- EUR/USD rises above 55-DMA for the first time since August 05.

- US dollar remains weak after the ADP figures missed expectations.

- US NFP report ahead is the key driver of market sentiment as Fed’s tapering timeline depends on jobs market conditions.

The EUR/USD price forecast is bullish as the Greenback is persistently weak while ECB supports the Euro with its hawkish comments.

The EUR/USD pair is at 1.1837 on Thursday, down 0.01% at the time of writing.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

US economic data helped the EUR/USD price to continue the rally. Recently, it climbed to 1.1857, its highest level since August 5. Furthermore, it closed above the 55-day SMA and near the highs for the first time since June.

Combined with a falling US dollar and a stronger euro, the EUR/USD gained ground. DXY is testing the low of the month at 92.40, down 0.22%. As a consequence of the European Central Bank’s more radical comments, the Euro climbed against the Pound and Swiss Franc.

ADP reported a 326,000-job increase in August, much less than the 943,000 non-farm jobs reported in the same month. Thus, even though the ADP is volatile this year and does not correlate with the NFP, it provides valuable information about the labor market.

The huge difference between July’s NFP and August’s ADP had economists expecting huge growth in private sector employment in August, but this did not happen. Instead, small businesses had the weakest employment growth, with an increase of only 374,000.

August Nonfarm Payroll report preview

August’s employment estimate is 750,000, down 20% from the average of 940,500 in June and July.

In light of quarantine restrictions last year, the Fed is mostly concerned with replacing job losses. However, in the wake of the pandemic, Chairman Powell has spoken and explained this countless times.

Due to the Fed’s attention to the labor market, the question arises how much higher wages will convince policymakers that job creation remains strong despite COVID, inflation, and a devastating war in Afghanistan.

NFP data that surpasses the consensus and reaches a two-month average will likely be required to influence the Fed’s decision to announce tapering in September.

While the economy has shrunk and the pandemic persists, governors, especially Powell, will have difficulty justifying the decline.

–Are you interested to learn more about forex signals? Check our detailed guide-

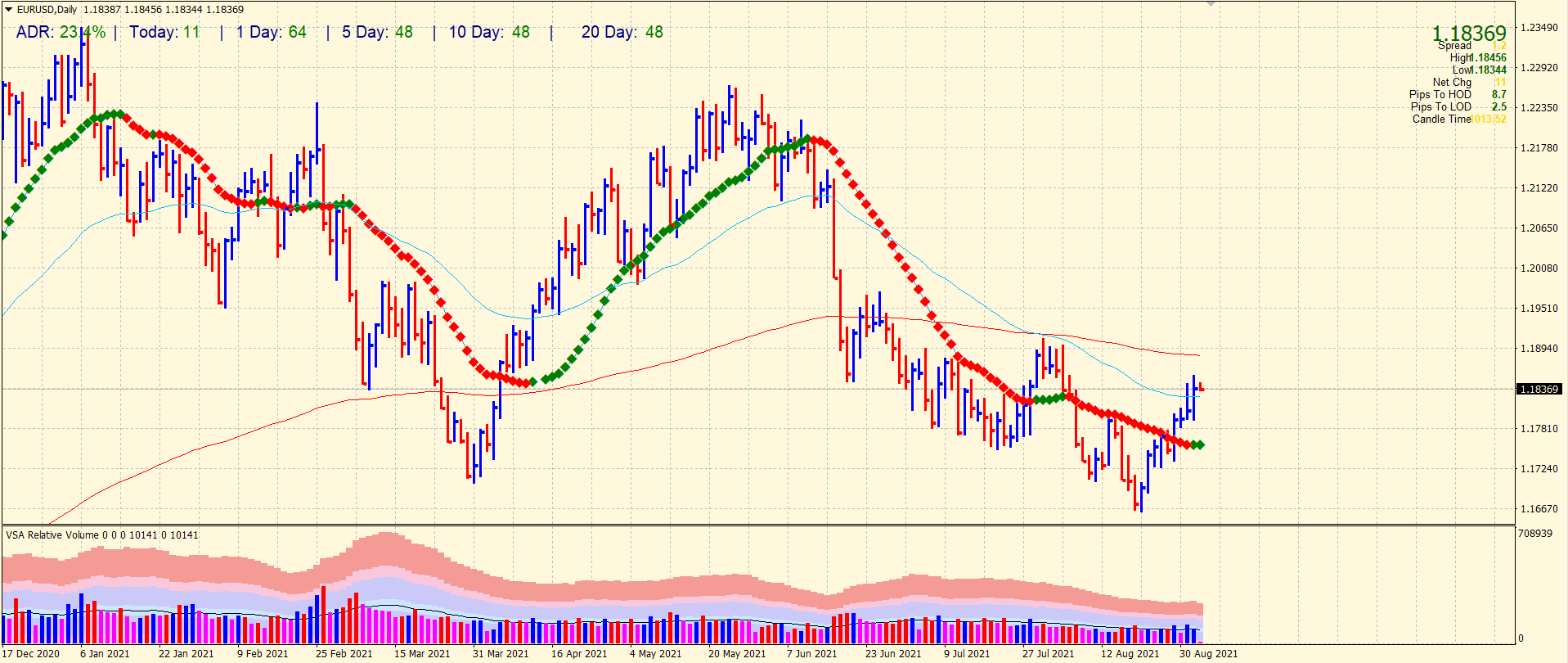

EUR/USD price technical forecast: 55-DMA lending support

The EUR/USD price managed to crack above the 55-day moving average for the first time since August 05. The price pared off some of yesterday’s gains, but the outlook is still positive. The price may find a 200-day moving average as the next hurdle. The average daily range is 23% so far. Meanwhile, volume supports the bullish momentum. The bulls will find a tough time cracking the swing highs at 1.1857 ahead of 1.1900. On the downside, the 1.1800 level may provide support ahead of 1.1770.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.