- Despite a two-day rebound from the yearly bottom, EUR/USD is pressured around an intraday low at the latest.

- There is more faith in ECB doves than Fed hawks.

- Bond yields and the dollar are boosted by US inflation expectations and stimulus hopes.

- A light calendar draws attention to Lagarde and Fedspeak.

The EUR/USD forecast remains mixed ahead of ECB and Fedspeak, while yesterday’s gains lack follow-through momentum.

–Are you interested to learn more about forex options trading? Check our detailed guide-

In the wake of Friday’s European session, the EUR/USD price is weakening for the first time in three days. Against the backdrop of gloomy early trading hours, the major currency pair is reacting to the recovery of the US dollar.

Following the 10-year yield on US government bonds – by one basis point (bps), the US dollar index (DXY) rose 0.12% to 95.64, a decline of around two days at the latest 1.596% recorded.

Inflation expectations in the US have recovered from a two-day decline from an 11-year high after US data improved and Fed officials made restrictive remarks. Using the 10-year break-even inflation rate from the St. Louis Federal Reserve System (FRED), the inflation indicator is used to support the yield on US Treasuries and the DXY.

Williams, NY Fed President, and FOMC Vice President emphasized inflation concerns and pushed for a rate hike, but Evans’ mixed comments shook the hawks to their core. Additionally, the stronger Philadelphia Fed Manufacturing Survey results for November 39 compared to the expected 24, along with the lower 268 US initial jobless claims, add to market concerns about reflation.

Meanwhile, the gossip about US stimulus measures exacerbates inflation worries and fuels demand the US dollar as a safe haven, putting pressure on EUR/USD prices. In a new analysis, the White House predicts that the Build Back Better (BBB) plan will reduce deficits by $112 billion over the next decade and increase the likelihood of the climate and social spending bill being passed when it is voted on.

In contrast to the Fed’s policymakers, the European Central Bank’s (ECB) chief economist Philip Lane said on Thursday that the bottlenecks will not worsen further, according to Reuters, and will decrease from here.

ECB President Christine Lagarde and the Bundesbank President Jens Weidmann will contribute to the Fed’s short-term comments on the EUR/USD pair.

–Are you interested to learn about forex bonuses? Check our detailed guide-

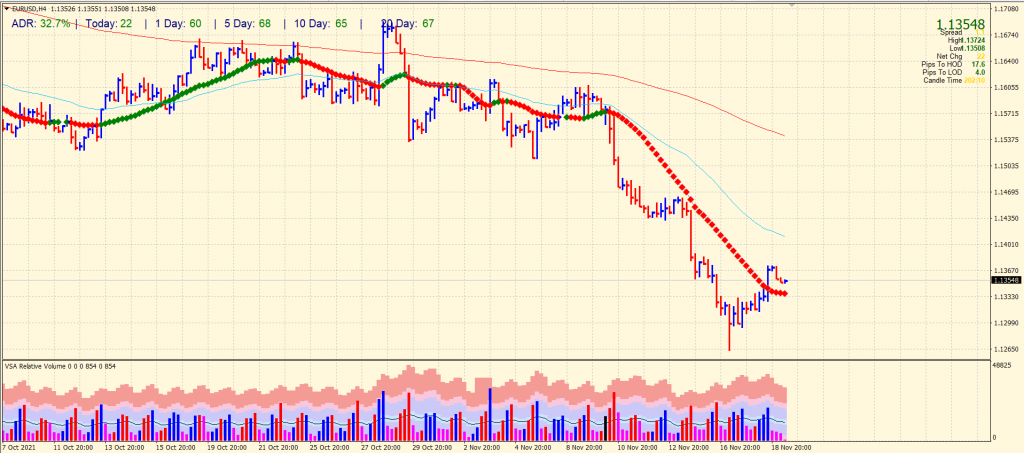

EUR/USD price technical forecast: Buying momentum continues

The strong rally in the EUR/USD price saw some correction on Friday. However, the minor down wave comes with a declining volume, indicating that the price may find support and resume the rally to mark fresh daily highs. Immediate support lies at 1.1335 (20-period SMA) on the 4-hour chart. The next support comes at the round number of 1.1300. On the upside, yesterday’s high at 11372 may provide resistance ahead of 1.1400.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.