- Bulls hold above a two-week high after a four-day winning streak.

- The ECB has tried to tame inflation concerns caused by the Ukraine-Russia crisis, but they have failed.

- The dollar index is losing bearish Treasury yields amid deteriorating market sentiment.

- The second level data from the block in Xi-Biden’s call could be entertaining for pairs traders.

The EUR/USD forecast has turned a little bearish as the price could not hold above the 1.1100 level or the second time amid risk aversion.

–Are you interested in learning more about making money with forex? Check our detailed guide-

As of early Friday, the EUR/USD price remains under pressure at 1.1080, posting its first downward daily reading in Europe in five days. There may be a link between the recent weakening of the pair and risk aversion from the market and the escalating inflation concerns.

Prevailing risk aversion

Despite protracted peace talks, diplomats from Ukraine and Russia are still negotiating. Still, the efforts by Turkey to include Russian President Putin and his Ukrainian counterpart Volodymyr Zelenskyy in the talks are encouraging traders. On the contrary, western warnings about Moscow’s potential use of chemical weapons and China’s likely support for Russia’s invasion of Ukraine are growing market fears.

Concerns over a Russian default and a rebound in China’s daily Covid numbers after a two-day decline weigh on EUR/USD sentiment and prices.

The backdrop of these games is a low yield on the US Treasury and a drop in equity futures. On a weekly basis, the US Dollar Index (DXY) has remained negative but in a downward trend for the past three days.

Eurozone inflation

Oil prices have gone up, and Eurozone inflation data have been optimistic, rekindling inflation concerns elsewhere. The final readings of the bloc’s key inflation indicators for February exceeded initial projections on Thursday. However, the European Central Bank (ECB) has tried to tame fears of faster monetary tightening, including President Christine Lagarde.

Xi-Biden talk to impact the market

The details of President Biden’s phone conversation with China’s Xi Jinping will have a major impact on the market and the EUR/USD pair. In addition, data on Eurozone labor costs for the fourth quarter (Q4) and January’s trade balance will also be significant.

EUR/USD price technical forecast: Receding towards 1.1000

The EUR/USD price is slowly receding towards the 20-period SMA (4-hour chart) around 1.1025 area. Moreover, the ascending trendline may also be the target for the sellers. Although the volume for the downside is decreasing, the recent weakness is only a correction. As long as the price remains below the 200-period SMA (currently at 1.1205), the pair will retain the bearish dominance.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

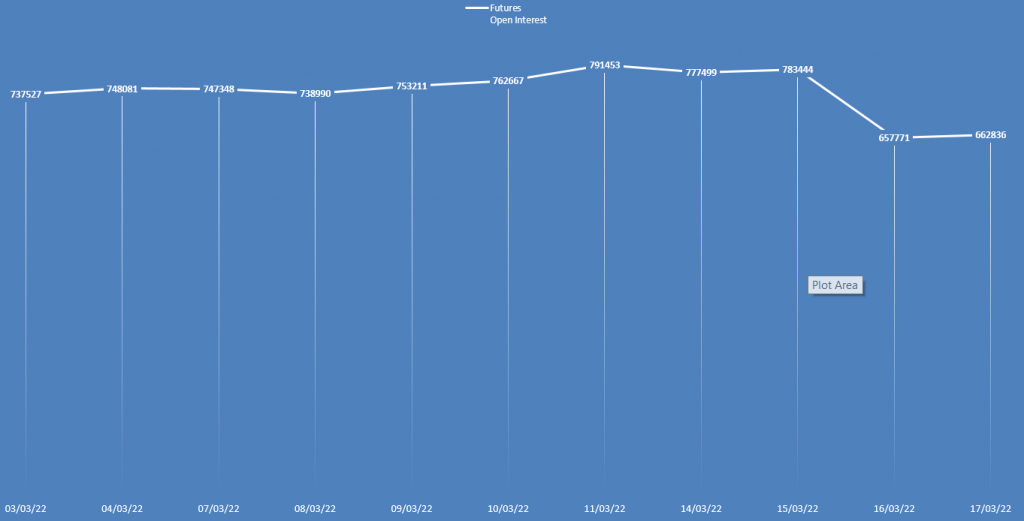

EUR/USD forecast via daily open interest

The open interest has slightly increased while the prices showed a surge beyond 1.1100 area. Therefore, it shows that the new buyers entered the market, and the upside may prevail.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money