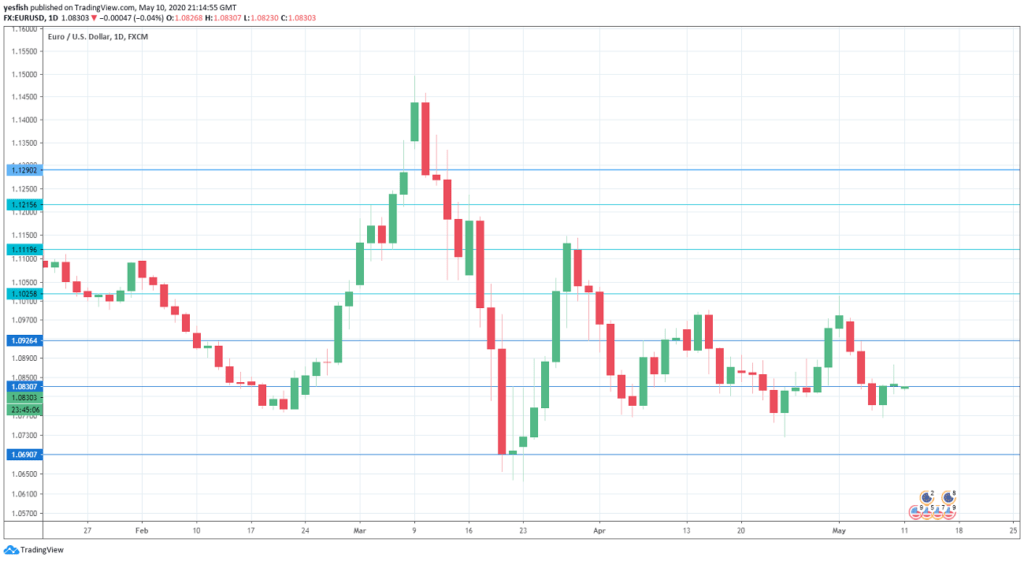

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Eurozone Industrial Production: Wednesday, 5:00. After a sharp gain of 2.3% in February, the indicator sagged and posted a decline of -0.1%. Analysts are braced for a huge drop of 12 percent.

- German CPI: Thursday, 2:00. The initial read for consumer inflation posted a gain of 0.3% in April, above the forecast of 0.0 percent. The final read is expected to confirm the initial release.

- German Preliminary GDP: Friday, 2:00. In the fourth quarter of 2019, the German economy was stagnant, with a reading of 0.0 percent. The initial read for Q1 stands at -2.3%, as Europe’s powerhouse is expected to show a sharp downturn.

- Eurozone Flash GDP: Friday, 5:00. The eurozone economy recorded a weak gain of 0.1% in Q4 of 2019. Investors are braced for a dismal reading in Q1, with a forecast of -3.8 percent.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.1215, which has held since mid-January. 1.1119 is next.

1.1025 (mentioned last week) has some breathing room after sharp losses by EUR/USD last week.

1.0900 remains relevant and has switched to a resistance role.

1.0829 was tested last week. It could see further action early next week.

The round number of 1.07 saw action in mid-March, when EUR/USD showed strong volatility.

1.0620 is protecting the 1.06 level.

1.05 is the final support level for now. is the final support line for now.

.

I remain bearish on EUR/USD

German and eurozone GDP numbers are projected to be brutal, reflecting deteriorating conditions across the eurozone due to the Covid-19 outbreak. This could weigh on the wobbly euro.

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe Trading!