- The EUR/USD currency pair is retreating from two-month highs and under pressure for the second day.

- The ECB’s president, Lagarde backed off her dovish inflation rhetoric, while the Kazakhs dismissed worries that rates might be raised in July.

- USD yields rise on mixed sentiment regarding trade, politics, and the Fed’s next move ahead of the US CPI report.

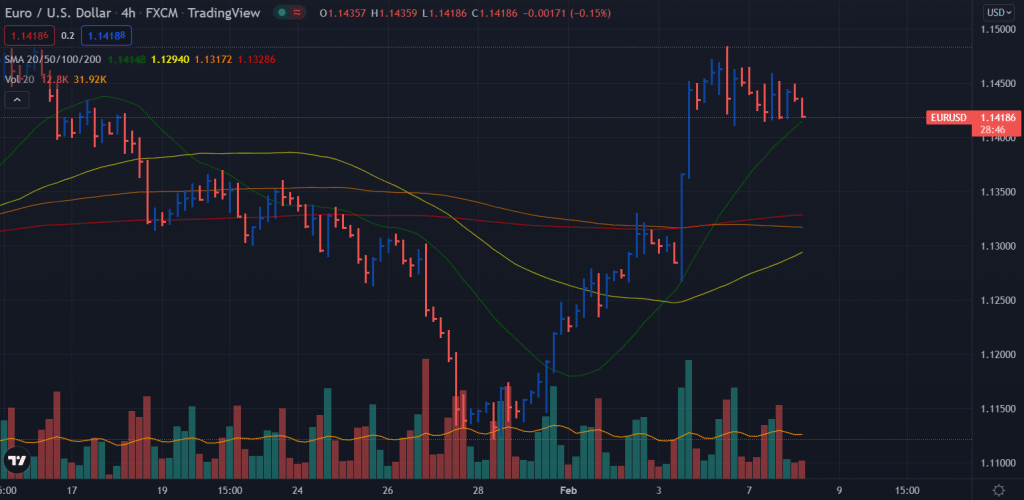

The EUR/USD forecast is bearish over the start of the week, trading around 1.1420 ahead of the European session on Tuesday.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

EUR/USD bulls were hit hard by Christine Lagarde’s dovish remark on Monday. Reuters reports that European Central Bank President Christine Lagarde said that there was no need for major monetary tightening in the Eurozone as inflation should ease and stabilize around 2%. Furthermore, the head of the Central Bank of Latvia, as well as ECB policymaker Martins Kazaks, commented that “the European Central Bank (ECB) may finish its stimulus program ahead of schedule, but it is unlikely it will raise its key interest rate in July, as investors expect,” according to Reuters.

Weakness in the EUR/USD pair can also be linked to the recovery of the US dollar as a result of higher government bond yields.

In February, the upbeat sentiment among Sentix investors in the Eurozone struggled to overcome the disappointing German industrial production read in December but failed to slow back buyers on the EUR/USD pair.

The drop in US inflation expectations threatens the prospects of a 0.50 percent Fed rate hike in March and puts the US dollar to the test. However, recent cautious optimism is also at the same level, bolstered by Coronavirus headlines and US-Japan trade news.

Nevertheless, Russia and Ukraine are hanging back over terms following skirmishes between China and the US to upset dollar-sellers.

US stock futures rose as late as 4485, while US 10-year Treasury yields rose two basis points to 1.936%, near their highest level since late 2020. However, as Wall Street closed sluggishly, US Treasuries fell from two-year highs.

Market participants await a better understanding of Thursday’s American Consumer Price Index (CPI) and the European Commission’s economic forecasts. Nevertheless, preliminary guidance can be provided by the risk catalysts mentioned above and the expected US trade balance for goods and services in December of -$83bn against -80.2bn.

EUR/USD price technical forecast: Bears to pounce 1.1400

The EUR/USD price is wobbling above the 20-period SMA on the 4-hour chart. However, the outlook is negative and may break below the 1.1400 mark. The next support would be around 1.1380 ahead of 1.1330.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

As long as the price remains below the 1.1480 mark, we will consider the outlook bearish. However, breaching the highs of 1.1480 may trigger more buying towards 1.1520 and then 1.1550.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money