- The EUR/USD pair may activate an upside continuation if it makes a new higher high.

- Only a bearish engulfing could invalidate the bullish scenario.

- DXY is located right above a strong demand zone. Therefore, a rebound could boost the USD.

The EUR/USD price climbed as high as 1.1163 today, registering a new high. The bias is bullish as the Dollar Index remains under strong downside pressure. DXY’s deeper correction could force the greenback to lose more ground.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

Technically, the currency pair challenges a strong resistance area. Nevertheless, a valid breakout may result in an upside continuation. Still, it remains to see how the Dollar Index reacts after reaching 97.73 static support.

False breakdowns or a major bullish pattern could result in a potentially higher leg. On the other hand, registering a valid breakdown through this downside obstacle may indicate that the USD could develop a larger depreciation in the coming period.

Fundamentally, the USD remains sluggish after mixed US data. The ADP Non-Farm Employment Change was reported at 455K, matching expectations below 486K in the previous reporting period. Unfortunately, the Final GDP rose by 6.9%, less than 7.0% expected, while the Final GDP Price Index registered a 7.1% growth.

Today, the Euro was supported by the German Prelim CPI, which rose by 2.5%, beating the 1.6% estimates and the 0.9% growth registered in the previous reporting period.

EUR/USD price technical analysis: Bulls back in power

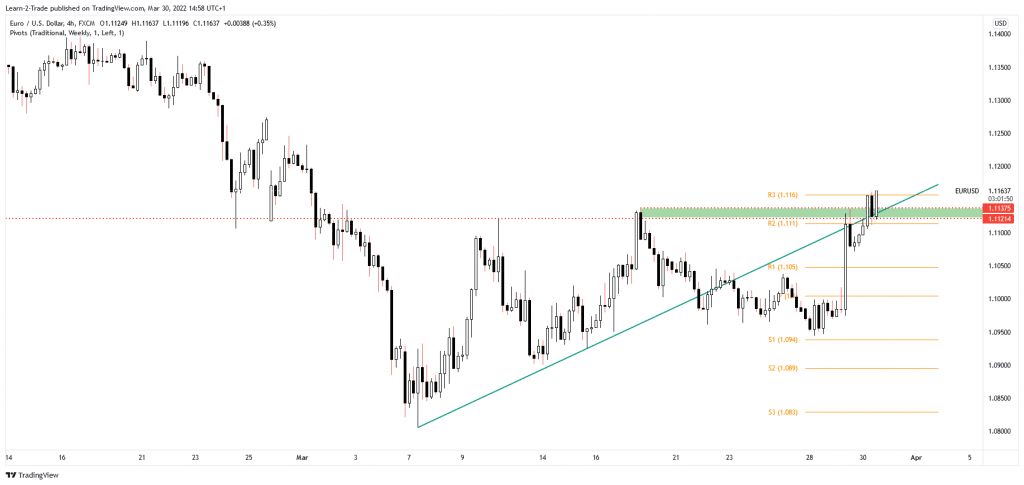

As you can see on the 4-hour chart, the EUR/USD pair jumped above the 1.1121 – 1.1137 resistance area. It challenges the weekly R3 (1.1160), which represents an upside obstacle. A valid breakout above this static resistance and a new higher high may activate an upside continuation. Earlier, the pair retreated and retested the R2 (1.1110), the uptrend line, and the 1.1121 broken resistance. As long as it stays above the broken levels, the price could try to approach and reach fresh new highs.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

In my opinion, only a bearish engulfing could invalidate an upside continuation and could announce a new leg down. Coming back and stabilizing below 1.11 could announce that the leg higher is over. You have to be careful as anything could happen. Personally, I want to see strong consolidation above the broken levels before I’ll consider going long.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money