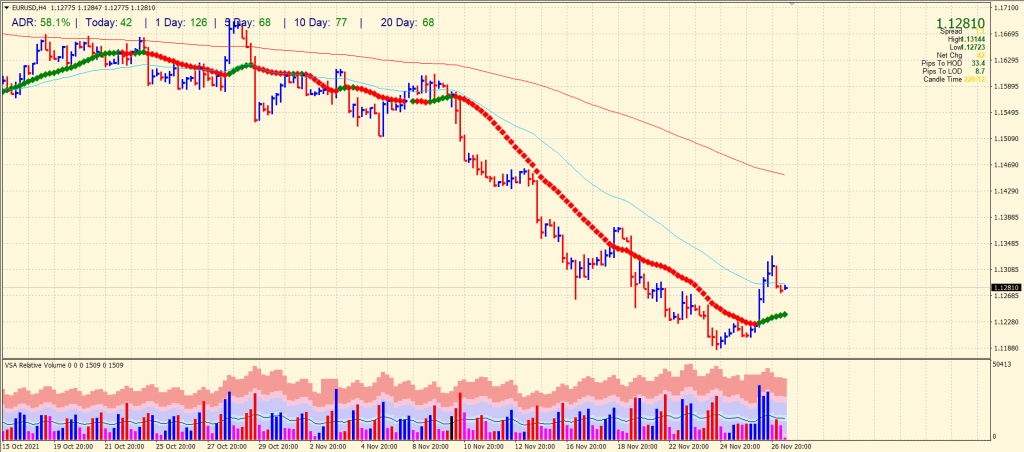

EUR/USD price technical forecast: Mixed below 1.1300

The EUR/USD price returns back below the 50-period SMA on the 4-hour chart as the price could not find acceptance above the 1.1300 mark. However, the price remains supported by the 20-period SMA on the same chart. So far, the average daily range is 58% which is quite higher than usual. The volume data remains mixed. Any move above 1.1300 will again gather attraction for the buyers.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.