- From 1.0820, EUR/USD rallied in what looked like a dead blip since there was no fundamental catalyst.

- DXY fell below 99.00 amid uncertainty over US inflation data.

- The ECB and the jobs report are among the events this week in the Eurozone

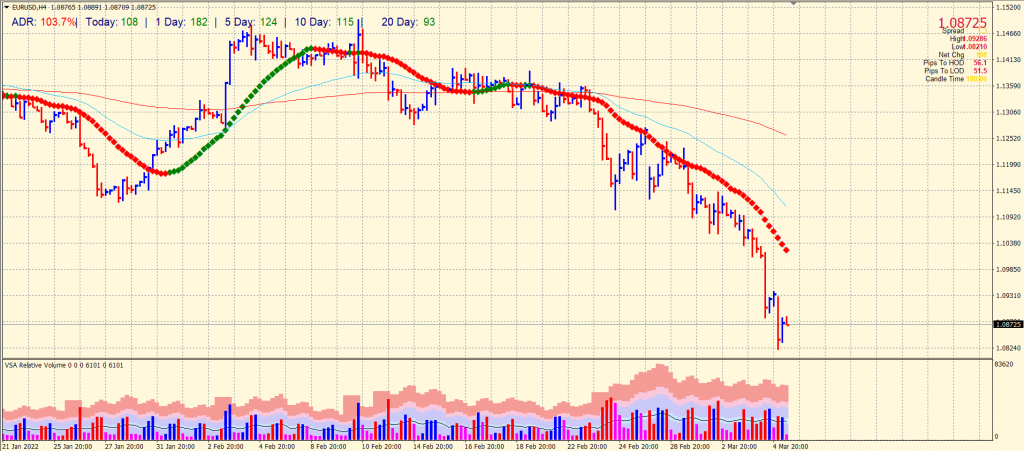

The EUR/USD price analysis has been largely bearish despite the recent recovery from the lows. The outlook is negative below the 1.1000 mark.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

From Monday’s nine-month low of 1.0820, the EUR/USD price has made a superficial recovery. The global economy hasn’t changed fundamentally to support the recovery. In this phase, choosing a topic related to risk aversion would be ideal. According to Bloomberg, the oil situation is deteriorating as US President Joe Biden is considering blocking US imports of Russian oil without the involvement of European allies.

Ban on Russian oil

The idea of banning Russian oil imports is likely to spread among other countries. This decision will profoundly impact the Russian economy, but it will also have a multiplier effect on Europe.

As noted above, Europe is increasing its demand for natural gas by 40% and imports more than a quarter of its oil from Russia. As a result, the ban on Russian oil imports will disproportionately affect Europe. As a result, the Eurozone will likely experience inflation, and the common currency will suffer.

Russian rebels have also shelled Ukraine’s Zaporizhzhya nuclear power plant, raising international security concerns. This was the primary reason for the Major’s barricade.

DXY’s retracement

In the meantime, profit-taking by market participants leads to the US Dollar Index falling below 99. Moreover, the US 10-year Treasury yield falls below 1.7% on the broader risk aversion theme.

What’s next for EUR/USD price analysis?

The European Central Bank (ECB) will decide the key interest rate this week. Although interest rates have not yet been raised by the ECB, it is important to note that it has not done so yet. On Tuesday, the ECB’s monetary policy and GDP and jobless claims in the Eurozone will be closely watched. On Thursday, investors will be watching US inflation data.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

EUR/USD price technical analysis: Bulls nowhere below 1.10

Although the EUR/USD price has a bottom just above the 1.0800 area, the pair is still prone to losses. The support is not strong enough. However, the pair has formed an up bar with above-average volume. This is a mild sign of upside correction. But it would be too early to predict the extent of upside correction.

We expect consolidation around the 1.0900 area before finding another directional movement in either direction.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money