- The EUR/USD price gains on Monday, paring off losses of the last week.

- A high probability of four rate hikes continues to underpin demand for USD.

- This week comes with plenty of crucial data, including ECB, BoE, RBA meetings, and the NFP.

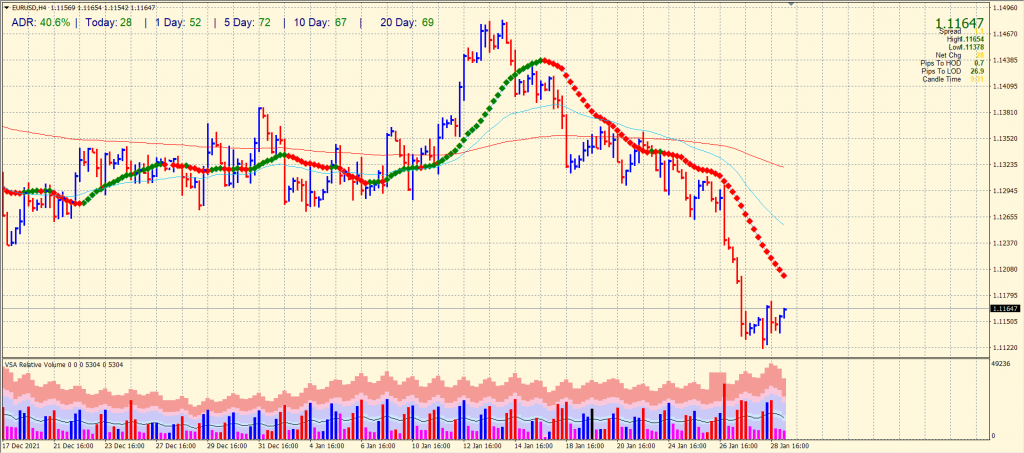

The EUR/USD outlook is slightly higher at the start of the week, trading up 0.10% on the day but the overall trend is still bearish. In the meantime, the dollar has remained high against the euro for nearly a year and a half, and stock market volatility is expected to boost the dollar in the coming week.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

The upcoming meetings of the central banks of Australia, the UK, and Europe will be key events for investors as they factor in the Federal Reserve’s restrictive dominance. As a result, the dollar index (DXY), which measures the dollar against six peer currencies, rose to 97.00. Friday’s 18-month high of 97.441 was a significant event that set the tone for the week.

Last week, the dollar enjoyed its best week in seven months as investors sought safety amid a selloff in riskier assets. However, considering that there is a probability of at least four rate hikes by the end of the year of over 90% and that there will be at least five rate hikes with a probability of 67%, the dollar remains stable.

TD Securities analysts also noted that the JOLTS December jobs report will be released on Tuesday and said 10.3 million are expected, saying this should help complete the jobs picture. “Unless the economy collapses completely, the Fed assumes we are approaching full employment and will continue to tighten until data calls for a pause.”

However, this week’s data could upset the market expectations. On Friday, US employment data will be released. “The consensus forecast calls for 150,000 new jobs, up from 199,000 in December, as well as a 3.9% unemployment rate and an average hourly wage increase of 5.2% over the next year from 4.7 percent in December,” Brown Brothers analysts predicted.

On Wednesday, ADP released its estimate for private-sector jobs, with a consensus estimate of 200,000 versus 807,000 in December.

On Thursday, the European Central Bank will also hold a policy meeting. At least for the first half of 2002, the ECB has been under control, but analysts are beginning to warn that the Fed’s upcoming rate hike will narrow the ECB’s window of opportunity.

Analysts at TD Securities predict little change in monetary policy decisions made this week, especially since no new forecasts will be released as the ECB gains momentum in the first half of next year.

During the press conference, Lagarde is expected to emphasize policy flexibility while stating that a rate hike in 2022 is unlikely. However, the analysts added that energy prices and inflation expectations would be critical.

EUR/USD technical outlook: Sell on strength

The EUR/USD price is attempting to recover towards the 1.1200 handle and above. However, the upside momentum lacks follow-through and may provide sellers another great selling opportunity. The 1.1260 will be another important resistance on the upside.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

On the flip side, the ultimate target for the bears is 1.1000. The average daily range is 39%, higher than the normal at this stage. Meanwhile, volume data does not support the upside at the moment.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.