- ECB rates will peak at 3.75% or higher.

- US unemployment claims increased more than anticipated last week.

- Experts believe US employers added 205,000 jobs in February.

Today’s EUR/USD outlook is bullish. According to analysts surveyed by Reuters, the peak for interest rates at the European Central Bank will be significantly higher than initially anticipated only a month ago. Rates will peak at 3.75% or higher. They also stated that stubbornly high inflation would force policymakers to be more aggressive.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

ECB President Christine Lagarde reiterated on Sunday what she had said at the previous Governing Council meeting: a 50 basis-point increase would likely occur next week.

The dollar fell on Thursday due to data showing that US unemployment claims increased more than anticipated last week. This news fueled hopes that a deteriorating labor market will lessen the chances of the Fed picking up the pace of rate increases.

For the week ending March 4, initial unemployment claims for state benefits increased from 21,000 to 211,000.

That comes just before the anticipated February jobs data, which might determine whether the Fed will speed up rate rises to 50 basis points at its March 21–22 meeting.

According to a Reuters poll of experts, employers added 205,000 jobs in February, significantly less than the much larger-than-expected 517,000 gains in January. During the month and annually, wages are anticipated to have climbed by 0.3% and 4.7%, respectively.

Tuesday’s consumer price inflation figures will heavily influence the Fed’s decision. Prices are predicted to have increased by 0.4% in February.

If the labor market remains strong and inflation is high, Treasury yields may increase further, strengthening the dollar.

EUR/USD key events today

Investors are eagerly awaiting US employment data. The nonfarm payrolls report and the unemployment rate report will affect the Fed’s next move.

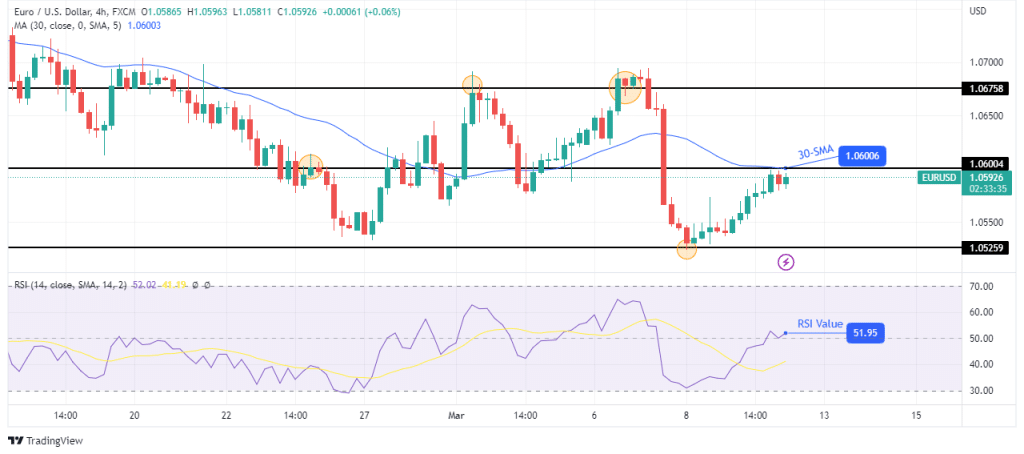

EUR/USD technical outlook: RSI points to stronger bullish momentum

The 4-hour chart shows EUR/USD trading near the 30-SMA after a strong bullish move from the 1.0525 support level. At the same time, the RSI has crossed above the 50-mark, showing bulls are getting stronger than bears.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

However, bulls must break above the 30-SMA and the 1.0600 key levels to confirm this. If this happens, bulls will be free to push the price higher to the next resistance level at 1.0675.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.