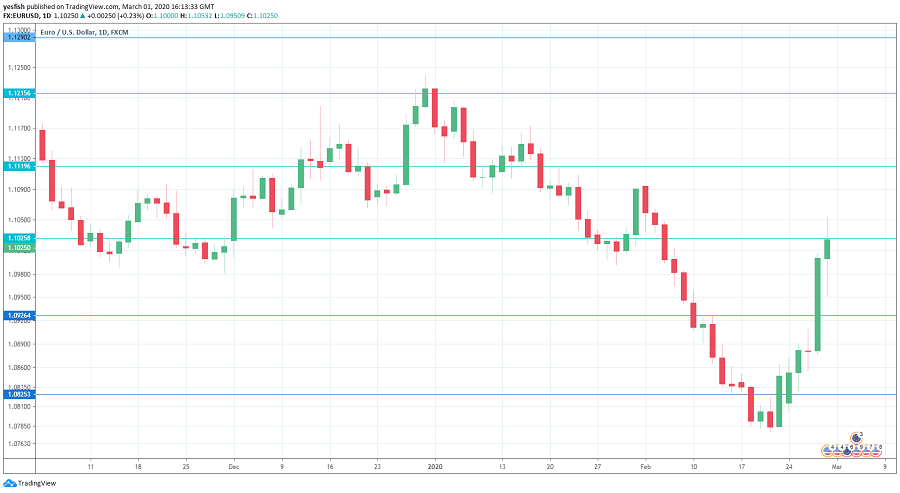

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMIs: Monday: 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German one at 8:55, and final euro-zone number at 9:00. These final PMI readings are expected to confirm the initial releases from late February, and all the estimates are below 50, which points to contraction. Spain’s manufacturing sector has been in contraction mode since May and the trend is expected to continue in February, with an estimate of 48.9 pts. In Italy, the manufacturing sector has been in decline for over a year and the forecast for the upcoming release is 48.0 pts. The German indicator is expected at 47.8 and the eurozone PMI is projected to improve to 49.1 pts. The French PMI is expected to slow to 49.7, down from 51.1 a month earlier.

- Eurozone inflation: Tuesday, 10:00. The initial estimate for Eurozone CPI edged up to 1.4% in February, matching the estimate. No change is expected in the final estimate.

- German Retail Sales: Wednesday, 7:00. Retail sales plunged 3.3% in December, the sharpest decline since December 2018. Analysts expect a strong rebound in January, with an estimate of 1.1%.

- Services PMIs: Wednesday, 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German one at 8:55, and final euro-zone number at 9:00. Services sector numbers have generally been better than those in the manufacturing one. Spain had a score of 52.5 in January. Italy had 51.4. The initial read for France stood at 52.6, for Germany it was 53.3 and for the euro-zone 52.8. No changes are expected in the final versions.

- Eurozone Retail Sales: Wednesday, 10:00. Retail sales declined by 1.6% in December, worse than the estimate of -0.6%. Analysts are expecting a strong rebound, with an estimate of 0.6%.

- German Factory Orders: Friday, 7:00. Germany’s manufacturing sector has struggled, with three successive declines. In December, the indicator declined by 2.1%, much weaker than the estimate of 0.6%. The estimate for January stands at 1.5%.

.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.1290.

1.1215 has held since mid-January. 1.1119 is next.

1.1025 (mentioned last week) is fluid, as EUR/USD ended the week on this line.

1.0925 is providing support.

1.0825 has some breathing room after strong gains by EUR/USD last week.

1.0690 is the final support level for now.

.

I remain bearish on EUR/USD

The euro finally put together an excellent week, but is still down close to 2 percent in 2020. The U.S. economy continues to outperform the eurozone, and much of last week’s gains for the euro may have been profit-taking.

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!