- EUR/USD remains on the downside, but the price action remains limited.

- The 10-year German bund yields dropped after seeing a rise on Friday.

- Risk-off sentiment stemming from Evergrande keeps the USD strong.

- Investors await the FOMC meeting to find clues about Fed’s tapering schedule.

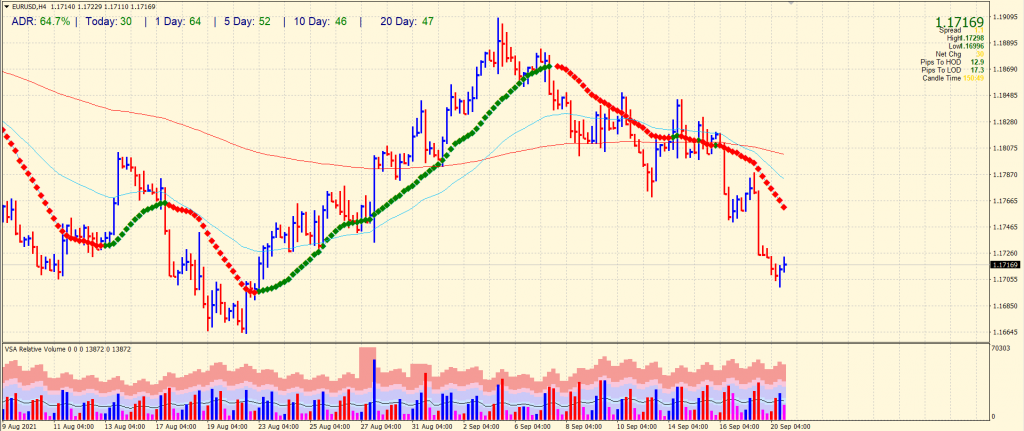

The EUR/USD price outlook is bearish as the price remains far below the 1.1800 level. Although the price stays above 1.1700, the pullback may extend to 1.1755, but the probability of breaking 1.1700 remains on the cards.

-Are you looking for the best CFD broker? Check our detailed guide-

The EUR/USD is headed for another three-day slide this month as the ECB continues to quell speculation about a change in monetary policy. The Governing Council vows to “act more patiently” as the central bank strives for success. Price stability is its only mandate.

Today, 10-year German Bund yields are back to -0.30% region after topping out last week at -0.28%. Retracements in German yields are similar to those in the United States, where yields on the 10-year benchmark note have eased to sub-1.35 percent levels.

Meanwhile, before the Fed’s rate announcement on the 22nd, retail sentiment could rise for the EUR/USD pair, similar to early in the year.

Since Thursday, the dollar has fully embraced its safe-haven status amid uncertainty over the Fed’s tapering schedule, days before the FOMC meeting, and fears of a financial catastrophe in the event of the bankruptcy of Chinese real estate giant Evergrande. Since Thursday, the yen and dollar have become safe haven currencies for investors, and investors have ignored financial assets, such as bonds.

Given the still uncertain timing of the Fed’s tapering, the outcome of Wednesday’s FOMC meeting is expected to be especially important and volatile for markets. Markets expect the Fed to announce its tapering agenda at the FOMC meeting, but expectations remain divided between October and December.

As Evergrande remains uncertain and the global economy remains weak, tapering in October could heighten short-term uncertainties and thus further strengthen the dollar. The dollar may also be penalized if the Fed is dovish and does not announce tapering.

-Are you looking for forex robots? Check our detailed guide-

EUR/USD price technical outlook: Oscillating between 1.17 and 1.18

The EUR/USD price remains quite calm on the day. Although the price fell around 40 pips during the Asian session, bears could not break the 1.1700 mark. We have seen only a 64% average daily range so far. If the price remains above the 1.1700 area, we may see a pullback towards 1.1755 ahead of the 1.1800 level. On the flip side, the YTD lows at 1.1660 may offer some support ahead of the round number at 1.1600.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.